Newer forms of communication, like email and instant chat tools, have replaced more traditional tools. The same phenomenon may seem to occur in the ARM space, with collection agencies and customers now interacting via email, text messages, chat, and IVR systems. But while each tool has its specific value, phone calls for debt collection and reminders are hardly dying!

Why Phone Calls Are Better for Contacting Debtors

In the U.S., about 28% of consumers have at least one debt in collection. Debt delinquency has grown dramatically during the COVID-19 pandemic, and collection agencies are tasked to chase after thousands of loan defaulters and slow-paying customers. Imagine persistently following up with debtors with back-and-forth emails to detail debt information that mostly goes unread or ignored at every stage! Or think of sending a combination of payment reminders via messaging systems that are usually one-sided and restrictive in terms of options to answer debt-related queries. Digital interaction methods unquestionably have their merits, and challenging them sounds flaky. But there are aspects to the good-old phone call which make it the best bet for high-performing collection campaigns:

1. It takes longer to text or type than to speak, and speech-based dictation is faster with speech recognition systems on mobile devices.

2. Phone calls are great for establishing an immediate connection within seconds of calling.

3. Voice calls are direct, personal, and confidential.

4. Phone calls allow for effective two-way communication. They are suitable for active listening, asking questions, troubleshooting, clarifying and sharing relevant debt-related information, and even reaching an agreement.

5. A phone call is an active way of engaging with debtors, unlike text messages, emails, or notices which are passive at best.

Manually Calling Each Debtor is Impractical

Typically, debt collection follows through a sequential flow of interactions across different modalities. Voice calls are not the first step of debtor contact. Collectors must tread carefully with a list of ‘avoidant’ defaulters to emphasize the immediacy of calls and prompt a favorable response without annoying them. Without digital tracking and real-time dashboards for delinquent lists, keeping a tab of debt statuses is challenging. This makes phone calls somewhat of a hit-and-miss method.

As for the debt collection agencies, even after scaling their collection teams, it becomes difficult to maintain speed, cost, and quality consistencies and also achieve conversion goals with just phone calls. Manual phone calls are expensive and exhausting. Here’s what a daily debt collection humdrum looks like:

- A large part of the collector’s JD is a relentless pursuit of debtors over manual calls.

- A significant chunk of time is lost in pre-call verification, cross-referencing the debt and debtor details, and segregating overdue accounts and their statuses.

- The collectors must be fully prepared for challenges like wrong numbers, customers dodging their calls, or disagreeing with the debt details.

- Time and task management just to comb through debtor contacts separate the ones with call back and ‘never call again’ requests.

