The complex world of healthcare revenue cycle management (RCM) and patient billing is evolving rapidly. New digital tools are enabling providers to tackle early-out collections, prevent charge-offs, and improve recovery strategies. For healthcare organizations’ patient billing and RCM providers, early-out collections are a crucial piece of the patient billing puzzle, and AI is here to help.

By contacting patients early and kindly after sending a bill, early-out practices encourage patients to make a payment before the bill is charged off and handed over to collections. This practice can significantly improve an organization’s cash flow as well as the customer experience. However, RCM businesses and divisions often lack the necessary resources to consistently implement early-out collections on a widespread scale.

In this article, we’ll explore how Conversational AI technology can streamline the revenue cycle management (RCM) process. This technology can significantly reduce the revenue cycle duration by automating two-way, human-like conversations with patients, engaging them effectively, and sending reminders through a multichannel approach. Ultimately, these advancements aim to enhance profit margins for healthcare providers.

Early-Out Collections for Healthcare RCM and Billing: Common Challenges and Pain Points

Early-out collection practices help prevent bad debt, encouraging patients to pay their bills in a timely manner. From the provider’s perspective, early-out practices help improve cash flow through revenue recovery.

However, that’s easier said than done. Here are some of the most common challenges and pain points faced by healthcare RCM and patient billing providers:

Patient outreach and follow-ups: The recentness of the bills presents an opportunity for collectors since the consumer is usually easier to reach. But to accomplish the goal, patients must be contacted timely and regular follow-ups must be conducted. The need for multiple engagements and touchpoints can represent a challenge when your business doesn’t have enough staff to handle all these calls manually.

Agent staffing: Agent bandwidth and staffing present a serious challenge for RCM providers. In the last few years, hiring and retaining staff has become very expensive for businesses, with attrition and training costs adding to the strain.

Thin profit margins: Due to low payments and high expenses, RCM businesses are seeing their profit margins shrink. Additionally, due to the rise of High Deductible Healthcare Plans, the average balance of self-pay accounts is higher, making it more difficult for patients to complete their minimum deductible payments.

Debt breakdowns and complex disputes: Patients may inquire into bill breakdowns and insurance intricacies. RCM agents are required to provide the bill breakdown, adding an extra layer of complexity to the recovery cycle.

Long recovery cycles: When it comes to healthcare bills, the clock ticks due to stringent deadlines. Failure to meet these deadlines will cause the bills to go delinquent. If insurance billing is not closed within 90 days of bill generation, insurers can reject any claims against the accounts later, impacting the healthcare provider. When the bill goes to collections, the involvement of third-party collection agencies will reduce the RCM provider’s margins. Additionally, if too many bills are charged off, the healthcare provider will likely stop working with the RCM provider.

What Is Multichannel Conversational AI for Patient Billing Collections

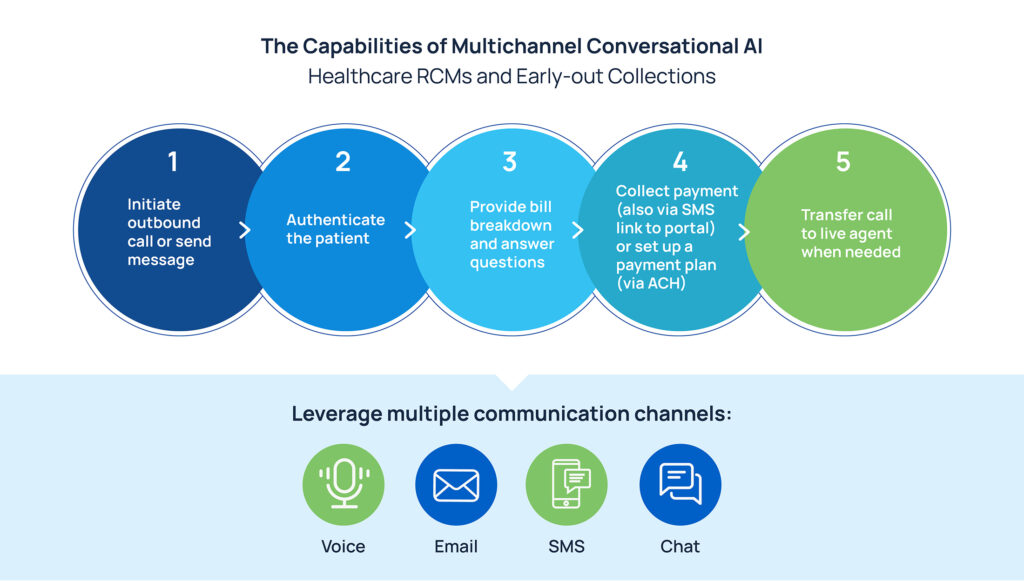

RCM providers are no strangers to software that can simplify and automate many day-to-day tasks. Conversational AI powered by large language models can transform early-out patient billing collections by automating patient outreach through multiple channels, such as phone calls, text messages, emails, and chatbots.

Outbound collections with intelligent bots enable RCM providers to reach as many patients as needed, engage them in human-like conversations, and encourage them to make a payment. This approach allows for effective patient outreach while optimizing the collection process and generating cash flow. Here’s what a bot can do:

- Initiate a call or send a text message to engage the patient.

- Authenticate the patient by verifying their identity.

- Provide bill breakdown and answer questions.

- Collect payments on-call or direct patients to a payment portal.

- Set up payment plans when needed, especially for high-amount bills.

- Transfer the call to a live agent when requested.

Skit.ai’s solution is compliant with all federal and state regulations, including the following laws: TCPA, HIPAA, and more.

The Benefits of AI in Early-Out Collections

Collect more payments: With Conversational AI, you can automate and schedule patient outreach at the right time and using multiple channels (e.g., phone and text messaging). This extensive outreach will generate more engagement and connectivity, driving more timely payments to your business.

Shorten the recovery cycle: Targeted outbound campaigns powered by AI will shorten the average recovery cycle, boosting cash flow.

Reduce charge-offs: Early-out collections enable you to reduce the number of charge-offs, i.e., bills that go into collections and become bad debt. Avoiding charge-offs will help you avoid additional headaches.

Solve staffing challenges: AI is not here to substitute humans but to augment their work. By adding AI to your current team, you’ll help them focus on disputes and complex cases and enable them to service a larger number of bills.

Save $$$: Leveraging artificial intelligence and automation can significantly drive down expenses and help you promote a healthy flow of payments.

Are you interested in learning how Skit.ai’s suite of multichannel solutions can benefit your business? Click here to schedule a consultation with one of our experts.