What is IVR for Collections?

IVR stands for “Interactive Voice Response,” a legacy technology that enables companies to automate both inbound and outbound calls. IVRs use a pre-recorded voice that interacts with consumers and guides them through a pre-set menu, which can be navigated by inputting DTMF (dual-tone multi-frequency) from the phone keyboard.

Virtually everyone has interacted with an IVR system at some point in their lives. Whether you’ve called a business, a bank, a pharmacy, a doctor’s office, or a phone service provider, you are certainly familiar with prompts like: “For hours of operations, press 1,” or “For Spanish, press 2.”

Call automation for call centers and businesses is not a new concept. IVRs became popular in the 1980s when they emerged as an essential customer service technology. Debt collection agencies have been using IVR for over a decade, for both outbound calls (such as payment reminders) and inbound calls (such as consumer inquiries).

However, the fact that IVR is so common does not mean that it’s an optimal solution. In this blog post, we’ll go over the limitations of IVR and explain why adopting a Conversational Voice AI solution is a far better option for collection agencies.

Why IVR Is Overwhelmingly Unpopular

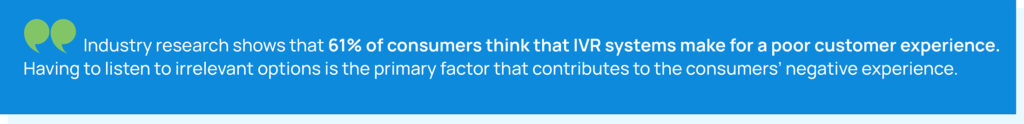

IVR reduces wait time for consumers, but it does not eliminate it, as it forces users to listen to lengthy menus that are for the most part irrelevant. At least 61% of consumers think that IVR systems make for a poor customer experience (CX).

A survey conducted by Vonage with Opinion Matters in 2019 revealed that having to listen to seemingly endless, irrelevant menu options is the primary factor contributing to consumers’ negative experiences. Additionally, the respondents complained that IVR menus are usually too long, that the reason for their call is sometimes not even listed, and that the system prevents them from speaking directly to a live customer representative.

Building the right IVR for your company can be tricky. If the system is not designed well, users will get frustrated and abandon the call. IVR is notoriously difficult to navigate, especially when a business offers different services or targets various sets of consumers.

In one sentence: consumers don’t like IVR. So what’s the alternative?

IVR vs. Voice AI: Which One Is the Best Option?