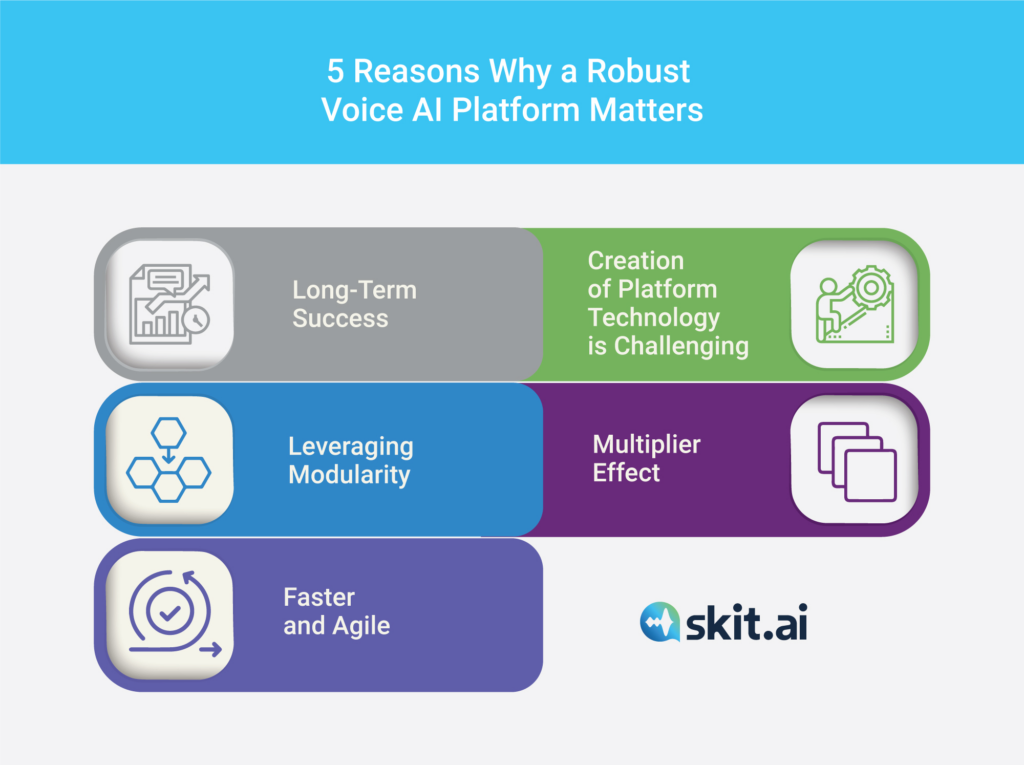

How Call Automation with Voice AI Amplifies Your Agency’s Debt Collection Efforts

To address the scalability and cost factors involved in manual debt collection calls, some firms choose an automated route that can be restrictive and risk missing out on the core purpose—debtors’ promise for payment. Automated debt collection systems with complex IVRs menus or robotic voices communicating debt information are generally an instant turn-off for customers. Therefore, the need of the hour is a combination of automation and human-like intervention to manage very high-volume debt collection calls while also empathetically reminding and aligning debtors to debt-related conversations.

