Discover the Intersection of

Collections and AI

Built to perform across the customer journey.

Over the past two years, the accounts receivables industry underwent a notable transformation, marked by a booming demand for AI and digital solutions in what has traditionally been a cautious marketplace. At Skit.ai, we witnessed and helped drive this shift.

Over 70 U.S. third and first-party debt collection agencies and lenders have adopted our Voice AI solution to automate collection calls and augment the work of live agents. As we approached this milestone, we became aware of a growing demand for more: more automation, more channels. While phone calls, whether manual or led by artificial intelligence, are still essential to any debt collection strategy, we’ve been seeing demand for additional channels to engage and interact with consumers.

The research supports this shift. A McKinsey study found that reaching out to consumers through their preferred digital channels boosts payment results. Traditional contact strategies, such as phone calls, letters, and voicemails, may still be prominent, but consumers often prefer to be contacted via digital channels, such as email and text message, especially among younger demographics.

Multi- and omnichannel strategies are not new and have already been successfully adopted in customer service, marketing, and retail; they are now coming to the accounts receivables industry, promising to accelerate collections processes and improve consumer engagement.

The use of digital channels to perform activities such as opening a bank account, applying for a credit card, applying for loans, and managing investments is virtually ubiquitous in today’s society. It’s only about time that the collections industry offers consumers those same digital channels to engage with lenders and collectors.

