Some technological tools and solutions, once adopted, become a seemingly indispensable part of a company’s operations, to the point that it’s hard to remember how things were before the advent of these technologies. The integration of artificial intelligence and large-language models appears poised to follow a similar trajectory across various industries, including the accounts receivables sector.

The debt collections industry has traditionally been slower at adopting new technologies in the past—likely due to the strict regulatory landscape and the nature of the industry itself. But a notable shift seems to be underway. We are seeing so many collections executives and companies proactively engage with AI providers, eagerly trying to figure out how different AI solutions can simplify processes and save them money.

At Skit.ai, we recently sponsored a webinar hosted by Accounts Recovery on this very topic. The quotes in this article are excerpts from the webinar; you can watch the recording to listen to the entire conversation and get the full context. The experts who spoke are Brandon Huisman of State Collection Service, Nate Kalnins of The Stark Agency, John Kelan of Hunter Warfield, Jeremy Mapes of Mapes Consulting, Alec Tilley of Goal Solutions, and Amit Ambre of Skit.ai.

How AI Is Changing the Way We Collect Debts

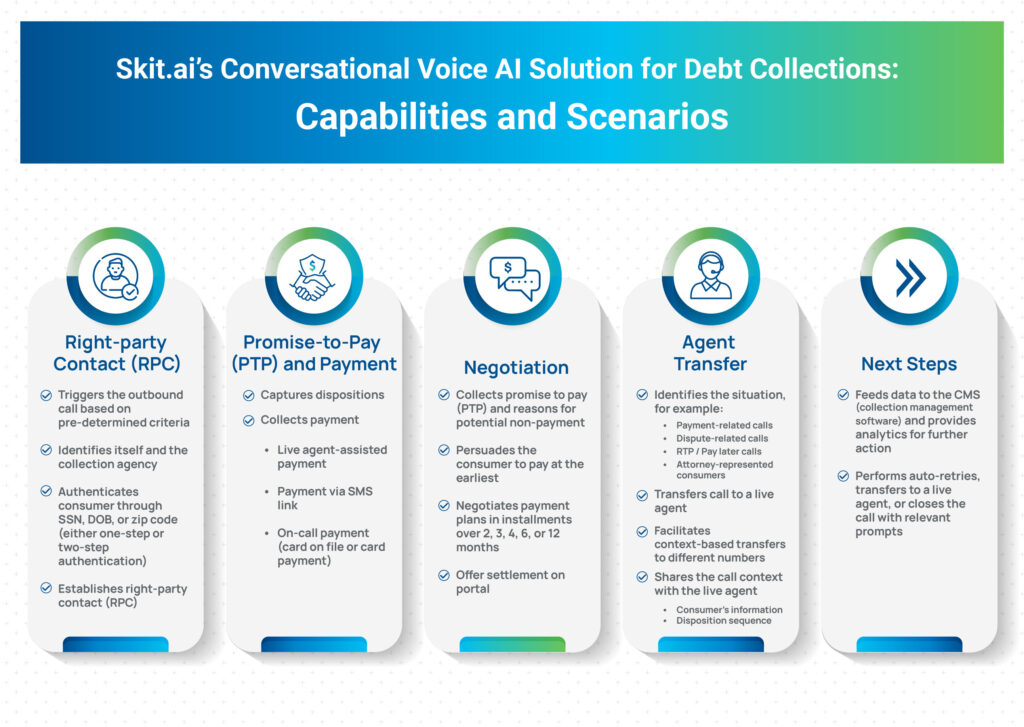

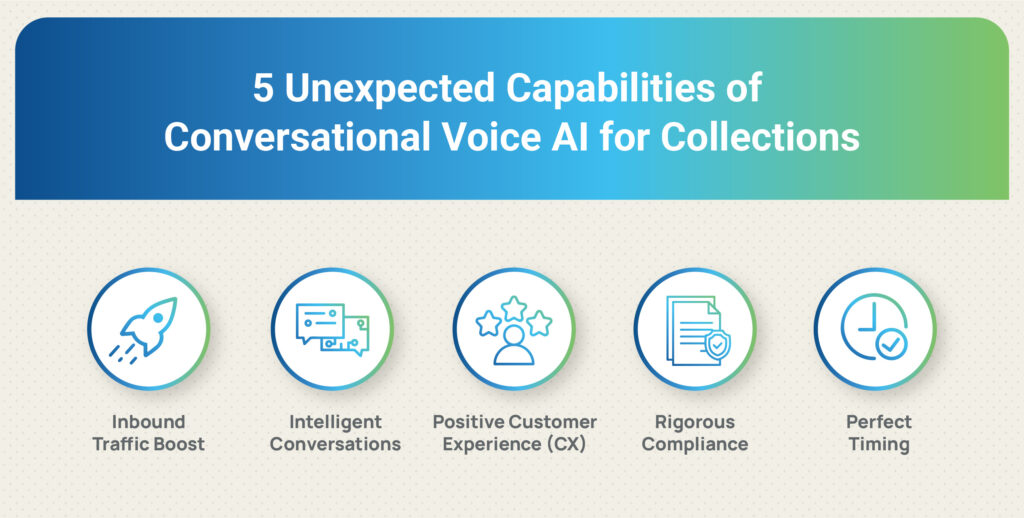

Voice AI adding self-service option and preventing volume handling challenges: “One thing we’ve seen on the Voice AI front is putting self-service on the forefront, and yet, offering that smart call routing back to the call center where it’s needed. So rather than clogging up the inbound lines, Voice AI allows the caller to really navigate and self-serve and hopefully prevent a phone call to the call center.” — Brandon Huisman of State Collection Service.

A more effective and efficient workflow: “Letting the Interactive Virtual Assistant (or Voice AI solution) handle the bulk of the conversations and prescreen interest for resolution, especially on low-scored accounts so that the agents can shift more towards helping the people that want to be helped and have a much more effective and efficient workflow in general. We’re also seeing benefits a little bit less directly operationally, but also in the way that the collection departments are being managed, like using