Discover the Intersection of

Collections and AI

Built to perform across the customer journey.

Veros Credit is a leading auto financing provider specializing in acquiring and servicing motor vehicle retail installment contracts through a vast franchise and independent dealers’ network. With over 25 years in the subprime auto finance industry, the company deeply understands both dealership and consumer needs.

Veros Credit focuses on building long-term partnerships with dealers while ensuring consumers are positioned for successful automobile ownership. Their data-driven application approval process creates value for all stakeholders—dealers, consumers, and Veros Credit—by making competitive lending decisions that balance risk and accessibility. They are particularly committed to serving subprime borrowers, recognizing their unique financial situations, and providing fair, flexible financing options.

Agent Team Size: 75 agents

Before adopting AI, Veros Credit relied heavily on human agents to manage all creditor outreach and handle collections via their CRM system. The team was primarily focused on maximizing debt recovery while also responding to customer inquiries regarding payments and outstanding balances, placing a significant strain on resources.

Skit.ai is a GenAI-first collections technology company, purpose-built to modernize and optimize the debt recovery lifecycle. Founded in 2016, Skit.ai has emerged as a category leader in Conversational AI—transforming traditional collections in the Accounts Receivables Management (ARM) landscape with intelligent, automated outreach.

Our platform combines AI-native conversational agents with precision decisioning capabilities, empowering financial institutions, debt buyers, and third-party agencies to achieve:

Deployed by leading financial institutions, debt buyers, and third-party collections agencies, Skit.ai leverages proprietary insights and deep domain expertise to modernize the full debt recovery lifecycle.

End-to-End Collection Automation with 24/7 Availability

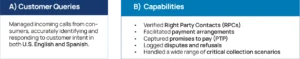

Veros Credit chose Skit.ai for its strong multilingual support in English and Spanish, and its proven track record in third-party collections. The presence of a dedicated local support team in New York, available 24/7, ensured reliable assistance. Additionally, Ski t.ai stood out for its fast issue resolution and consistently responsive service, making it the ideal partner for scaling AI-driven collections.

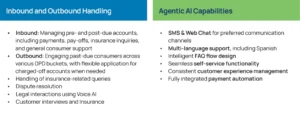

To meet Veros Credit’s specific needs, Skit.ai deployed a customized GenAI-powered voice solution, designed to automate and streamline their collections workflows across multiple touchpoints.

For a seamless customer experience management

The original target was a 20% containment rate—but through continuous refinement and close collaboration, the solution achieved 40% containment, doubling expectations.

This success highlights two important truths:

Veros Credit plans to extend Skit.ai’s capabilities to new use cases, including charged-off accounts, investment-related interactions, and customer interviews based on submitted forms. The solution will also be enhanced to handle FAQs related to payoffs, principal amounts, refinancing, repossession, insurance claims, autopay, deferred payments, and account details.

The team is exploring an omnichannel approach, with upcoming support for:

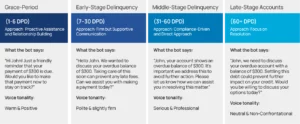

They also plan to scale AI usage in early-stage delinquency segments to boost recovery rates. Using the tonality feature of our platform, they plan to segment accounts into different DPD buckets and target them with personalized messaging and approach.

Skit.ai is a Gen AI-first collections technology company reinventing the debt collection industry. By combining AI-driven decisioning with human-AI collaboration, we deliver higher liquidation, lower costs, and a superior consumer experience—at scale. Skit.ai’s platform is built on proprietary data from over 53,000 creditors and spans 19+ debt types across varied delinquency buckets and portfolios. Skit.ai has received several awards and recognitions, including the BIG AI Excellence Award 2024, Stevie Gold Winner 2023 for Most Innovative Company by The International Business Awards, and Disruptive Technology of the Year 2022 by CCW. Skit.ai is headquartered in New York City, NY.

Book a Demo to transform your collections today!

Built to perform across the customer journey.

Stop Searching for “Collection Agency Near Me”

Stop Searching for “Collection Agency Near Me”