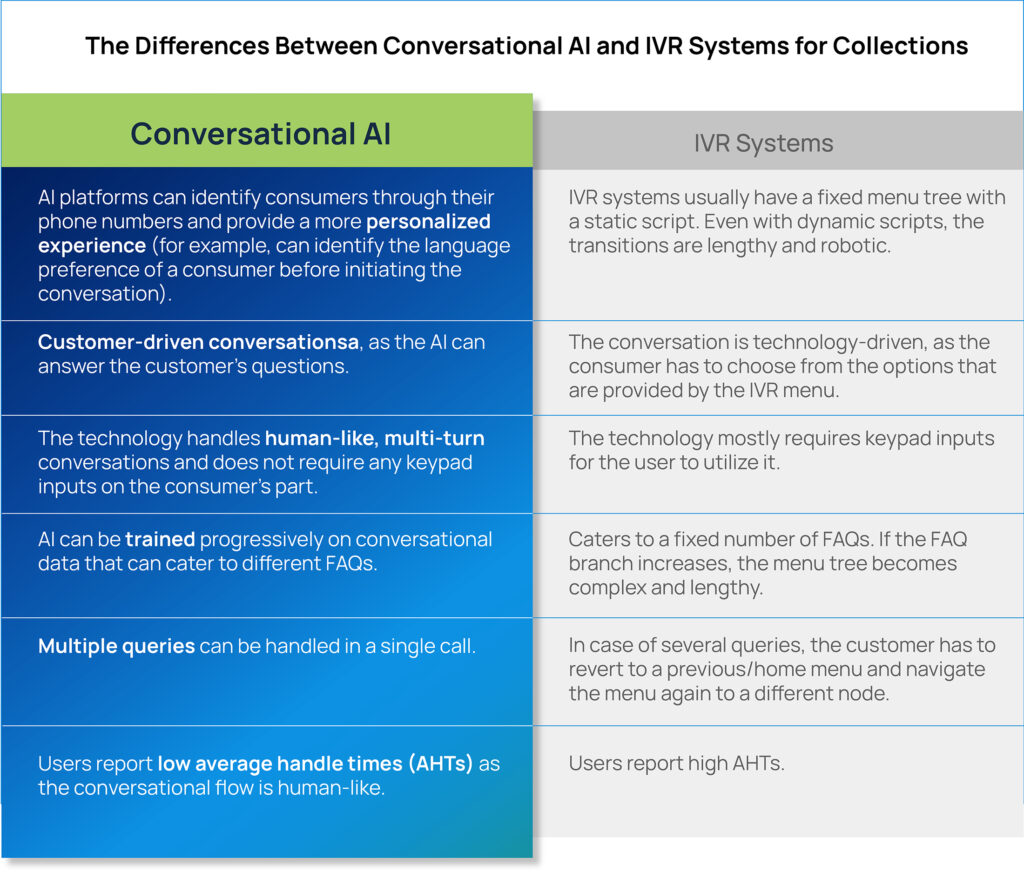

Conversational AI is the technology behind what is commonly referred to as a “voicebot.” It enables companies to automate both inbound and outbound calls with consumers without the involvement of a live agent. In recent years, SaaS platforms offering Conversational AI solutions have become more affordable and easier to deploy; additionally, some of these solutions are now trained with large language models (LLMs), which enable them to be even more effective at handling complex interactions.

In the accounts receivables industry, Voice AI can transform creditors’ and collection agencies’ recovery strategies by providing an infinitely scalable team of voicebots that can handle the vast majority of consumer calls. The solution can handle the most repetitive and mundane calls, empowering live agents to focus on more complex and revenue-generating accounts.

Skit.ai’s solution can handle intelligent, personalized, and effective conversations with consumers, eliminating wait times and significantly cutting costs for the company adopting it. The solution retains the context of previous interactions and will tailor the service it offers based on the specific needs of the user. The technology not only understands what the user says but also the semantics of the conversation.

Conversational Voice AI for Outbound Collection Calls

Collectors are usually expected to go through thousands of accounts per month; a large number of those accounts remain untouched because it’s impossible for a human collector to contact and engage so many consumers. This process leads to substantial losses in potential revenue for the creditor or agency.

Artificial intelligence does not have this problem. When fed with large quantities of accounts, an AI platform can initiate and handle an extraordinarily high number of calls or interactions through a variety of communication channels, and they are available 24/7. These are some of the solution’s capabilities:

- Establish right-party contact (RPC)

- Read the Mini Miranda

- Collect payment disposition or promise-to-pay (PTP)

- Collect payment via gateway

- Negotiate settlement

- Record disputes

- Segment files

- Record call outcome in the CRM

- Agent callback request

The solution can easily transfer the more complex calls to a live agent when it cannot reach a satisfactory resolution. When agents see that a call is being transferred from the voicebot, they know the consumer is usually inclined to make a payment or reach a settlement.

Why You Should Not Use IVR for Outbound Collection Calls

Using IVR for debt collection calls is limiting and is unlikely to lead to a successful debt recovery on a consistent basis. The system can’t capture dispositions and is capable of performing a limited number of actions. Let’s say the consumer refuses to pay or disputes the debt—can your IVR capture the reason? Let’s say the consumer is willing to pay but can only pay off part of the debt at this time; can your IVR handle a negotiation? If the consumer is busy right now, is your IVR able to schedule a call-back at a time that’s convenient for the consumer? Probably not.

Conversational Voice AI for Inbound Queries

When a consumer calls a creditor or collection agency, they probably don’t want to deal with a frustrating and lengthy IVR menu. An intelligent voicebot is a much more welcome alternative!

The voicebot picks up the call right away, eliminating the wait time of a regular call; additionally, the user does not have to patiently listen to a long list of options. The voicebot typically authenticates the caller’s identity and, if relevant, informs them of their due balance. Here the customer gets to have an intelligent, effective, multi-turn conversation with the Voice AI solution.

