Discover the Intersection of

Collections and AI

Built to perform across the customer journey.

In the new normal, key players in the debt collection industry, from creditors to every downstream collection agency, face significant challenges to improve collections. This is happening mainly for two reasons. First, there are rapidly evolving regulatory and compliance frameworks to which collection agencies must adhere. Second, the mitigation of cost has become an extremely uphill task.

However, there is an additional issue at play: The most common solutions prevalent in today’s market, such as Robocaller and outbound IVR voice blaster, are incapable of conversations, feedback, and insights. Instead, an AI-enabled Voice Agent is capable of meaningful and human-like conversations with customers.

Unlike the most common solution prevalent today, i.e. Robocaller or outbound IVR voice blaster (incapable of conversations, feedback, or insights), an Intelligent Voice Agent is an AI-enabled machine capable of meaningful human-like conversations.

Learn more about the differences between Robocaller and AI-powered Digital Voice Agent.

Intelligent Voice Agent, which is the blend of conversational voice AI and human intelligence, holds me

The rapid rise in call volumes, defaults, demand for remote resolution of disputes and diminishing CX have resulted in collection agencies scrambling to catch up.

The need for better outbound collections efforts—along with managing increasing volumes of inbound inquiries from customers—is putting pressure to scale contact center teams, an undesirable and herculean task.

Call center turnover (30 – 45%) has always been a challenge and has generally been twice as high as the industry average (13.5 – 18.5%), while collection agencies perform worse, with some reporting as high as 100% employee turnover. The concatenation of these factors—higher call volumes, regulations, and agent turnover—has made companies lookout for technology solutions such as Voice AI-enabled contact center automation.

Read More if you are interested to know how Intelligent Digital Voice Agents work in detail.

Research provides plenty of information to support the cause of automating collection calls. Apart from research provides plenty of information to support the cause of automating collection calls. Apart from improved recovery, 1 in 4 US consumers prefers interacting with an Intelligent Voice Assistant when handling awkward financial situations, according to a 2018 consumer sentiment survey by The Harris Poll.

The rapid rise in call volumes, defaults, demand for remote resolution of disputes and diminishing CX have resulted in collection agencies scrambling to catch up.

The need for better outbound collections efforts—along with managing increasing volumes of inbound inquiries from customers—is putting pressure to scale contact center teams, an undesirable and herculean task.

Call center turnover (30 – 45%) has always been a challenge and has generally been twice as high as the industry average (13.5 – 18.5%), while collection agencies perform worse, with some reporting as high as 100% employee turnover. The concatenation of these factors—higher call volumes, regulations, and agent turnover—has made companies lookout for technology solutions such as Voice AI-enabled contact center automation.

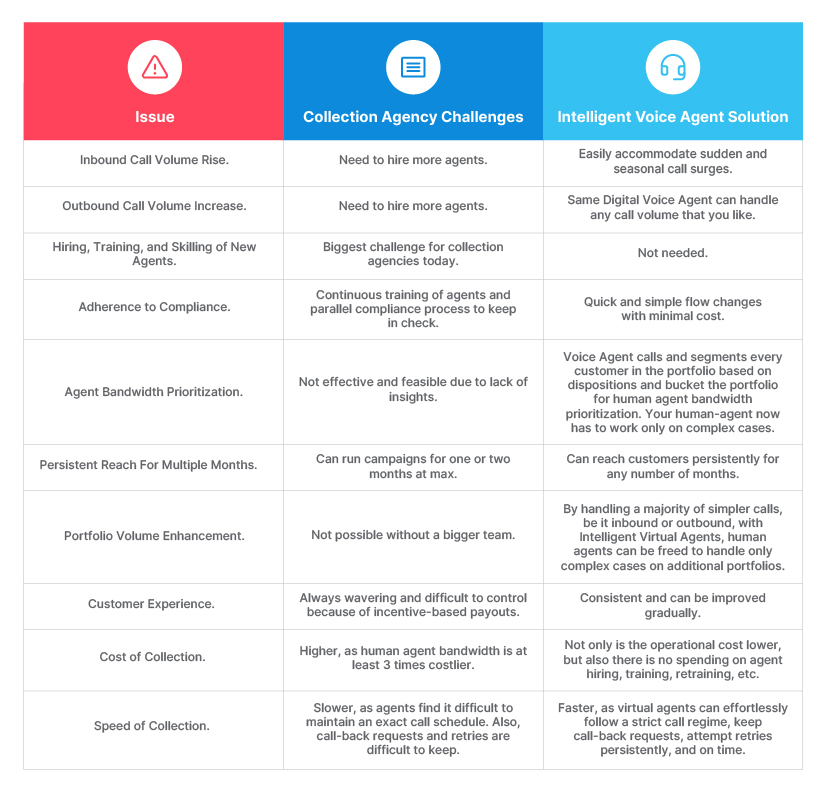

Let’s compare the challenges collections agencies are facing to how a conversational AI-enabled Intelligent Voice Agent meets every challenge.

