Shrutidhara Kakoti

September 24, 2024

Hello! Welcome to Skit.ai. Click here to book a demo.

September 24, 2024

Customer experience and debt collection might seem like an oxymoron at first glance. After all, for most people, the thought of being reminded about an outstanding debt is far from enjoyable. The perception of collection calls as uncomfortable or even stressful is widespread. However, just because these calls aren’t the most welcome interactions doesn’t mean the customer experience (CX) has to be negative or impersonal.

At Skit.ai, we offer an effective and easy-to-deploy Conversational AI solution for debt collection use cases across multiple industries. There are many ways to make the interaction between a user and an AI solution efficient, easy to navigate, and painless. Enhancing the customer experience is particularly important when Voice AI is used in collection calls.

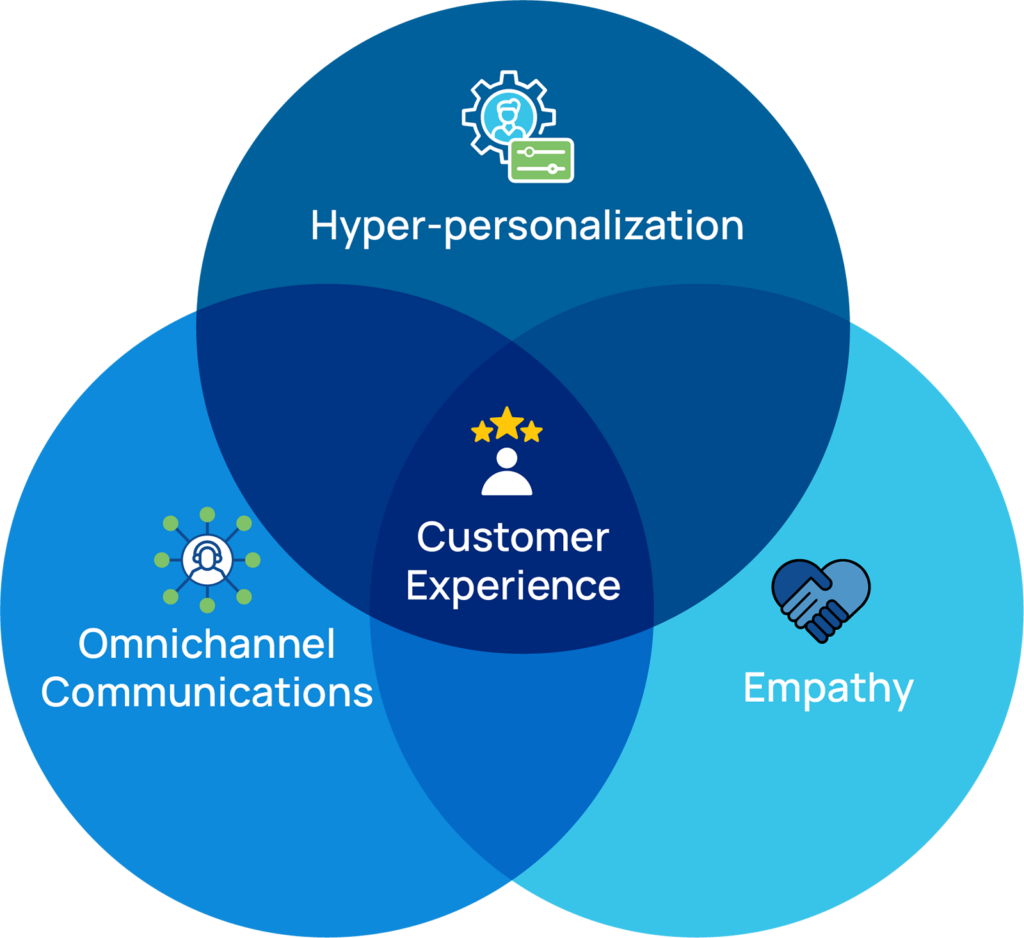

In this article, we’ll share the best practices for improving CX in automated collection calls, from multichannel communication to hyper-personalization and empathy.

