Simone Somekh

January 30, 2024

Hello! Welcome to Skit.ai. Click here to book a demo.

January 30, 2024

Since the COVID-19 pandemic, massive supply chain delays, and the ongoing recession, auto finance companies have had to be as competitive and forward-thinking as possible. After an unprecedented year, many companies are looking to invest more in technology, specifically artificial intelligence, in 2024.

At the moment, four facts are defining the auto finance industry:

Let’s break these statements down with the help of a few data points.

Car prices are still very high: After hitting record prices in 2022, the average price for a new car was at $48,247 at the end of 2023. Used car prices were down to $27,300 in June 2023.

High car prices = higher auto loan debt: Auto loan balances hit a record $1.6 trillion in Q3 2023. Between high interest rates, high inflation, and high prices, affording a car has been increasingly difficult for consumers.

Interest rates are climbing: Interest rates are very high; we’re looking at 7.03% for new cars and 11.35% for used cars.

Delinquencies are increasing: Delinquency rates reached their highest level in almost 30 years at the end of 2023. This is likely due to the increase in loan size, interest rates, and monthly payments.

Financial institutions, in general, have been eager to adopt AI solutions to process loans and vet borrowers. But AI can do much more than professionals in the auto finance field might expect.

With the high demand for auto loans, providers have been adopting new solutions to streamline operations. One of the biggest focuses in auto finance right now is the digitization journey—starting with digital contracting. Digitization makes operations more efficient and scalable, helps to improve compliance, and enhances the customer experience. Yet, artificial intelligence can achieve much more than just “going paperless.”

AI can expedite many processes, saving time, money, and other resources; it can generate data-driven predictions much faster and more accurately than humans. While AI can be extremely helpful, it does not substitute human work but rather augments and simplifies it. Paired with human expertise, AI can be an incredible asset for auto finance companies.

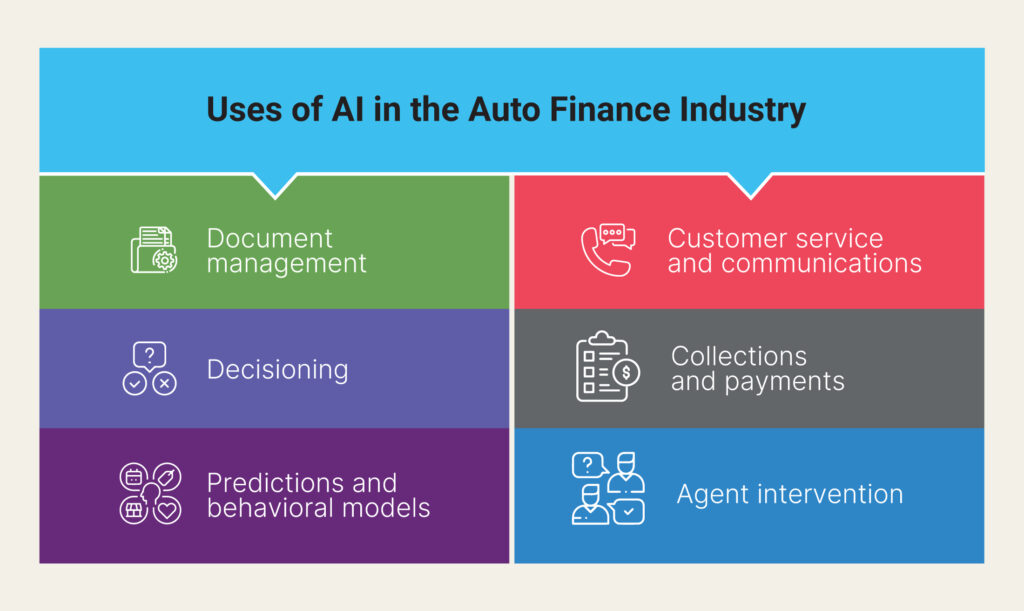

Here are some of the applications of AI:

Document management with AI: Document management with AI enables companies to classify, process, and cluster documents, extract data, secure sensitive information, and recognize signatures. This can be useful when processing applications; it helps reduce errors, improving the consistency and accuracy of the data.

Decisioning with AI: AI can assess risk and help auto finance companies in the approval process. While AI should not make irreversible decisions independently, it can help companies to make data-driven decisions.

Predictions and behavioral models with AI: Predictive models allow auto finance companies to better understand their customer base and its behavior as they identify patterns that can be useful for future decisions.

Customer service and communications with AI: Chatbots and voice bots have the ability to transform and streamline customer service, improving the company’s customer experience and providing a distinct competitive edge.

Collections and payments with Voice AI: Conversational Voice AI can also help auto finance companies in the collection process, as it automates outbound calls to customers, reminding them of outstanding payments and collecting payments over the phone.

Agent intervention with AI: Thanks to AI-powered predictive models, auto finance companies can flag accounts that require additional communications and facilitate agent intervention.

Of all the existing trends we’ve mentioned, Voice AI seems to be the one that will get a spotlight in 2024. More providers are turning to Voice AI to automate customer service calls for both inbound and outbound use cases.

Voice AI companies like Skit.ai develop voice bots to augment the activity of human agents, handling the majority of repetitive, mundane calls.

Collection calls and payment reminders are one category of customer interactions that a Voice AI solution can easily handle from start to finish—from dialing the number and establishing right-party contact to engaging in a conversation with the customer and collecting payments via gateway.

The Voice AI platform enables auto finance companies to call thousands of different customers simultaneously, sending them reminders and collecting payments on-call or via a third-party gateway. The Voice AI platform can be easily integrated with multiple tools and applications, such as telephony platforms, CRM systems, payment gateways, and messaging tools; all while complying with the latest laws and regulations.

Context is critical: The Voice AI solution keeps track of the information obtained from the customers, feeding the data to the CRM in real-time and providing helpful analytics for future action.

As a result, companies adopting Voice AI can collect payments more efficiently, saving a lot of time and money they would otherwise spend if they did everything manually.

Voice AI can be adopted for many use cases, not just payments and collections. Voice bots can be employed for both inbound and outbound use cases, customer service, and other types of communication.

Interested in learning more about how Conversational AI can transform the auto finance industry? Schedule a call with one of Skit.ai’s experts using the chat tool below.

The auto finance industry is experiencing significant transformations driven by market dynamics, consumer behavior, and technological innovations. Here are the key trends shaping the future of auto finance, focusing on the implications for Buy Here Pay Here (BHPH) dealers and the role of Conversational AI and contact center automation in streamlining operations, which will help […]

The auto finance industry, a crucial pillar in the automotive market, experienced a turbulent Q2 in 2024. The rise of delinquent accounts in subprime lending has become a significant concern for industry stakeholders. Subprime lending, which targets borrowers with lower credit scores, is inherently riskier, and recent economic pressures have worsened these risks. This blog […]