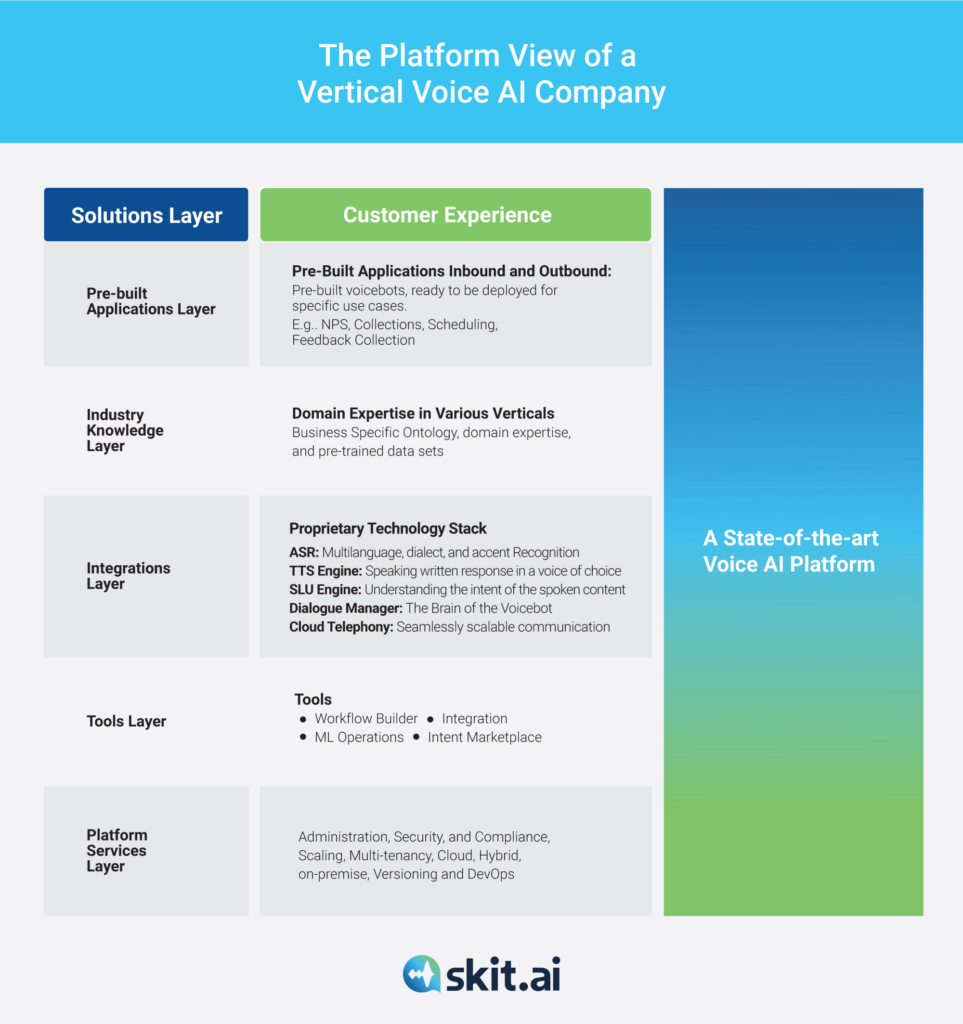

Voice AI technology helps elevate the significance of phone calls as an effective debt recovery tool. Skit.ai’s purpose-built and domain-specific Voice AI platform helps debt collection agencies to adopt meaningful approaches to customer interactions over phone calls with strikingly accurate and intelligent multi-turn conversations.

