Discover the Intersection of

Collections and AI

Built to perform across the customer journey.

Billions in recoverable debt go uncollected every year—not because borrowers disappeared, and not because they flat-out refuse to pay. It’s because most collections teams are still using blunt-force tactics: same scripts, same cadences, same assumptions.

Treating every borrower the same is the fastest way to lose them.

AI-powered segmentation flips that on its head. It replaces guesswork with real signals—intent, timing, behavior—and delivers the right message to the right borrower, exactly when it matters.

If you’re still sorting accounts by balance size or days past due, you’re not just falling behind. You’re leaving recovery on the table.

At Skit.ai, we didn’t just theorize about borrower behavior—we studied it at scale. Analyzing over 14 million accounts across creditors, banks, and fintechs lenders, we uncovered a game-changing insight:

Borrowers don’t behave according to static labels like “30 days past due” or “FICO score 620.”

They behave according to something far more powerful—and often invisible: intent.

This realization challenged and ultimately reshaped the old model of collections strategy.

Instead of segmenting by superficial factors (balance size, loan age, credit score), Skit.ai’s Collection Intelligence Platform re-segments accounts based on a dynamic behavioral axis:

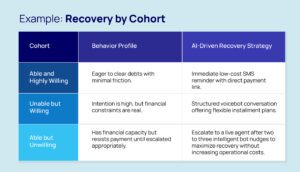

This produces 12 precision cohorts across 19 debt types, each with distinct psychological and financial profiles. Each cohort demands a custom recovery approach, not a one-size-fits-all call script.

Unlike manual teams that rely on outdated heuristics, Skit.ai’s system learns from real-world interaction signals, such as:

Based on these signals, our platform dynamically recommends for each cohort:

Recovery stops being a reactive guessing game.

It becomes an engineered sequence of micro-optimizations, tailored to the hidden psychology of each borrower.

The core insight is clear:

By speaking to each borrower differently—through the right channel, at the right time, with the right message—you unlock uplift and efficiencies that traditional blanket campaigns simply cannot achieve.

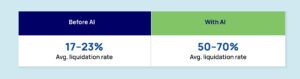

This is not a marginal improvement. It is a transformational uplift, delivering 50–70% better liquidation rates across real portfolios already living with Skit.ai’s platform.

Traditional collections teams often chase liquidation rates with:

In contrast, our AI platform takes a surgical approach. When Skit.ai’s segmentation engine is applied, recovery rates see an immediate jump:

That’s without adding a single new headcount to your team. The reason is simple: AI segmentation respects borrower behavior, allowing you to deploy human agents only when necessary, while bots handle scalable nudges and negotiations.

One major blind spot in traditional collections is outreach timing.

Without real behavioral data, companies default to mass blasts: calling everyone in a single time window, regardless of likelihood to convert.

Skit.ai’s AI platform analyzes past engagement patterns to optimize not just who you contact, but when.

Example:

A cohort identified as “Willing but Anxious” showed 38% higher payment promise rates when contacted on Tuesday evenings versus Monday mornings. Manual teams would never catch that nuance—AI does, instantly.

This is why intelligent collections aren’t just “faster”—they’re exponentially smarter.

The collections landscape is evolving—and so are the tools leading it forward.

Creditors leveraging behavioral segmentation and AI-driven strategies aren’t just recovering more—they’re doing it faster, more efficiently, and with greater borrower empathy.

With over 53,000+ creditors already seeing 50–70% uplift in recovery rates, the momentum is clear: Precision is outperforming tradition.

As you plan your Q3 and beyond, consider what’s possible when segmentation aligns with strategy—when every outreach is timely, targeted, and tailored. Better liquidation is no longer a stretch goal. It’s a smart, data-backed next step.

Ready to Take the Long View with AI in Collections? Let’s talk.

Built to perform across the customer journey.

A Million Conversations. One AI Platform.

A Million Conversations. One AI Platform.