Introduction

Pollack and Rosen, a long-standing creditors’ rights law firm, partnered with Skit.ai to modernize its collections operations, streamline outreach, and intelligently scale recovery without increasing headcount. With Skit.ai’s proprietary Collections Intelligence engine and Agentic AI, the firm transitioned from fragmented outreach to a data-rich, AI-native collections process, improving engagement, operational efficiency, and recoveries across its portfolio.

Core Challenges

Pollack and Rosen had a strong legal infrastructure, but were struggling with:

- Operational inefficiencies from fragmented outreach tools and manual workflows, with no unified reporting or automation

- Scalability constraints due to agent-dependent execution, making it hard to respond to high-volume surges or dynamic outreach needs

- Consumer communication gaps as preferences shifted from calls to email/SMS.

- Recruitment friction in finding qualified talent to meet growing business demand

Skit.ai’s Suite of Solutions

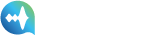

- Omnichannel Agentic AI: Regulation-aware voice and messaging bots for collections, delivering hyper-personalized, scalable outreach.

- Voice Bots: Automate inbound and outbound calls with consistent, high-performance interactions.

- Two-way SMS and Email Bots: Contextual follow-ups via SMS/email, integrated with voice workflows.

- Chatbots: 24/7 support and resolution via web and in-app chat.

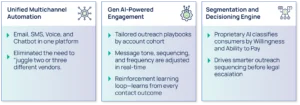

- Collections Intelligence: AI models segment accounts using metadata, behavior signals, and external data to optimize strategy.

- Reinforcement Learning Loop: Enhances campaigns in real-time based on interaction patterns and outcomes.

One Conversation, Multiple Channels

End-to-end Collection Automation with 24/7 Availability

Skit.ai’s Voice AI Solution for Creditors

Why Skit.ai

When Skit.ai’s team first reached out via a cold call, it coincided with internal discussions about modernizing outreach. After evaluating 5–6 different vendors, Pollack and Rosen chose Skit.ai for its:

Deployment and Adoption

- Phase 1: Email Campaigns

- Delivered strong open rates and drive-to-portal conversions

- Generated numerous multi-month payment plans in the early weeks

- Allowed the redeployment of agents previously handling outbound email

- Phase 2: SMS Rollout

- Recently launched with expected performance similar to email

- Aims to reactivate less responsive segments

- Team Optimization

- No hiring needed despite onboarding two major new clients

- Human capital redirected to higher-order strategic tasks

In Greg’s Words..

About Skit.ai

Skit.ai is a Gen AI-first collections technology company reinventing the debt collection industry. By combining AI-driven decisioning with human-AI collaboration, we deliver higher liquidation, lower costs, and a superior consumer experience—at scale. Skit.ai’s platform is built on proprietary data from over 53,000 creditors and spans 19+ debt types across varied delinquency buckets and portfolios. Skit.ai has received several awards and recognitions, including the BIG AI Excellence Award 2024, Stevie Gold Winner 2023 for Most Innovative Company by The International Business Awards, and Disruptive Technology of the Year 2022 by CCW. Skit.ai is headquartered in New York City, NY.

Book a Demo to transform your collections today!