Simone Somekh

November 14, 2023

Hello! Welcome to Skit.ai. Click here to book a demo.

November 14, 2023

Let’s face it: debt collection agencies often sit on high-volume portfolios of accounts, as they lack the capabilities and resources to contact all consumers in a timely manner. Ultimately, some agencies give up on reaching all those accounts to focus solely on the larger ones.

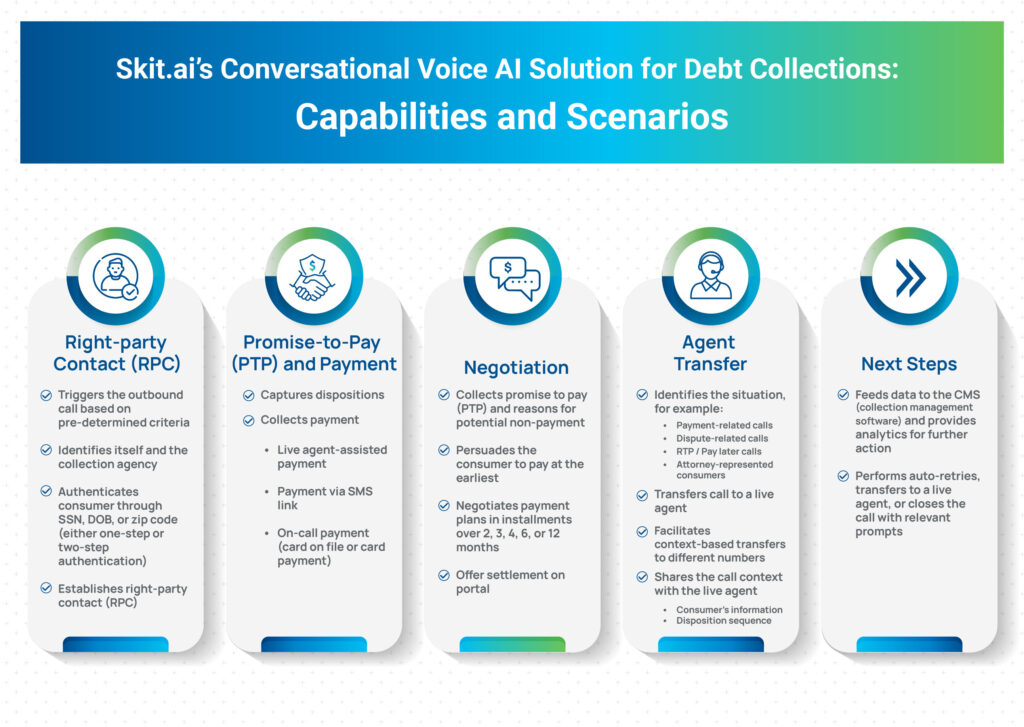

ARM companies usually handle thousands of new accounts each month, but many of those accounts might be left untouched due to the lack of bandwidth. For each account, agents need to establish right-party contact (RPC), remind the customer of their outstanding balance, and offer ways to help them pay off their debt, such as a payment plan. More often than not, customers are not available right away, and the agent has to call them back at a different time.

What if I told you that you could automate this entire process?

Yes, you heard that right. A conversational voice AI solution can handle your collection calls on your behalf. In this article, we’ll explain how this type of solution works.

Nowadays, 88% of consumers expect organizations to offer a self-service support portal. Contact centers in all industries — from banking to e-commerce and, of course, accounts receivable management (ARM) — are turning to automation as a strategy to overcome the challenges of managing both inbound and outbound calls with customers.

In this rapid-changing environment, marked by the surge of generative AI, conversational AI has emerged as a key debt collection software to solve automation challenges. These tools are capable of handling conversations with consumers from start to finish, without the need for any human intervention.

Voice AI technologies may sound “new” to you today, but they are set to become the industry standard in the collections and payments space within a few years. Early adopters are already reaping the benefits as they are ahead of the learning curve.

When they hear “call automation,” many people tend to think of IVR (interactive voice response) systems. Think, “To make a payment, press 1…” In recent years, voice automation, AI, and speech recognition technologies have significantly evolved, also with the emergence of conversational voice AI and large language models, delivering a much more sophisticated technology than IVR. You can think of IVR as the “grandfather” of voice AI.

A conversational voice AI platform delivers a human-feeling and effective two-way conversation with a consumer, answering questions and providing context-specific information.

Once you upload data for a collection campaign, the solution can initiate thousands of calls to consumers, establishing RPC and reminding them of their outstanding balances; the solution then helps them pay via select payment gateways or negotiates a payment plan.

Because Skit.ai’s technology is powered by AI, no interaction will be identical to the other; every customer is different, and each call is personalized. The technology is built to handle a natural-sounding back-and-forth conversation with the consumer following their responses, cues, and questions ad hoc.

If you want to learn more about our approach to customer experience (CX) and how we build a persona for our voice AI solution, read our article about how Skit.ai elevates CX in collection calls.

The voice AI platform handles these scenarios:

Compliance is one of the most common pain points and concerns for executives working in collections. There are many regulations at both federal and state levels, and sometimes consumers may file lawsuits against ARM companies, causing major expenses on the agencies’ part. Additionally, regulations often change, and collectors sometimes struggle to keep up with the new developments.

Skit.ai’s conversational voice AI solution fully complies with the current laws and regulations related to collections and phone calls, such as Reg F, the TCPA, and more. We ensure that the solution initiates calls only at the permitted times of the day and within the correct frequency. We prioritize information security; we have, among others, ISO 27001:2013 and PCI DSS certifications and use AES-256 encryption.

It’s actually easier to ensure that an AI solution rigorously complies with regulatory requirements; this is because the solution:

Do you want to learn more about call automation for collections and payments? Are you looking to adopt a Conversational AI solution for your business? Schedule a call with one of our experts by using the chat tool below!

Collecting delinquent debts from consumers has always been challenging for collection agencies, whether first- or third-party. Traditional debt collection methods often involve managing numerous accounts manually, which can be unreliable and lead to inefficiencies, delays, and customer dissatisfaction. However, with the emergence of conversational AI automation, debt collection processes are undergoing a transformative shift. AI-powered […]

The complex world of healthcare revenue cycle management (RCM) and patient billing is evolving rapidly. New digital tools are enabling providers to tackle early-out collections, prevent charge-offs, and improve recovery strategies. For healthcare organizations’ patient billing and RCM providers, early-out collections are a crucial piece of the patient billing puzzle, and AI is here to […]