One key element that can significantly improve customer experience in debt collection is omnichannel communication. In an age where people are more active on digital communication platforms, consumers engage with brands and businesses through multiple channels, and debt collection should be no different.

By offering communication across various channels and platforms—such as voice calls, SMS, email, and chatbots—businesses give customers the flexibility to choose the method they feel most comfortable with. Omnichannel communication allows debt collectors to meet customers where they are, improving the likelihood of engagement and making the overall experience less invasive.

Imagine a scenario where a customer receives an SMS reminder about their debt and then follows up with an email. The customer might prefer to address the issue via email rather than a phone call, where they feel less pressured. By offering a variety of touchpoints, businesses can increase their chances of successful collections while also respecting the customer’s preferences.

Omnichannel communication also enhances customer experience by ensuring consistency across platforms. With AI-driven automation, every channel can carry the same messaging tone, verbiage, and information, ensuring the customer receives clear, concise, and friendly communication regardless of how they choose to engage.

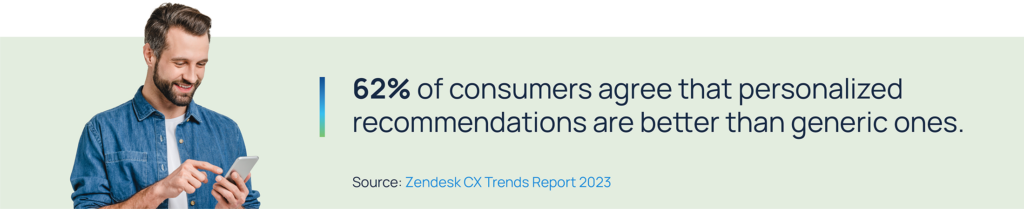

Yes, hyper-personalization does help, and it’s critical in improving customer experience in debt collection.

Generic, one-size-fits-all communication is not only impersonal but can also be perceived as insensitive, especially in a context where financial difficulties may be at play. Personalization goes a long way toward making customers feel respected and understood.

With AI-driven solutions, businesses can leverage data to hyper-personalize communication at scale. Instead of a standard message, imagine a conversation where the system addresses the customer by name, acknowledges their specific payment history, and offers tailored payment options that suit their financial situation. This type of personalization demonstrates a level of care and understanding that significantly softens the interaction.

Hyper-personalization also allows companies to provide a more humanized experience despite the conversation being led by AI. In debt collection, where emotions might run high, personalization can reduce friction and make the experience feel less transactional.

A key misconception about automated debt collection calls is that they can’t be empathetic. In reality, empathy is a cornerstone of positive customer experience, and it can absolutely be incorporated into AI-driven collection conversations.

Empathy in debt collection is not about avoiding the subject of payment—it’s about understanding the customer’s perspective and approaching the conversation with sensitivity. A well-designed AI solution can include language that acknowledges the customer’s situation and offers helpful solutions.

For instance, instead of a robotic, “You owe $X, please pay now,” an empathetic AI solution might say, “We understand that managing finances can be challenging. We’re here to help you resolve your outstanding balance in a way that works best for you.”

This shift in tone not only makes the conversation feel more supportive but also increases the likelihood of cooperation from the customer. When customers feel that the company understands their challenges, they are more open to resolving their debt.

Here are three essential tips for improving customer experience in debt collection communications:

Personalizing each conversation is crucial in making the interaction feel human. AI can gather and analyze data to tailor responses based on each customer’s specific situation, allowing businesses to deliver personalized communication at scale.

For instance, instead of sending a generic reminder message, the AI can address the customer by name, reference their unique account details, and provide tailored options for resolving the outstanding debt. A message like, “Hi Sarah, we noticed that your last payment was on August 10th. Would you like to set up a payment plan to clear your remaining balance?” is much more engaging than a cold, “Your payment is overdue.” This simple gesture of personalization can dramatically improve the customer’s perception of the interaction and increase their willingness to cooperate.