Dive deeper: How Call Automation Impacts Debt Collections

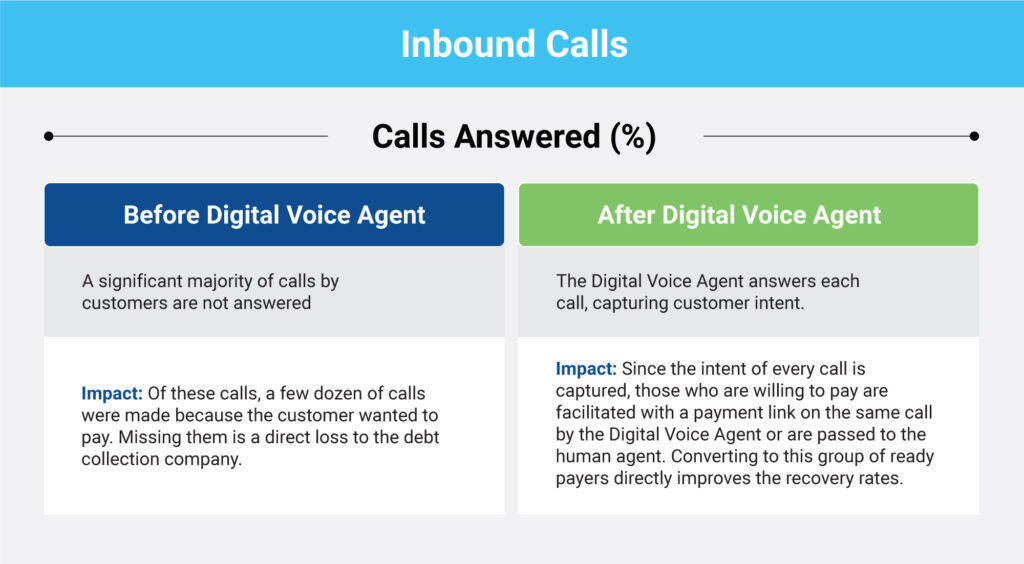

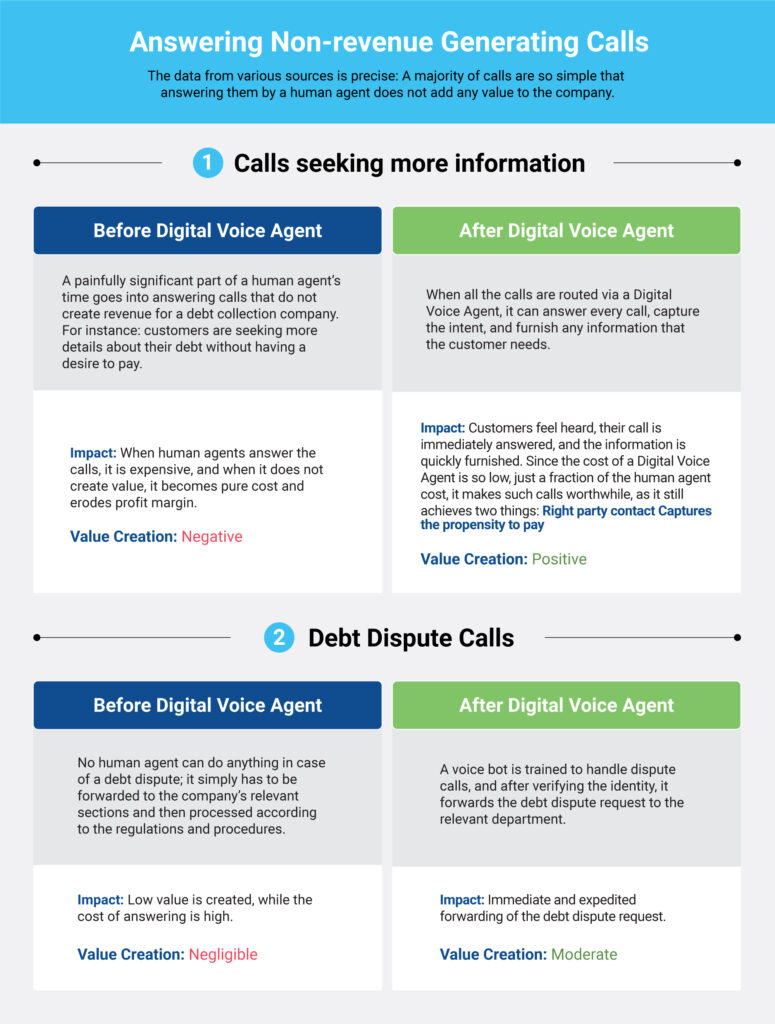

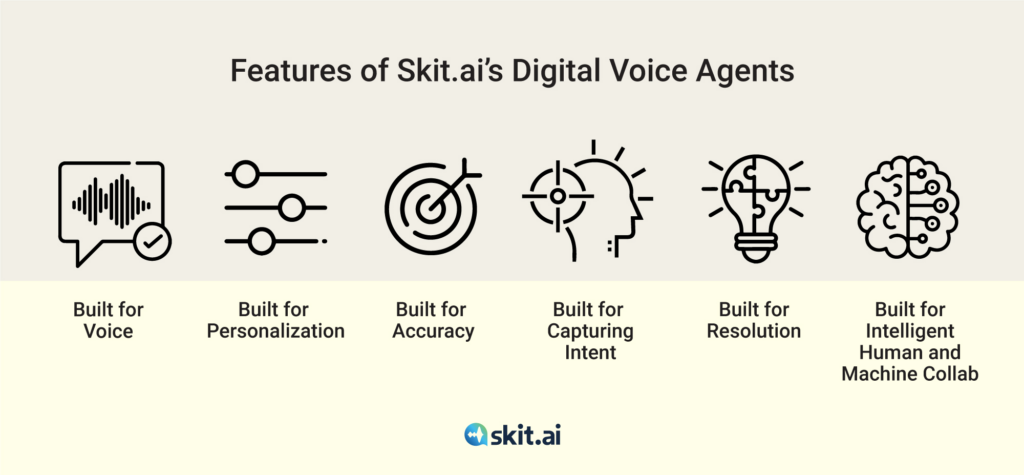

The intelligent Digital Voice Agents are modeled on human interactions and plug into contact centers to automate responses for repetitive, zero-value queries. These voice agents can hold human-like conversations and resolve tier-1 caller/customer queries without needing any intervention by a human agent. Only complex customer/caller queries that the Digital Voice Agents cannot handle are transferred to human agents. Augmented Voice Intelligence focuses on expanding the collection agencies’ workforce by combining the power of human voice and machines.

