Discover the Intersection of

Collections and AI

Built to perform across the customer journey.

Auto Finance (and auto loans) contribute a significant chunk of the lending economy, comprising 25% of the non-mortgage accounts in the US. With lower rates, auto loans are expected to become more affordable, potentially boosting loan originations. Additionally, stable inflation may enhance car affordability for consumers.

While conditions seem to improve for Auto Finance and Buy-Here-Pay-Here consumers regarding loan originations, the high delinquency rates remain a significant concern. This article will explore why managing collections and reducing delinquencies on existing accounts will continue to be challenging for auto lenders.

In short, loans originated in 2022-23 were issued on high car prices and loan amounts, creating financial strain. Lower interest rates can’t offset these high monthly payments, which will likely drive delinquencies higher over the remaining loan terms.

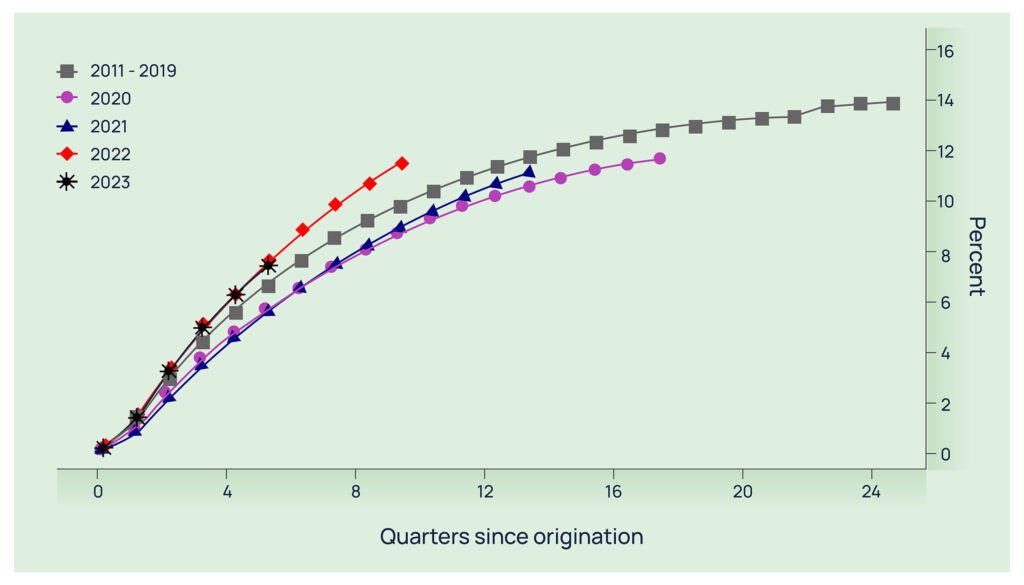

Auto loan delinquencies are currently 60% above pre-pandemic levels, reaching their highest point since the 2008 housing crisis. The 30-day past-due rate (DPD) now stands at 3.7%, with most delinquencies originating from near-prime or subprime borrowers. Notably, delinquency rates are rising sharply among loans issued in 2022-23.

The primary driver of these high delinquency rates is the high monthly loan payments, which surged by 27% from January 2020 to January 2023. In comparison, monthly payments only grew by 9.3% from January 2017 to January 2020. According to Federal Reserve research, a 1% rise in monthly loan payments increases the likelihood of delinquencies by 0.03%.

Monthly loan payments are influenced by three main factors:

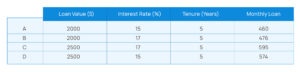

For simplicity, we’ll keep the loan tenure constant, as standard terms typically range between 60 to 66 months. Focusing on the other factors, subprime borrowers saw a 30% increase in loan value during 2022-23, coupled with a 140-basis-point rise in interest rates.

The table below illustrates how shifts in loan value and interest rates affect subprime borrowers. These figures assume typical market rates and loan amounts for this segment, reflecting post-pandemic trends in both parameters.

A 200-basis-point rise in interest rates (from Scenario A to B) leads to a 3% increase in monthly payments.

When loan value jumps by 25% (from Scenario B to C), monthly payments increase by 25%.

Combining these factors (Scenario C compared to A) results in a total 30% increase in monthly payments. Even if interest rates decline (Scenario D compared to C), monthly payments would only decrease by about 3%.

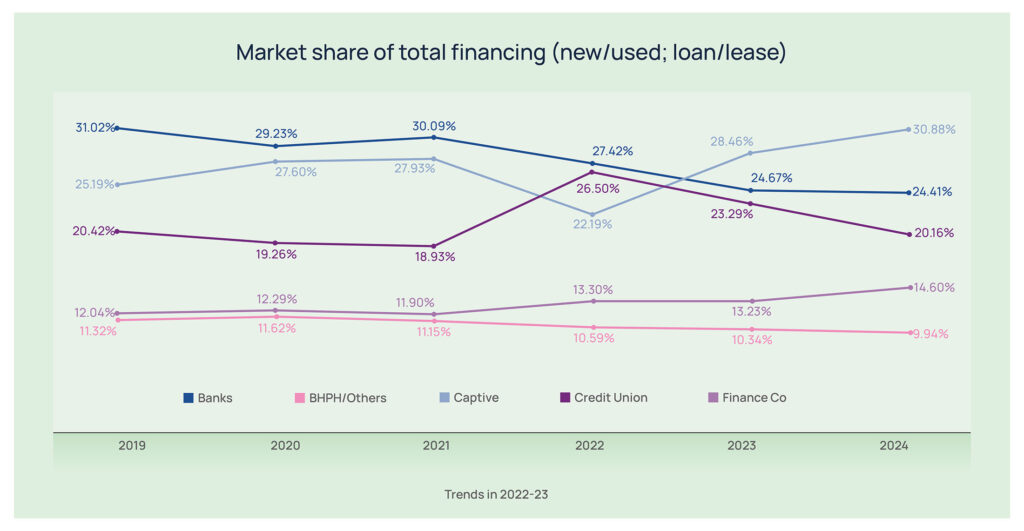

During the post-pandemic period, car prices rose significantly due to supply chain disruptions, chip shortages, and increased demand driven by low interest rates and economic stimulus. As a result, banks tightened lending standards, and most auto loans during this time were issued by credit unions, captive finance companies, BHPH dealerships, and auto finance firms. Rejection rates for auto loans, which were approximately 7% pre-pandemic, fell to around 5%. [Refer to “Trends in 2022-23” graphic below]

Unlike banks, it is credit unions, BHPH dealerships, and auto finance companies that are likely to experience a continued rise in delinquencies, especially from loans originated in 2022-23. Given the typical 5-year loan term, it may take an additional 2-3 years before delinquency rates return to the more acceptable, pre-pandemic benchmarks.

Consistent consumer engagement is essential for managing delinquencies effectively. Providing 24/7 support and flexible payment options can optimize recovery efforts. Reaching consumers through their preferred channels—whether voice, SMS, or email—enhances connectivity and engagement.

Skit.ai offers omnichannel capabilities, enabling seamless conversations across all communication channels. Leveraging generative AI specialized in collections, Skit.ai verifies consumers, negotiates terms, offers flexible payment plans, and processes payments—all without requiring agent intervention. The Conversational AI platform can place multiple calls simultaneously to increase contact attempts per account, and it can send and receive SMS responses from customers, processing payments via credit cards directly through SMS.

Are you interested in learning more about how Conversational AI can benefit your business? Book a demo with one of our experts.

Built to perform across the customer journey.

Artificial Intelligence: Empowering Human Agents for Better Efficiency

Artificial Intelligence: Empowering Human Agents for Better Efficiency