In addition, AI can adjust its tone and language based on the customer’s previous interactions and responses. This adaptability ensures that customers feel understood and that the communication remains relevant and respectful, no matter where they are in their debt repayment journey. Personalized interactions also show the customer that their individual circumstances matter, which can help build trust and encourage more positive outcomes.

Incorporating empathy into debt collection conversations is not just a nice-to-have; it’s a necessity for improving customer experience. Collections can be a stressful and emotional process for customers, and if the communication lacks empathy, it can feel cold, impersonal, and even confrontational. While many assume that AI can’t be empathetic, the truth is that empathy can be programmed into AI solutions, making the interactions feel more supportive and human-like.

Empathy in collections doesn’t mean avoiding the topic of debt—it’s about acknowledging the customer’s situation and offering constructive, respectful solutions. AI can be designed to recognize and respond to emotions, such as frustration, confusion, or anxiety, and modify its responses accordingly. For example, if a customer indicates they are struggling financially, the AI can respond with understanding and offer helpful alternatives, such as extended payment plans or reduced payment options.

For instance, instead of saying, “You are overdue on your payments,” an empathetic AI might say, “We understand that managing finances can be challenging. Let’s explore options that might help you with your current situation.” This shift in language not only makes the customer feel heard but also reduces the adversarial nature of the conversation.

Additionally, empathy can improve the likelihood of successful debt resolution. When customers feel that the company is genuinely trying to help them rather than simply collecting money, they are more likely to engage and cooperate. Empathy can turn a typically stressful interaction into an opportunity for the company to demonstrate care, which in turn, fosters customer loyalty and retention.

Omnichannel communication is another essential strategy for improving customer experience in debt collection. Customers today expect the convenience of interacting with businesses on their terms across multiple platforms. By offering communication across various channels—such as voice calls, SMS, email, or chat—businesses can cater to individual preferences and make the collection process more comfortable and accessible for the customer.

For example, some customers may prefer the immediacy and directness of a phone call, while others might feel more comfortable responding to a less intrusive text message or email. Giving customers the choice of how to engage with the collection process enhances their sense of control and makes the interaction feel less invasive. The more flexible and convenient the communication options, the more likely customers are to respond positively.

Omnichannel communication also allows for a more seamless and consistent customer experience. Whether a customer interacts with a voicebot over the phone, sends a message via SMS, or replies to an email, the AI-driven system ensures that the same tone, information, and context are maintained across all channels. This consistency is key to building trust and ensuring that customers don’t feel like they are being bombarded with conflicting messages.

Omnichannel flexibility also provides a safety net for businesses. If one communication method is unsuccessful, the AI can follow up via another channel, increasing the chances of customer engagement. For instance, if a customer doesn’t respond to an email, the system can trigger an SMS reminder, ensuring the message gets across while maintaining a respectful distance.

Debt collection doesn’t have to come at the cost of customer experience. With the right tools and strategies, such as AI-driven automation, hyper-personalization, omnichannel communication, and empathetic language, businesses can turn even the most challenging conversations into opportunities to build trust and rapport with their customers.

At Skit.ai, we’re redefining the art of collection communication, ensuring that positive customer experiences remain a top priority, even during difficult conversations. Skit.ai is not just a leader in Conversational AI; we are innovators committed to empowering businesses with advanced AI technologies. By simplifying customer interactions with data-driven strategies and reaching users through their chosen communication channels, we help businesses achieve better collections and improve their operations. As we continue to evolve, we remain dedicated to driving success for our clients and setting new standards in the industry.

Are you ready to take the next step toward call automation with Conversational AI? Schedule a free demo with one of our experts to learn more!

The field of AI is advancing rapidly, especially in large language models. Prominent models like GPT-3 and GPT-4 have impressive capabilities in generating coherent, human-like text. However, these models face a significant limitation: they rely solely on the data they were trained on, often leading to outdated or contextually incorrect information. As a result, the […]

You are ready to adopt a Conversational AI or Voice AI solution for your contact center, or you are in the process of adopting one—congratulations! Now is the time to think about integrations. In this article, we’ll discuss the benefits of integrating your Conversational AI platform with various tools and applications to transform your tech […]