Discover the Intersection of

Collections and AI

Built to perform across the customer journey.

Most AI-powered debt recovery strategies age faster than you realize. You craft an outreach sequence—timed to salary cycles, carefully tuned for tone, and reviewed for regulatory compliance. But by the time it rolls out, your debtors have already changed.

Behavior patterns shift with inflation, economic trends, and even headlines. What worked yesterday can underperform today. Yet, many campaigns stay static—updated quarterly at best, adjusted manually, and always trailing consumer behavior.

Missed calls pile up. Response rates decline. Feedback loops remain slow.

But what if your collections strategy evolved faster than the people it’s trying to reach?

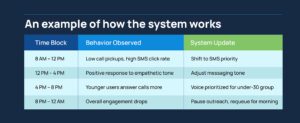

At the heart of modern AI-powered debt recovery lies a continuously learning engine. Forget static playbooks. These systems analyze behavioral signals from every interaction and adapt in near real-time.

This is not theoretical. Today, AI-powered debt recovery systems are analyzing tens of millions of debtor interactions per day and updating campaign tactics every six hours—autonomously.

Every call, SMS, or email becomes a data point. The system observes what works, suppresses what doesn’t, and updates strategy accordingly. It might:

Your AI-powered debt recovery platform becomes a living system—not a quarterly report.

Reinforcement Learning: The Brain Behind the Change

This approach is built on reinforcement learning — a type of machine learning where systems learn from feedback rather than pre-programmed logic.

Each interaction is a signal. If a message results in a positive action — a reply, a payment, or even a click — the strategy behind it gets reinforced. If the outreach is ignored or triggers opt-outs, the approach is suppressed. Over time, these micro-adjustments compound, refining the outreach engine across millions of accounts.

Unlike static A/B testing, AI-powered debt recovery isn’t a single experiment. It’s a loop that runs continuously, exploring new options while also exploiting known high-performers. The system balances risk and reward intelligently, without needing manual oversight.

Self-healing campaigns touch every layer of your outreach strategy. With an AI-powered debt recovery engine, you’re not locked into static rules—you’re dynamically adjusting in real-time.

The AI dynamically shifts the balance between voice calls, texts, and emails based on response rates. If SMS begins outperforming calls for a certain segment, the system pivots accordingly. If email engagement drops off mid-week, other channels are prioritized.

Rather than sticking to fixed schedules, the system identifies high-response windows on a per-segment basis. If a certain demographic starts engaging more at 8 PM instead of 5 PM, outreach timing is adjusted. The traditional “best time to contact” becomes a continuously updating variable.

Messaging is not one-size-fits-all. Some audiences respond better to urgency, others to empathy. The AI adapts tone across segments by analyzing response patterns. If firm language is met with silence, the tone softens. If friendly nudges yield no progress, a more direct message may be tested.

It is built into the system by design, and not as an afterthought. Every decision adheres to:

For instance, even if data suggests that engagement rates spike late in the evening, the system will automatically suppress outreach if it falls outside of Reg F-defined contact hours. Similarly, TCPA consent requirements are strictly enforced — no SMS or call attempt is made without prior express consent where applicable.

Beyond timing, the system also adjusts language based on tone sensitivity, filtering out content that could trigger compliance risks or violate the consumer-rights provisions defined under FDCPA. As regulations change, compliance modules are updated — ensuring outreach remains not just effective, but audit-ready and legally sound.

These refinements happen up to four times a day. What once took a quarter of experimentation and human review now happens in the background — and at scale.

Automation handles the tactical decisions—timing, tone, and channel mix—freeing up space for broader strategic thinking. Instead of managing every detail, people can set clear objectives: recovery targets, compliance boundaries, or preferred communication ratios.

Within these parameters, the AI continuously learns and adapts. When new engagement patterns emerge, the system responds immediately—testing, refining, and shifting course without waiting for manual input.

Humans stay firmly in the loop—not to manage mechanics, but to shape intent. The focus shifts from execution to oversight, ensuring that outcomes align with business goals while the system handles the complexity of day-to-day optimization.

Debt collection isn’t just about catching up—it’s about keeping pace with consumers whose behavior shifts faster than legacy strategies can handle. Quarterly updates and manual tweaks no longer cut it in a landscape shaped by real-time decisions and ever-tightening compliance regulations.

AI-powered debt recovery systems change the game. They don’t just streamline operations—they actively learn, adjust, and optimize every six hours. From timing and tone to channel strategy and compliance, self-healing campaigns ensure your outreach is always one step ahead.

This isn’t the end of strategy—it’s the beginning of strategy that evolves with you. The difference between falling behind and staying ahead comes down to how quickly your system can adapt.

Ready to turn static campaigns into living, learning systems? Book a demo to see AI-powered debt recovery in action—and start optimizing every six hours.

Built to perform across the customer journey.

Pollack & Rosen Reimagines Legal Collections with Skit.ai’s Gen AI-Native...

Pollack & Rosen Reimagines Legal Collections with Skit.ai’s Gen AI-Native...