Augmented Voice Intelligence, which is the blend of Conversational AI and human intelligence, creates meaningful conversations with customers to support them throughout their entire collection journey while staying true to compliances and regulations. Let’s delve deeper into the 7 core reasons:

The beauty of deploying an Augmented Voice Intelligence is that it can call all the customers and it then filters out the complex cases that need human agent intervention. In the present system, agents call the entire list of contacts, be it a simple case or a complex one, not creating desired value in the process.

With a virtual voice agent, all the contacts in the portfolio are called at the right time of the day and within a couple of hours. The entire portfolio is then segmented based on the disposition collected for each debtor. The dispositions captured can be: propensity to pay, refusal to pay, wrong-party contacts, disputed debt, call-back later, validation requests, etc.

For willing debtors, the virtual voice agent can not only collect the payment during the call but can also negotiate and offer alternate payment options. It also reminds them of the next due date.

Additionally, the Digital Voice Agent calls back all the debtors who could not be reached in the first attempt without the need for human agent intervention. This takes a huge burden off them.

For the dispositions in which human intervention is required, the Voice Agent can segment the portfolio so that relevant human agents can be assigned the downstream tasks based on the importance of the disposition for the portfolio and the company.

This automation and prioritization of bandwidth unlock massive value for the collection companies.

If, let’s say, 66% of the debtors are handled by digital voice agents end-to-end, now collection agencies can take up 3X more portfolios or cover 3X more customers with the same set of human agents. This illustrates how the same support team can manage higher levels of business with even better results.

Collection agencies can take up more portfolios or take bigger ones, as they now have better customer coverage.

Contact center automation with Conversational Voice AI assistant ensures that service quality and speed remain consistent, which otherwise will be volatile as new human agents with less experience join the team. Also, continuous hiring and training is a great operational hassle.

The Digital Voice Agents can make hundreds of concurrent calls at scale, economically, and in just an hour. Not only that, voice agents, being a machine, are very punctual and reach out to debtors that request a callback or make reattempts right on time when the probability of connecting to contact is highest. All this is done within the prescribed compliance framework.

Better collection and recovery require persistent efforts. When nudged at the right time, a debtor who is willing but unable to pay now might pay a few months down the line. Thus, what matters is how persistently collection agencies can reach out to a certain segment of debtors, ideally disposed to pay.

Understandably, a significant section of debtors will not pick up calls in the first attempt or might request a call-back at a certain time in the future. It is near impossible for human agents to follow up on every single contact, but the intelligent voice agent can do it with perfection.

It’s a piece of cake for a Digital Voice Agent to schedule follow-up calls, honoring the regulatory guidelines, spread over weeks/months, and ensure better recovery rates. With timely and adequate calls going out to customers, and 24/7 support, the right voice-tech solution checks all the boxes to improve collections and recovery.

A significant amount of agent training and monitoring can be avoided with the deployment of Voice AI agents. High employee turnover, clubbed with significant training costs makes the entire exercise of meeting compliance, extremely costly. While the possibility of potential errors as regulatory regime complications is on the rise, it cannot still be eliminated.

Conversational Voice AI Agents operate with negligible errors and can be easily updated, thus improving compliance significantly. Also, a Voice Collection Agent can be well trained in regulatory frameworks and will therefore ensure strict adherence to consumer data security and protection (encryption and redaction) by sticking to industry best practices.

A Voice AI agent can ensure a smooth, courteous, and positive debtor experience, leading to a positive attitude towards the collections process and ultimately a positive brand image.

Business volatility and fluctuations put an economic strain on collection agencies that need to maintain a qualified team of human agents which has to grow and shrink with demand volatility. Scaling becomes further challenging as employee turnover is the highest among industries.

With the deployment of Augmented Voice Intelligence, there is no need for maintaining a large contact center team to deal with large call volumes, as voice automation helps in handling a majority of calls. Thus the problem of team management becomes minimized.

At times of disruption, it’s essential to leverage technology to craft a sustainable competitive edge by addressing core business challenges.

Growing evidence hints at the power of Augmented Voice Intelligence to enable cost optimization, and handle a broader customer base while minimizing significantly the operational challenges relating to regulatory compliances, and team management.

With a tad steep learning curve, it’s best to be an early bird. The evidence abounds, with the right tech solution partner, there is a great amount of value creation possible.

Move early, move fast, grow faster!

For more information and free consultation, let’s connect over a quick call – Book Now!

Also, for more information visit our Collections Page.

Built to perform across the customer journey.

Why CX is the Next Disruptor in Financial Services

Why CX is the Next Disruptor in Financial Services