In revenue-generating inbound calls, the voicebot can help the consumer make a payment. In non-revenue-generating inbound calls, the solution will answer the consumer’s questions based on the information it has on file and will transfer the call to an agent when needed.

Why You Should Not Use IVR for Inbound Queries

Whenever a consumer is interested in making a payment and resolving their debt, they might be turned off by the poor customer experience offered by the IVR. In non-revenue-generating inbound calls, the IVR system is often incapable of resolving the query and will, therefore, transfer the call to a live agent.

U.S. debt collection agencies report that their agents spend about 20% of their time answering inbound calls! Many of these calls are not revenue-generating, so they consume time and resources that could be allocated to collection calls.

A disadvantage of relying on live agents for inbound calls is their limited availability; they are not available 24/7. As a result, when consumers have queries or wish to make payments during off-hours, it is not possible, causing collection agencies to miss out on collection opportunities.

The Benefits of Adopting Multichannel Conversational AI for Debt Collection Agencies

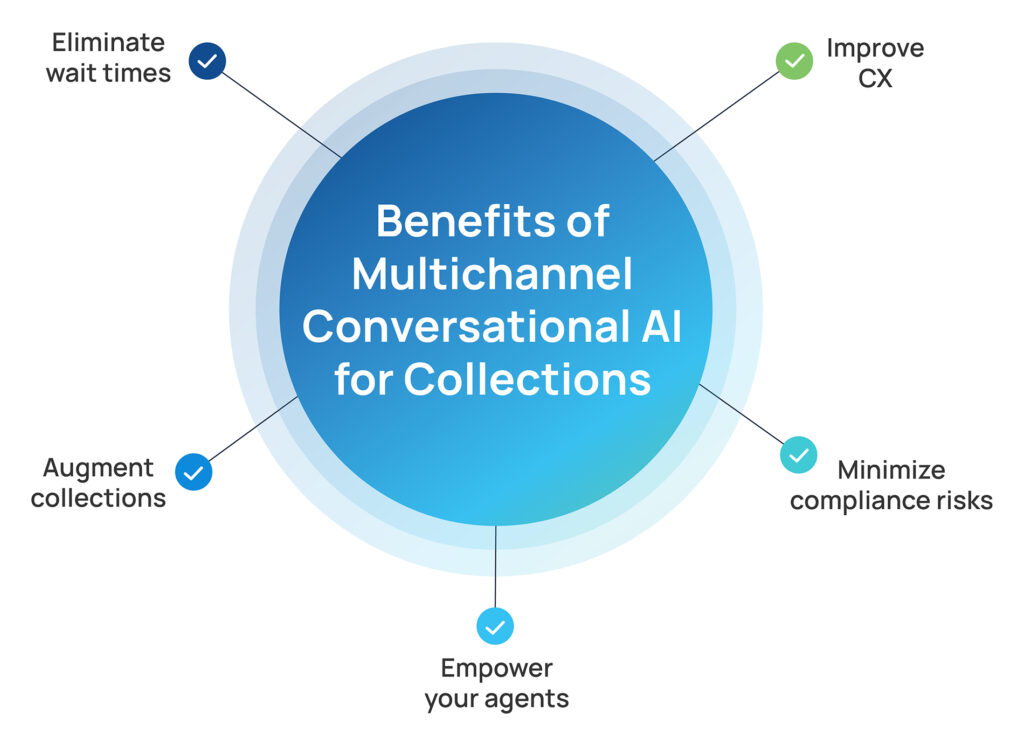

Here are some of the benefits reported by collections agencies that have adopted Skit.ai’s Voice AI platform:

- Eliminate wait times: Say goodbye to long wait times, Beethoven symphonies, and lengthy IVR menus.

- Augment collections: Thanks to total account penetration within minutes and automatic file segmentation, you’ll get much better clarity into your portfolio.

- Empower your agents: Because AI can take care of the most repetitive and mundane tasks, your live agents can focus on the most revenue-generating calls.

- Minimize compliance risks: The Conversational AI solution is built to be fully compliant with local laws and regulations.

- Improve CX: By offering multiple communication channels available 24/7—voice, SMS, chat, and email—you empower consumers to engage using their preferred method.

Interested in learning more about how Conversational AI can help you streamline your collection strategy and reach your full potential? Schedule a free demo with one of our experts.