transcription tools to create meeting minutes and direct takeaways to take stakeholders in different departments or even generating SOPs and things like that via loom and screen recorders, where you can dictate exactly what you’re doing and have that transcribed into something that essentially serves as a readymade SOP to make our processes more repeatable and easily trainable.” — Nate Kalnins of The Stark Agency.

Filling the staffing gap left by COVID-19: “You could go on Google right now and you’d find easily 25, 30 different types of AI groups. Additionally, during COVID-19 and afterward, a lot of agencies have been challenged with finding employees, so they’ve been looking for what to do. AI is starting to fill a large part of that gap, besides just the outsourcing that they might potentially do. I think the opportunities are limitless.” — Jeremy Mapes of Mapes Consulting.

Finding the right combination and calibration between channels: “I think the next bit will be trying to find the sweet spot across all the multiple tools and all the multiple AI platforms and figuring out how to maximize them for your own use case and your own kind of debt.” — Amit Ambre.

Are Machines Ever Replacing Collectors?

Don’t forget consumers’ preferences: “I don’t think we’ll ever fully replace humans doing the job, nor should we. I think we would be foolish to not account for consumer preference. And there will always be consumers that prefer to deal face-to-face or directly with a person. At the end of the day, I still think that skilled labor is a precious resource and one that we can use to differentiate the quality of the services we provide. So, we tend to view Interactive Virtual Assistants (IVAs) and bots as something that we can use to scale our services without adding additional staff and lean more on developing the skillsets and retaining the staff that we do have.” — Nate Kalnins of The Stark Agency.

How is AI changing the agents’ skills? “The question is not just the percentage [of work that is being automated with AI], but what is the agent skillset that’s required afterward? So if the AI is handling a lot of easier tasks, does that mean that the agents have to be higher-skilled and have more training and more access to information for more complicated use cases that aren’t easily handled by technology? I think that’s likely.” — Alec Tilley of Goal Solutions.

