Discover the Intersection of

Collections and AI

Built to perform across the customer journey.

In the high-stakes world of commercial (B2B) debt collections, where high call volumes and rising staffing costs are common challenges, the integration of AI-powered technology can be a game-changer for collection agencies. Here’s where Conversational AI—in the forms of multichannel automation, including voice, email, and text—can transform a business’ recovery prospects. This technology can enhance agent productivity, streamline operations, and significantly improve customer satisfaction.

In this article, we’ll explore the power and potential of Conversational AI automation for B2B collections and how you can leverage this technology to optimize every step of your recovery efforts.

Collection agencies servicing commercial debts typically face several staffing-related challenges:

Staffing Costs: Recruiting, hiring, training, and retaining talented agents is not easy, and certainly not cheap. The costs associated with maintaining a robust workforce to handle calls and pursue collections represent a significant portion of an agency’s operational expenses. In a competitive market, these costs can easily eat into profit margins.

High Call Volumes: Commercial collection agencies endure a relentless stream of outbound calls, each call representing an opportunity to engage with the debtor and move toward a resolution. Agents tend to be overwhelmed by the high number of calls they are expected to place, leading to burnout and decreased productivity.

Persistent Follow-ups: Successful debt recovery often hinges on persistent follow-ups, a business imperative for the recovery strategy. The process typically requires multiple contact attempts before a resolution can be reached; persistent follow-ups require significant staffing resources and capabilities.

Compliance: The collections regulatory environment is fast-evolving and not always easy to navigate. Staff needs to be regularly trained and updated on laws and regulations, an effort that adds another layer of complexity to the agents’ jobs. Even in commercial collections, where fewer regulations are at play, collectors want to commit to the most ethical practices.

AI has been the talk of the town in virtually every industry, and the accounts receivables space is no different. The challenges we outlined in the previous section make automation with artificial intelligence, Conversational AI in particular, an obvious solution for collection companies and lenders handling all types of debt—including commercial debt.

Industry-leading agencies have adopted Conversational AI, such as Voice AI, to automate interactions with consumers, accelerating recoveries and reducing costs. Whether these interactions take place over the phone or via email, Conversational AI can handle them end-to-end.

The benefits of Conversational AI go beyond those of the collection agency as a business, but significantly improve the agent experience as well. By automating repetitive and tedious calls and tasks, agents can focus on more rewarding or complex scenarios. Additionally, agents can focus on call transfers from the Voice AI solution.

Voice AI refers to the use of Interactive Voice Assistants or voicebots to initiate and handle outbound or inbound calls. In the context of collections, a Voice AI solution can handle collection calls from start to finish—from identifying the end-user to providing information on the due balance to collecting the payment on- or off-call. Powered by Generative AI, Skit.ai’s voicebots can handle multi-turn, two-way, intelligent conversations with consumers.

Conversational AI represents a significant leap in the efficacy of conversational interfaces. By leveraging the power of natural language processing and machine learning, these systems hold conversations that are just as good as your average agent’s conversations.

AI-driven systems do not just handle repetitive tasks; they also progress through call scripts and collections processes logically and methodically, ensuring that no detail is overlooked and that customers receive a consistent and polished interaction.

AI-powered email automation, when synergized with Voice AI, creates a comprehensive collection approach that extends beyond mere telephony. It casts a wider net for customer engagement and offers a structured, multimodal avenue for debt resolution. Skit.ai’s multichannel platform relies on the synergic utilization of multiple channels, without losing the context from one interaction to the other regardless of the channel.

Here are some benefits of incorporating email automation into your recovery strategy:

Timely and Cohesive Communications: Emails are scheduled and dispatched at opportune moments, complementing the call strategy to create a seamless and unrelenting push towards recovery. This synchronization significantly improves message retention and customer response rates.

Tailored Messaging: With email automation, each message is curated to resonate with the customer’s unique situation and history, engendering a sense of personal and purposeful outreach that traditional email blasts simply cannot replicate.

Customer Convenience: The inclusion of payment links in emails provides a user-friendly payment method, optimizing the customer’s experience and increasing the likelihood of prompt settlements.

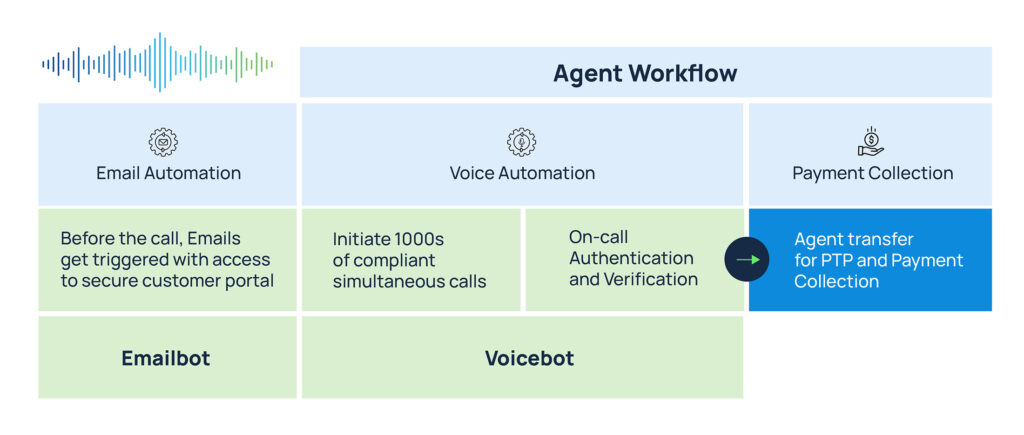

Let’s see a sample collection workflow that combines voice and email automation, as done by one of Skit.ai’s clients. When the agency receives an email from a debtor, an automated call can be triggered, which can be easily transferred to one of your live agents for a quick resolution.

Email bot / Email Automation: A personalized email is triggered including a link to a secure payment portal.

Voicebot / Voice Automation: The voiciebot can initiate and handle thousands of compliant, simultaneous calls to different debtors. On the call, the voicebot can verify the user’s identity and provide the necessary information on the debt. The voicebot can answer questions, capture promise-to-pay (PTP), process payments, or negotiate settlements as needed.

Live Transfers: When needed, the voicebot can easily transfer the call to a live agent, who can collect the payment or capture a promise-to-pay (PTP).

Our clients have reported remarkable success using our multichannel platform.

For the email bot, they experienced an open rate of up to 40% and a payment rate of up to 7.5%. Both metrics varied based on age and type of debt.

With the Voice AI solution synched with the email bot, our clients experienced 100% account penetration and a connectivity rate of 13%. The solution enabled them to save their agents’ time by up to 50% and boost their agents’ productivity by 25%.

Are you interested in learning how Skit.ai’s multichannel solution for collections can benefit your business? Use the chat tool below to schedule a meeting with one of our experts.

Built to perform across the customer journey.

4 Easy Steps to Go Live with Voice AI for Collections

4 Easy Steps to Go Live with Voice AI for Collections