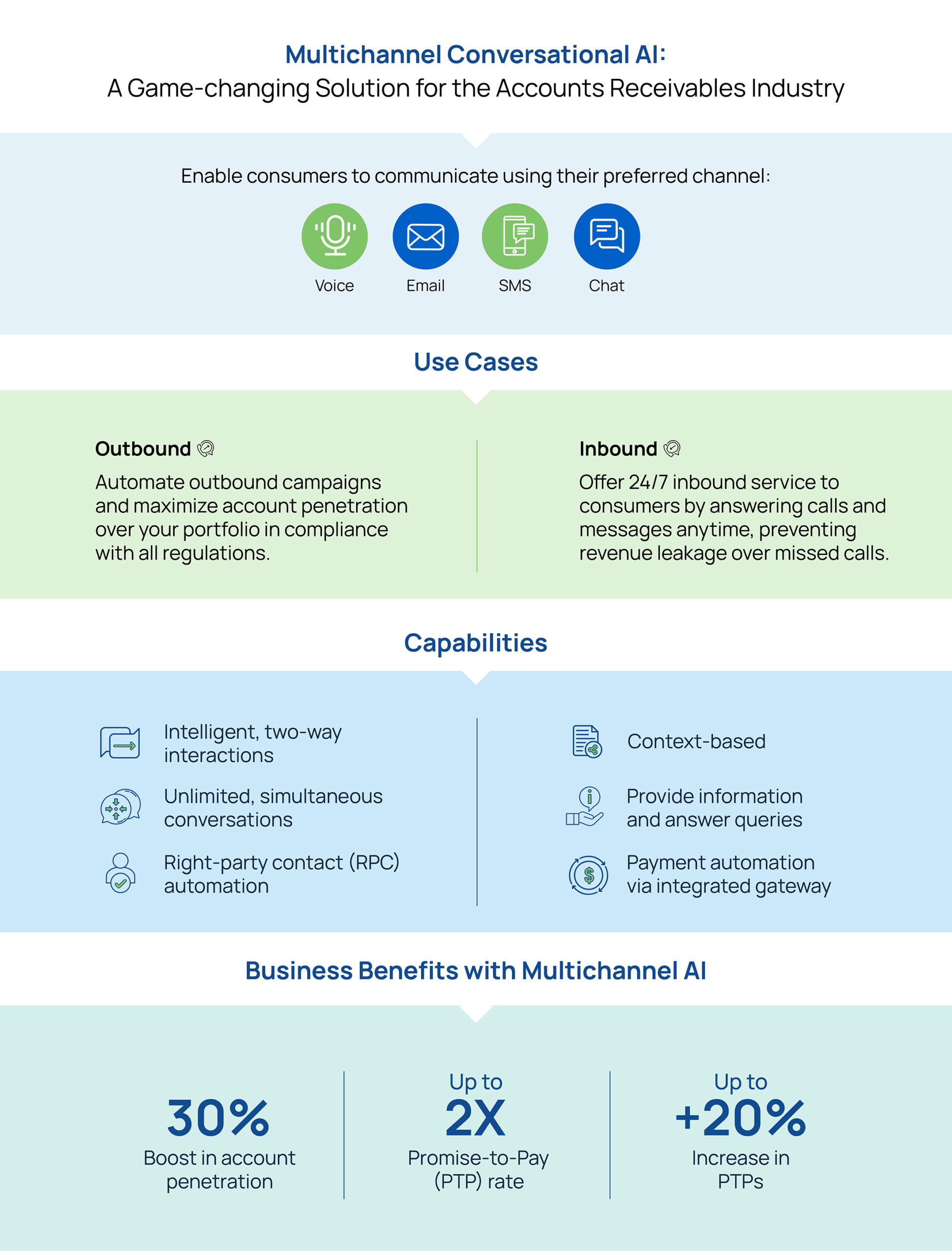

A multichannel strategy caters to consumer preferences by offering multiple communication channels, such as voice, chat, email, and text messaging, both for outbound and inbound interactions, so that each consumer and demographic can interact using the channel of their choice. A multichannel strategy is context-based, meaning that consumers can utilize any channel without losing the context of their previous interactions.

For outbound use cases, a multichannel strategy enables consumers to engage through multiple communication channels at all stages of the delinquency cycle, maximizing account penetration and ensuring compliant outreach frequency through rigorous compliance filters. The technology offers the ability to follow up with unengaged consumers via new channels for incremental penetration.

For inbound use cases, the case for multichannel is just as strong, as it enables companies to offer 24/7 availability, including nighttime, weekends, and holidays, eliminate wait times, and never miss a payment opportunity.

Traditional communication channels such as phone calls are not always working, especially among younger demographics. Different consumers prefer to utilize different channels; now is the time to start tapping into the unimaginable potential that AI-powered conversations can offer.

The success of Voice AI in the accounts receivables industry has shown that consumers are comfortable with the use of bots to resolve debts, and in some cases prefer interacting with a bot rather than a human. Voice AI is far more intelligent than legacy IVR systems, which are unable to handle multi-turn, two-way interactions in a way that is comparable to human conversations. Thanks to technological advances in speech recognition, natural language understanding, and the advent of large language models, Conversational AI has made IVRs a thing of the past.

But Conversational AI has more to offer beyond automated voice conversations—there are chatbots, SMS bots, and email bots, and in a digital-first landscape that highly favors self-service portals, consumers are eager to adopt these additional channels in their interactions with lenders and collectors.

Financial services organizations that have embraced a multichannel strategy have already seen significant success in their collection efforts. By offering consumers the flexibility to interact through various channels, these businesses cater to individual preferences and facilitate more positive interactions. One of our clients saw a 213% boost in recoveries after augmenting their voice-only strategy with additional AI channels.

The relationship between ARM organizations and consumers is evolving. Technology is playing a pivotal role in ensuring that this evolution benefits both parties involved. A multichannel strategy is not about replacing human interactions; it’s about enhancing it by offering multiple touchpoints that meet the diverse needs of consumers and optimizing the resources available to collection entities.

By leveraging cutting-edge technology, businesses can pave the way for a more consumer-centric approach to debt collection, one that is efficient, compliant, and effective. Thanks to the benefits provided by various communication channels, lenders and collection agencies can personalize campaigns, streamline processes, and ultimately improve business results.

Do you want to learn how you can optimize your business with Conversational AI? Use the tool below to schedule a free demo with one of our experts.

Built to perform across the customer journey.

Automate Early-Out RCM Collections with Conversational AI

Automate Early-Out RCM Collections with Conversational AI