The industry is constantly evolving: “I definitely don’t think we’ll ever be able to get to 100% reliance on AI, but I think definitely 80-90%, I could see feasible. Even looking at right now versus a year ago, how much is in this industry that wasn’t there before. It’s evolving constantly. There are more vendors out there. The price points are coming down. It’s easier for companies like us to get these types of technologies in place. If we can manage 80% of our business with AI, I think that’s a huge win for the industry, but I think there will always be a place for the reps themselves in our business.” — Brandon Huisman of State Collection Service.

What Will the Industry Look Like 5 Years from Now?

Ask the tough questions: “Fundamentally, we have to ask ourselves: What problems can we foresee that exist today that would also be a problem five years from now? I think you just have to pose some questions that you think will be there in the next two to three years and ask yourself, why are you trying to solve these with technology? You have to weigh out the pros and cons of using it based on cost, FTE changes, and shifting culture. Those types of things are what weigh on us when we’re looking at any kind of new products, like chatbots. When we were first trying to determine why we would want a chatbot during operational hours, [we] realized there are a lot of repetitive things that chat agents have to go through constantly, that are just basically a copy-and-paste or a quick-link response. So you start saying, what if we start hitting off that at the forefront? What technology can you bring on today that you can evolve over that next period to hopefully help you combat what might still be there in the near future?” — John Kelan of Hunter Warfield.

Don’t wait for the perfect solution: “If you wait until the perfect solution exists—one; you might be left behind. And two; when it presents itself, you may be knowledge-deficient because it’s just so overwhelming. There’s so much to bring on that you’re not in a good position to bring it on and use its full capabilities responsibly. So for us, it’s more [about] constant progress and really understanding how this works and tailoring and how we can use it for our use cases.” — Nate Kalnins of The Stark Agency.

Investing Time and Resources to Implement New Tools

Plan short and long-term: “You can’t just assume that you’re just going to buy something and turn it on out of the box. I think it’s cool that you can do some things in two to three months, but I would view this as a car you’re going to be driving for a long time and have resources that are constantly pushing towards using these tools, more and more. Can you get up and running in a few months with a flat-file kind of situation? Sure. But then how do you get better API integration? How do you add more use cases? How do you figure out why they’re calling in the first place? I think the right approach is a long-term commitment with some resources dedicated to it.” — Alec Tilley of Goal Solutions.

Try with pre-set models. “Solutions like Skit.ai have pre-set models that can be used; so that’s a very short time to go live. I know a lot of us in the industry like to see anything that we’re testing, anything that’s new, be out there for six months to a year just because we don’t want to be the first ones to get sued. I think the Voice AI solutions that are coming up now, they’ve been out there for six months to a year; so you can trim that down.” — Jeremy Mapes of Mapes Consulting.

What’s Your Vision for the Future of Collections?

Meet every consumer’s preferences: “The vision we’re focusing on is being able to have a seamless interaction with a consumer using the channel of their choice and the technology of their choice. We just want the consumer to be able to have, 24/7/365, any tool, any technology to allow them to resolve their debt with the simplest, least complicated process possible. It also to take some of the repetitiveness or the stressfulness off the agents.” John Kelan of Hunter Warfield.

AI will become the baseline expectation: “We see, among our clients, a tremendous interest in these same topics we’re discussing here. And many of them have already deployed this type of technology themselves. So they’re looking long and hard at it, and at some point, it’s going to become the expectation [to offer] those seamless interactions for consumers – that’s just the baseline expectation and no longer a differentiating factor of work.” — Nate Kalnins of The Stark Agency.

Focus on alignment: “At the end of the day, from a collection agency perspective, the three stakeholders are obviously your clients, the consumers you are interacting with, and your agents. Irrespective of whether with AI or without AI, we need to ensure that there’s an alignment in terms of the results that we want to achieve for all three different stakeholders. In terms of AI, the whole perspective has to be how things can work together to ensure that you make this experience as smooth and as easy for the stakeholders as possible.” — Amit Ambre of Skit.ai.

Want to learn more about Conversational AI and how it can benefit your business? Use the chat tool below to schedule a free consultation with one of our experts!