There have been a total of 13.7 million car sales in the U.S. in 2022, according to an IBISWorld estimate. Car sales have been declining since the beginning of the COVID-19 pandemic due to many factors, including the growing prevalence of remote work, supply chain issues, and a looming recession.

As a consequence, interest rates have been rising significantly, hitting over 6.0% and negatively affecting the number of car sales. With higher prices, bigger loans, and higher interest rates, comes an increase in delinquencies. It has become an issue for many auto finance companies to keep up with the high number of delinquent borrowers.

In this article, we’ll discuss how Voice AI (the technology behind a voicebot) can transform auto loan collections in different ways.

What Is Voice AI?

Also referred to as a voicebot, Voice AI is a technology that enables companies to automate calls with customers from start to finish without requiring the involvement of a human agent.

AI-powered Digital Voice Agents are capable of handling intelligent conversations with users. The technology understands what the user needs and helps them effectively resolve the issue in just a few minutes. Voice AI should not be confused with Outbound IVR (Interactive Voice Response), a dated technology that consumers tend to dislike.

Auto finance companies that perform collection calls are now turning to Voice AI to automate many of the repetitive, tedious calls they used to perform manually and allow their live agents to focus on more complex and revenue-generating tasks. The Digital Voice Agent engages with the borrower, verifies their identity, and collects the payment on-call, covering up to 70% of the company’s outbound call volume.

To better understand what Voice AI is, think about Siri or Alexa, but for collections. However, there is one difference. While voice assistants like Alexa can only handle one or two conversation turns, a solution like Skit.ai’s Digital Voice Agent is designed to address issues that often require several conversation turns. Just like humans need to gather the context before solving a problem, a Digital Voice Agent might ask multiple questions before proposing a resolution.

What Are the Most Common Uses of Voice AI in Auto Finance Collections?

Voice AI is just one of the many artificial intelligence trends that are taking the auto industry by storm. Its ability to automate collection calls and other common types of outbound calls to borrowers is particularly appealing to auto finance leaders looking for ways to cut contact center costs and maximize profits.

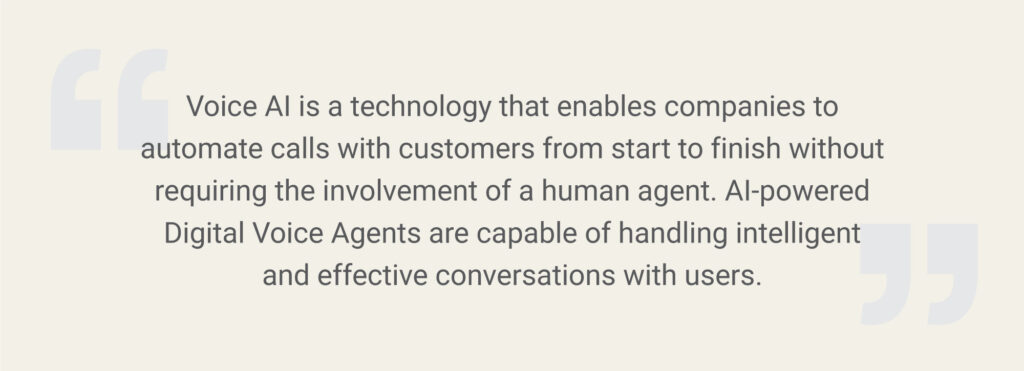

Let’s dive deeper into the four most common uses of Voice AI (the technology behind Skit.ai’s Digital Voice Agent) in auto finance collections:

Welcome calls: Lenders and auto finance companies typically deliver an initial “welcome call” to borrowers to let them know that they are servicing the loan or in charge of collecting payments. While these calls are important, they are not revenue-generating and utilize the precious time of the company’s live agents.

Skit.ai’s voicebot solution can easily initiate an outbound call to borrowers to deliver the message and then answer some of the customers’ most common questions.

Payment reminders: Auto finance agents typically spend most of their time calling borrowers to remind them of payments that are due soon or payments that are already overdue. Reaching borrowers is not always a straightforward process! Agents have to establish right-party contact, explain who they are, and remind the borrower about the payment. When the volume of loans increases, it can be challenging for managers to scale the contact center to fit the need of the moment.

Skit.ai’s Voice AI solution can offload up to 70% of the calls from live agents, handling payment reminders automatically. Skit.ai’s clients have even reported that some borrowers prefer to interact with a voicebot rather than a human agent, as it can be embarrassing for them to discuss pending payments and the risk of going delinquent. The voicebot can easily establish right-party contact, remind the borrowers of the due balance, and offer different ways to pay it off.

On-call collections: The end goal for any collector is to recover the payment from the borrower; if the borrower is willing to make the payment on-call, even better. While this part of the process is directly revenue-generating, it still takes time and resources to complete.

Skit.ai’s Digital Voice Agent has the capability to collect the payment during the call, making the process significantly cheaper for the company servicing the loan. The collection is processed through a payment gateway of the company’s choice.

Autopay or ACH sign-up: Many auto finance companies servicing loans initiate outbound calls to borrowers to offer them to sign up for autopay. With autopay or ACH, borrowers can automate payments from their credit card or bank account so that they can be processed on a regular basis.

Skit.ai’s Digital Voice Agent can easily call borrowers, explain how autopay works, and offer them to sign up on call. This is an ideal scenario for auto finance companies, as it ensures a regular cash flow.

How Do Auto Finance Collections Work?

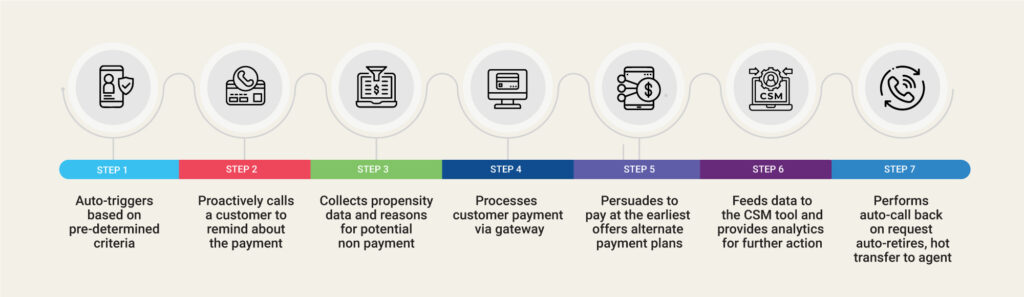

Now that we know what Voice AI is and the main use cases in auto finance, let’s go over the main steps of a standard collection call handled by one of Skit.ai’s Digital Voice Agents.

The voicebot follows these steps:

- Triggers the outbound call based on pre-determined criteria

- Establishes contact with the borrower (RPC) and reminds them about the payment

- Collects propensity data and reasons for potential non-payment

- If the customer is interested in making the payment right away, the Digital Voice Agent guides them through the process via a payment gateway

- Persuades the customer to pay at the earliest, or offers alternate payment plans

- Feeds data to the CMS (collection management software) and provides analytics for further action

- Performs auto-callback on request, auto-retries, hot transfer to agent

Are you interested in learning more about how Skit.ai’s Augmented Voice Intelligence platform works and how your auto finance company can adopt it? Schedule a call with one of our experts using the chat tool below!