Discover the Intersection of

Collections and AI

Built to perform across the customer journey.

By definition, debt collection agencies tend to make outbound outreach the focus of their recovery strategy. Contact consumers, remind them of their due balances, and collect payments. Whether it’s manual or automated, outbound outreach is at the core of what a collection agency does. But inbound calls from consumers can easily represent a dangerous blind spot resulting in a significant loss of revenue.

Every time a consumer calls your collection agency and their call goes to your voicemail or to an inconvenient IVR menu, you lose an opportunity to collect a payment.

The statistics are sobering. Agencies can lose up to 14% of their collection opportunities whenever inbound calls route to voicemail or drop due to the absence of an available agent. At Skit.ai, we reviewed data on inbound consumer calls provided by one of our partnering agencies prior to the adoption of Skit.ai’s solution.

In this article, we’ll discuss our findings and how our Multichannel Conversational AI solution can help agencies solve this issue.

Inbound calls lead to several challenges for collection agencies, especially those without a large team of live agents on the floor.

Inability to answer inbound calls 24/7: Agencies tend to receive many inbound calls from consumers outside of business hours—in the evening or during the weekend. While these are times when agencies don’t have staff available to answer calls, they’re also the times consumers tend to be free. According to the data we reviewed, as many as 43% of your inbound calls may be coming outside of operational business hours.

Limited staffing and resources: For several years, agency executives have been grappling with the challenges related to hiring and retaining agents and collectors. Given the limited resources most agencies have, it’s likely that agents may not be able to answer an inbound call also during business hours.

Call volume is not uniformly distributed throughout the day: 20% of inbound voicemail messages were received during business hours when inbound calls were at their peak and there were not enough agents to handle all the traffic. For example, 4:00 p.m. to 8:00 p.m. tends to be the busiest time of the day for agencies, according to our research.

In the graphic below, you can see an example of inbound traffic on an average day, showing that call volume is not uniformly distributed:

The idea that your business is not able to operate 24/7 is wrong and outdated. To never miss a single inbound call, automation through artificial intelligence is the answer. AI–enabled platforms present a practical and innovative solution to provide round-the-clock inbound support.

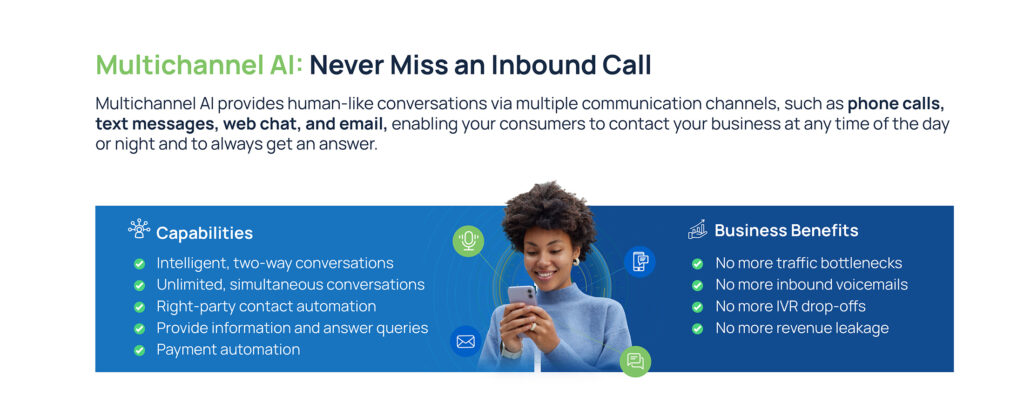

Multichannel AI provides human-like conversations via multiple communication channels, such as phone calls, text messages, web chat, and email, enabling your consumers to contact your business at any time of the day or night and to always get an answer.

Here are the capabilities of a multichannel bot for inbound use cases:

Intelligent, two-way conversations: A virtual assistant or bot can handle human-like, intelligent conversations that are multi-turn.

Unlimited, simultaneous conversations: Conversational AI can handle as many conversations as needed simultaneously, solving the issue of traffic volume for agencies and lenders.

Right-party contact automation: Automate simple and repetitive tasks such as right-party contact verification.

Provide information and answer questions: The virtual assistant will be able to answer common queries, and provide information on the outstanding debt or balance.

Payment automation: The bot can easily collect payments during the interaction via an integrated payment gateway.

Automating inbound calls and communications can save collection agencies and creditors a lot of money, enablign them to seize more recovery opportunities.

No more traffic bottlenecks: Solve traffic bottlenecks with Conversational AI, eliminating wait times.

No more inbound voicemails: Setting up a voicemail for inbound calls is likely to kill many recovery opportunities. Instead, allow your consumers to chat with your bot to get the assistance they need right away.

No more IVR drop-offs: IVR menus force consumers to listen to many irrelevant options and make their way through complicated IVR trees, resulting in high drop-off rates.

When automating inbound communications with Conversational AI, at Skit.ai we’ve seen the following results:

Multichannel Conversational AI also elevates the user experience for your consumers, making their debt resolution easier and faster. While customer experience (CX) might not always be top of mind for collectors, Conversational AI does provide many benefits for consumers:

Consumers utilize their preferred channel: Every individual prefers to communicate through a different channels. Some may prefer to speak over the phone, others may prefer to text via SMS. Offering multiple channels enables consumers to utilize whatever method of communication they feel most comfortable with.

Are you ready to automate your inbound operations with multichannel Conversational AI? Use the chat tool below to schedule a meeting with one of our experts to learn how your can optimize your collection strategy.

Built to perform across the customer journey.

How Is the ARM Industry Adopting AI?

How Is the ARM Industry Adopting AI?