Buyer’s Guide: Digital Voice Agent for Debt Collections

Voice AI works with the adage that voice interactions are the most natural communication forms. With the platform built, designed, and optimized for voice interactions, collection agencies can realize the full potential of their debt recovery initiatives by automating calls and augmenting the workforce to involve only in complex scenarios that need detailed articulation and communication parameters that go beyond basic texts, emails or automated responses.

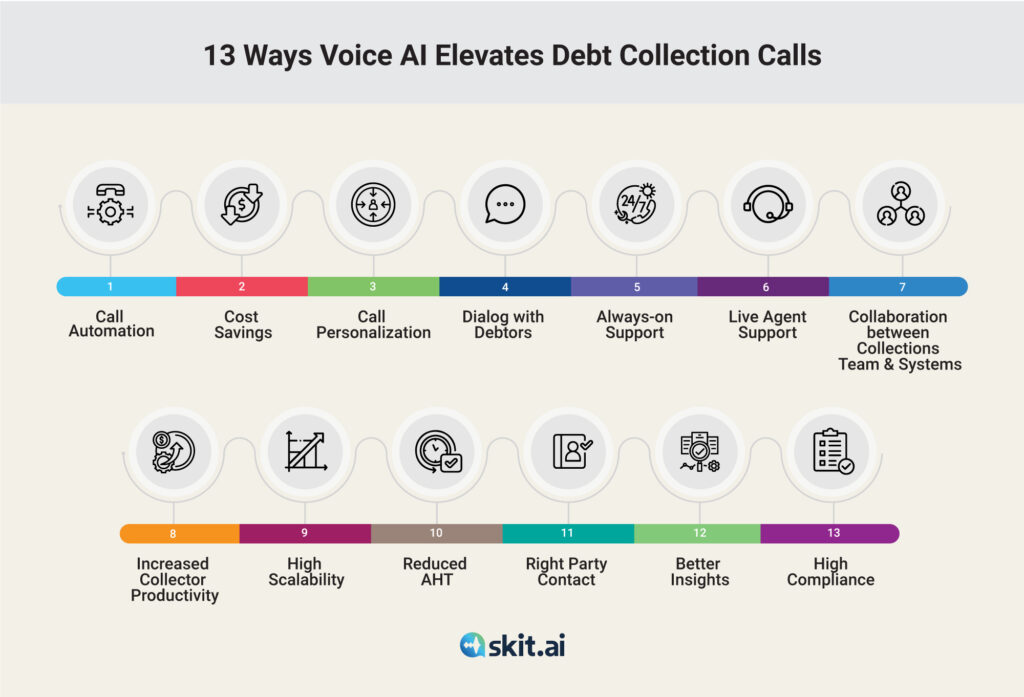

13 Ways Voice AI Elevates the Role of Phone Calls for Debt Collection

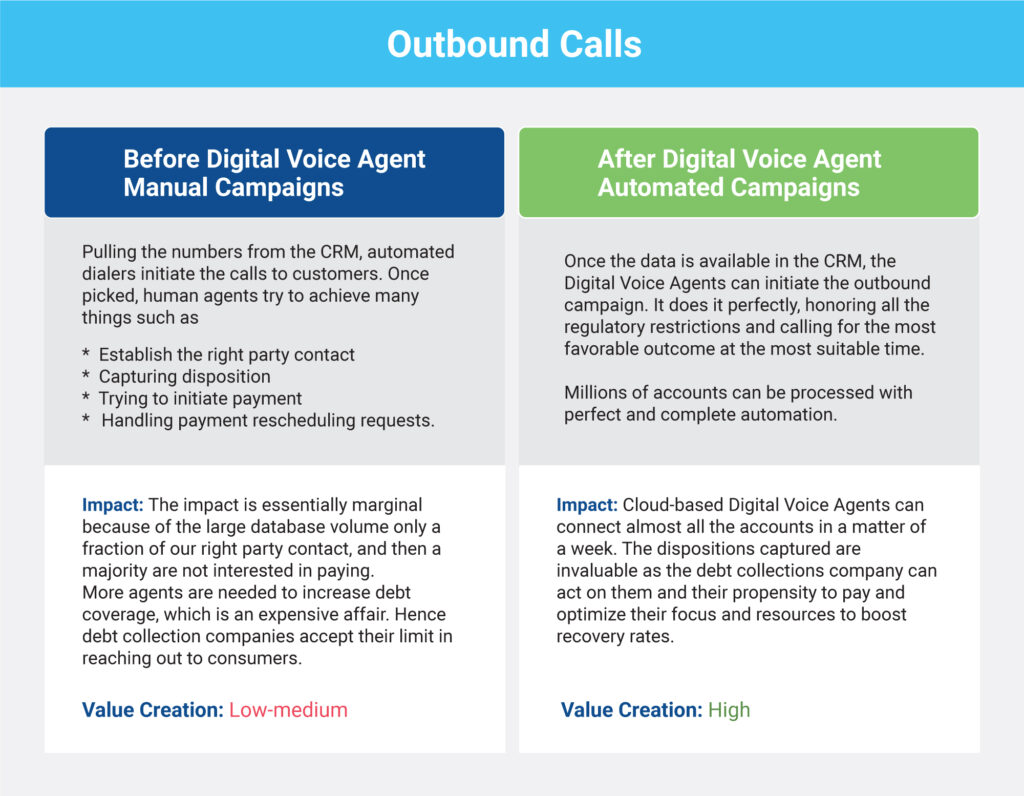

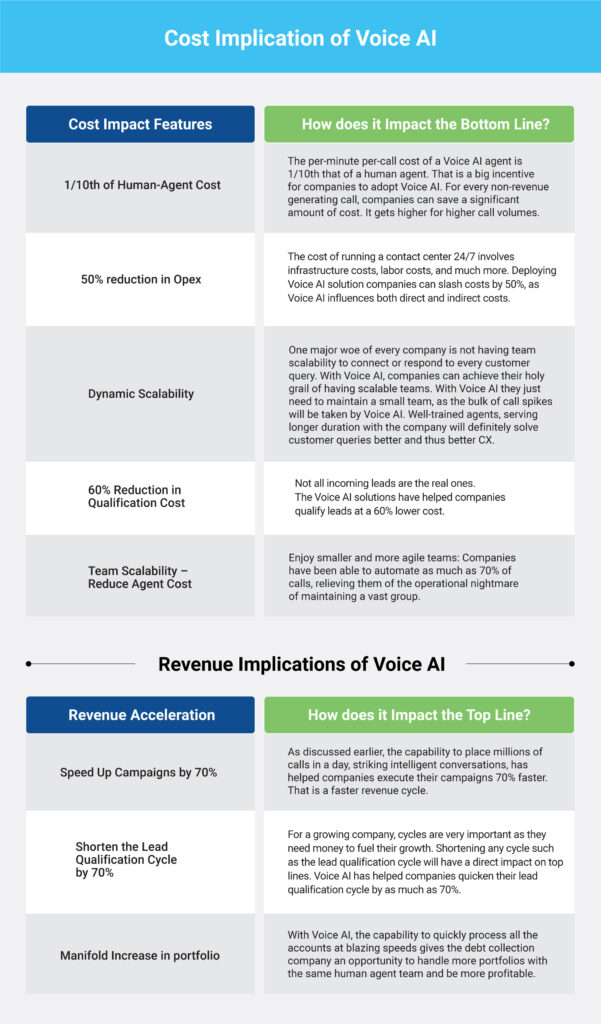

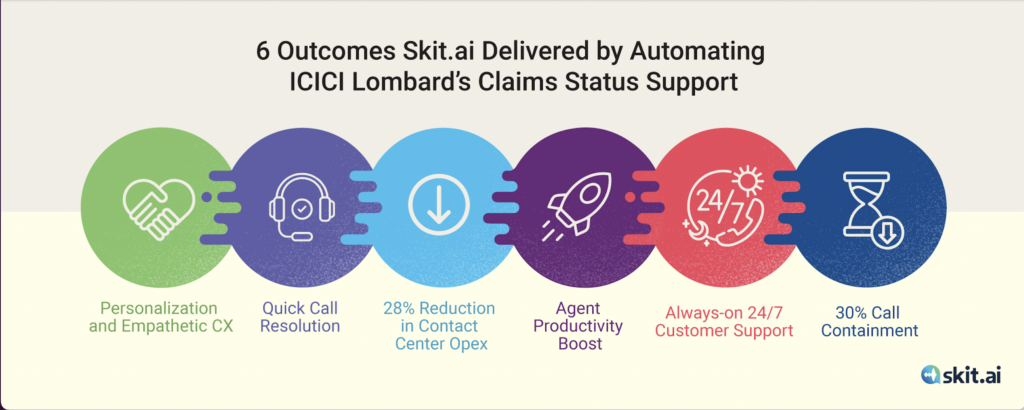

- Call Automation: Debt collection agencies can reduce manual efforts by automating up to 70 percent of calls with Voice AI.

- Cost Savings: With Digital Voice Agents taking over the calls instead of human agents, collection agencies can achieve cost savings of up to 50 percent on their debtor outreach.

- Personalized Debt Collection Calls: Auto-dialers with pre-recorded messages are great for mass calls but lack personalization. Voice AI adds value here as it can tailor to the use case. Human-like conversations with Digital Voice Agents make the debt recovery calls more personal. Also, with multi-language support, it makes it easier for call customization.

