Harshad Bajpai

May 6, 2022

Hello! Welcome to Skit.ai. Click here to book a demo.

One in four Americans (28%) have at least one debt. This underscores the significance of debt collection services. As more consumers depend on credit for multiple purchases from homes to vehicles, household appliances, and sometimes everyday living expenses, debt collection services are playing an even more significant role in the availability and recovery of credit.

Though the use of IVR outbound Robocaller or outbound IVR is largely demotivated for debt collection through TCPA and FDCPA, we would discuss a little bit about the use of IVR outbound Robocaller for debt collection in this blog.

Over the last couple of decades, it was perhaps wise to deploy Outbound IVRs, Voice Blasters, or Robocallers. The technology helped companies send pre-recorded phone messages to hundreds of consumers at once.

In the last couple of decades, they have helped companies reduce calling errors, call costs, and improve productivity. But with rapid advancements in technology, especially Voice AI, the competitive landscape has changed rapidly in favor of intelligent voice conversations.

In this blog, we delve into the core of the issue to explain why Intelligent Voice Agents are the way to deliver superior business performance and customer experience.

Explore how Voice AI solutions are Transforming Debt Collections

Typically, an Outbound IVR (Interactive Voice Response) is used to proactively reach out to a large number of customers in a personalized manner using different interaction channels, such as voice messages. The most common use cases are feedback, promotions, announcements, reminders, etc.

Robocaller or outbound IVR has essentially two components in it; a dialer capability and a text-to-speech engine (Advanced Outbound IVRs) or a recorded voice message (Robocaller). Businesses can upload thousands of contacts in the dialer and configure certain parameters such as number and time of retry attempts, time of call, etc. Dialer calls up these contacts and plays a voice message that consumers can listen to. At the end of the call, the consumer can provide keypad-based number input to listen to the message again and certain other things.

In the 1990s this technology was a game-changer and led to a huge improvement in efficiency, however, today it is ineffective and unnecessary, to say the least.

Even the best outbound IVRs ail from persistent challenges as enumerated below:

IVRs, even at their best, do not contribute to CX or major productivity gains, whereas a bad IVR experience can prove very costly. The State of IVR in 2018 noted that 83% of customers would avoid a company after a poor experience with an IVR.

The more pressing problem still remains:

“How to automate the mundane, repetitive and non-value additive tasks human agents are doing”

For a long time, we did not have an answer, or we did not have a commercially viable technology solution, but today we have, and it is an Intelligent Voice AI Agent.

Explore how AI-enabled Voice AI Agents are the Perfect Solution to Meet Compliance Requirements

Digital Voice agents are AI-powered virtual agents that allow customers to converse intelligently, without having to punch 1,2,3,4 on their screen to hold a meaningful contextual conversation. It is able to converse with your consumers just like your human agents. It is capable of understanding, interpreting, and then analyzing conversational voice input expressed by an individual and responding to them in an everyday language.

A Virtual Voice Agent goes beyond understanding words and determines what the consumer is saying based on underlying semantics, without relying on specific keywords. Using machine learning, a Virtual Voice Agent is continuously improving itself and the customer experience. Read more about Digital Voice AI agent here.

Unlike Siri and Alexa, which are designed to handle everyday context-less tasks such as setting up an alarm or playing songs, AI-powered digital voice agents are trained specifically to handle complex problems, and understand what a customer may want in all probable scenarios, making them highly effective in solving customer problems and requests.

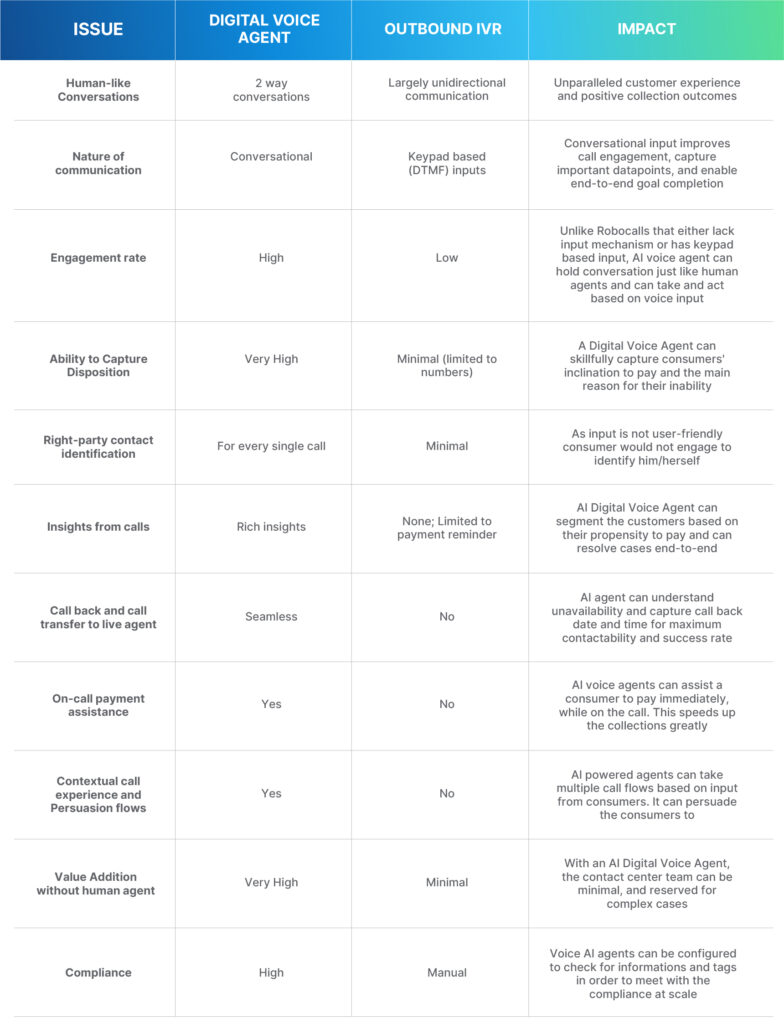

A Comparative Look: Digital Voice Agent Vs Outbound IVR

For any company, AI-enabled Digital Voice Agents are a quantum leap from aging outbound IVRs. There is no comparison. Digital Voice Agents are AI-enabled, making them improve exponentially with time. One can surmise the amount of competitive leg-up companies can create as they start early. Here are the core business benefits of deploying Digital Voice Agents over IVRs:

For more information and free consultation, let’s connect over a quick call; Book Now!

Also, for more information visit our Collections Page.

The auto finance industry is experiencing significant transformations driven by market dynamics, consumer behavior, and technological innovations. Here are the key trends shaping the future of auto finance, focusing on the implications for Buy Here Pay Here (BHPH) dealers and the role of Conversational AI and contact center automation in streamlining operations, which will help […]

The auto finance industry, a crucial pillar in the automotive market, experienced a turbulent Q2 in 2024. The rise of delinquent accounts in subprime lending has become a significant concern for industry stakeholders. Subprime lending, which targets borrowers with lower credit scores, is inherently riskier, and recent economic pressures have worsened these risks. This blog […]