Introduction

Veros Credit is a leading auto financing provider specializing in acquiring and servicing motor vehicle retail installment contracts through a vast franchise and independent dealers’ network. With over 25 years in the subprime auto finance industry, the company deeply understands both dealership and consumer needs.

Veros Credit focuses on building long-term partnerships with dealers while ensuring consumers are positioned for successful automobile ownership. Their data-driven application approval process creates value for all stakeholders—dealers, consumers, and Veros Credit—by making competitive lending decisions that balance risk and accessibility. They are particularly committed to serving subprime borrowers, recognizing their unique financial situations, and providing fair, flexible financing options.

Agent Team Size: 75 agents

Challenges Faced

Before adopting AI, Veros Credit relied heavily on human agents to manage all creditor outreach and handle collections via their CRM system. The team was primarily focused on maximizing debt recovery while also responding to customer inquiries regarding payments and outstanding balances, placing a significant strain on resources.

Skit.ai’s Strategic Capabilities

Skit.ai is a GenAI-first collections technology company, purpose-built to modernize and optimize the debt recovery lifecycle. Founded in 2016, Skit.ai has emerged as a category leader in Conversational AI—transforming traditional collections in the Accounts Receivables Management (ARM) landscape with intelligent, automated outreach.

Our platform combines AI-native conversational agents with precision decisioning capabilities, empowering financial institutions, debt buyers, and third-party agencies to achieve:

Deployed by leading financial institutions, debt buyers, and third-party collections agencies, Skit.ai leverages proprietary insights and deep domain expertise to modernize the full debt recovery lifecycle.

Our Suite of Solutions

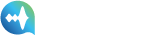

- Omnichannel GenAI Agents: Regulation-aware voice and messaging bots for collections, delivering hyper-personalized, scalable outreach.

- Voice Bots: Automate inbound and outbound calls with consistent, high-performance interactions.

- Two-Way SMS and Email Bots: Contextual follow-ups via SMS/email, integrated with voice workflows.

- Chatbots: 24/7 support and resolution via web and in-app chat.

- Reinforcement Learning Loop: Enhances campaigns in real time based on interaction patterns and outcomes.

- Collections Intelligence: AI models segment accounts using metadata, behavior signals, and external data to optimize strategy.

One Conversation, Multiple Channels

End-to-End Collection Automation with 24/7 Availability

Skit.ai’s Voice AI Solution for Creditors

Why Veros Credit Chose Skit.ai

Veros Credit chose Skit.ai for its strong multilingual support in English and Spanish, and its proven track record in third-party collections. The presence of a dedicated local support team in New York, available 24/7, ensured reliable assistance. Additionally, Ski t.ai stood out for its fast issue resolution and consistently responsive service, making it the ideal partner for scaling AI-driven collections.

The Solution

To meet Veros Credit’s specific needs, Skit.ai deployed a customized GenAI-powered voice solution, designed to automate and streamline their collections workflows across multiple touchpoints.

Current Use Cases

End-to-End Automation

- Complete workflow coverage—from Right Party Contact (RPC) identification to Promise-to-Pay (PTP) capture and payment processing

- Supports payments from both primary borrowers and co-borrowers

- Instant live agent transfer for escalations or assistance requests

System Integrations

For a seamless customer experience management

- Payment Gateway: Paymentus: Integration with native APIs to enable Card on Call, Card on File and IVR integration on consumer’s need basis.

- Telephony Systems: Alvaria and NobleBiz: Configured telephony SIP trunk integration to enable lower Total Cost of Ownership (TCO)

- CRM Platform: Shaw Systems: Real-time data exchange in & out for in-house CRM system

Implementation Journey

From Pilot to Expansion: A Phased Deployment Strategy

- Started with inbound service call automation

- Expanded to early-stage delinquencies

- Upgraded to a Large Language Model (LLM), tripling outbound containment

Built for Visibility and Control

- Real-time dashboards for performance monitoring and analytics

- Custom journey mapping for use case flexibility

- Secure verification: DOB and identity checks

Integrated Seamlessly Into Existing Ecosystem

- SIP telephony for inbound/outbound flows

- Real-time CRM sync

- Native APIs for:

- Card-on-call & card-on-file

- Custom integrations by consumer context

Driving Down Costs, Not Performance

- Reduced Total Cost of Ownership (TCO) via:

- Smarter telephony routing

- Streamlined automated payment processing

- Streamlined integration architecture

Outcomes

Agent Efficiency & Cost Savings

Collections Performance

- 34% payment conversion rate

- Bot-influenced payments:

- $903,000 average per case

- $567,000/month on average

Consumer Reach & Containment

- 40% overall containment rate (inbound + outbound)

- Right Party Contact (RPC) success:

- Inbound: 70–75% (on par with agents)

- Outbound: 40–44% (vs. 22–23% for agents)

Compliance & Scalability

- Fully supports English and Spanish

- Manages accounts up to 20 days past due

- Seamless handling of millions in balances monthly

From Goal to Outperformance

The original target was a 20% containment rate—but through continuous refinement and close collaboration, the solution achieved 40% containment, doubling expectations.

This success highlights two important truths:

- Effective AI performance takes iteration and fine-tuning

- Early, hands-on involvement leads to faster, better outcomes

Future Scope

Veros Credit plans to extend Skit.ai’s capabilities to new use cases, including charged-off accounts, investment-related interactions, and customer interviews based on submitted forms. The solution will also be enhanced to handle FAQs related to payoffs, principal amounts, refinancing, repossession, insurance claims, autopay, deferred payments, and account details.

The team is exploring an omnichannel approach, with upcoming support for:

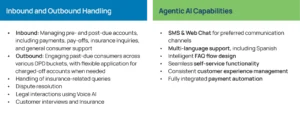

They also plan to scale AI usage in early-stage delinquency segments to boost recovery rates. Using the tonality feature of our platform, they plan to segment accounts into different DPD buckets and target them with personalized messaging and approach.

About Skit.ai

Skit.ai is a Gen AI-first collections technology company reinventing the debt collection industry. By combining AI-driven decisioning with human-AI collaboration, we deliver higher liquidation, lower costs, and a superior consumer experience—at scale. Skit.ai’s platform is built on proprietary data from over 53,000 creditors and spans 19+ debt types across varied delinquency buckets and portfolios. Skit.ai has received several awards and recognitions, including the BIG AI Excellence Award 2024, Stevie Gold Winner 2023 for Most Innovative Company by The International Business Awards, and Disruptive Technology of the Year 2022 by CCW. Skit.ai is headquartered in New York City, NY.

Book a Demo to transform your collections today!