- Foster a Dialog with Debtors: Built ground up for voice interaction, the Voice AI platform makes debt collection interaction conversational and two-way, unlike IVRs, chatbots, and automated messages. This helps steer clear of confusion and assumptions by allowing agents to listen to the debtors’ complaints or situations and clarify when necessary.

- Always-on, 24/7 Support: Digital Voice Agents function independently of human agents to make debt collection voice calls without being impacted by time-zone differences.

- Live Interaction and Support: Voice agents answer or call debtors to interact and provide real-time support. This is better than pre-recorded IVR messages or time-consuming conversations with a debt collector.

- Intelligent Collab between Collectors and Collection Systems: Augmented Voice Intelligence allows for collaborative intelligence between humans and machines by transferring only complex queries to human agents.

- Enhance Collectors’ Productivity: Voice AI platform analytics dashboard and caller history, along with automated features for call routing and authentication, impact collectors’ productivity, making them more proactive.

- High Scalability: Agencies can ramp up collection outreach and handle peak call volumes without increasing the size of human-agent teams by leveraging call automation.

- Reduce Average Handling Time: The prompt responses and high engagement via the Voice AI platform reduce hold time and the chances of customers abandoning the calls. Collection agencies can leverage this platform to reduce the average call handling time by 40 percent.

- Right-Party Contact: Often, debt collectors can dial the wrong numbers or reach the wrong party while making the debt collection calls. Voice AI’s unique value proposition is the accuracy that helps collectors land the right contact.

- Better Call and Caller Insights: Debt collectors can improve their performance and call quality by tracking relevant metrics for debt collections, such as payment propensity rates, the success of their debt collection campaigns, and targeting risky accounts with real-time insights with the Voice AI platform.

- Better Compliance: When the debt collection calls are manually driven, it is tricky to check every item on the to-do list. The scope for human errors and unruly behaviors is high when the calls are handled by the human team. Voice AI platform can be tailored according to the various stages in the debt recovery process and ensures every adheres to compliance best practices.

How TCPA Impacts Voice AI in the Collections Industry?

Our Two Cents:

In reality, it is tricky to remind people to repay their debts. In the current stage of piling deliquescent debts in the U.S. adoption of Voice AI is necessary to create strategies that convert potential conflicts and confusions into meaningful conversations on outstanding loans and payments.

Voice AI will continue making a strong impact in the debt collection industry by transforming a simple phone call into a prolific tool to manage debt-recovery cases without going overboard with time, cost, and human effort.

To learn more about how call automation with Voice AI can transform your debt collection agency, schedule a call with one of our experts or use the chat tool below.