One Conversation,Multiple Channels

Supercharged by Generative AI

Outbound and Inbound Call Automation | Context-based Live Agent Transfers Two-way Email, Chat, and SMS Automation

- In English and Spanish

- Inbound and Outbound Voice AI

- Email, SMS and Chat Assistants

- Enhanced CX

- Fully Compliant Outreach

Simplifying Recovery: Making It Effortless and Efficient

Connect with your consumers using the channels they prefer

Dial 1000s of calls within minutes to achieve 100% account penetration. Initiate calls at your preferred times and schedule callbacks upon request. Persistent retries and callbacks can maximize connectivity to increase opportunities to collect. Use AI assistants to send emails and text messages at the right time, with the right information.

Voice AI: Verifies and authenticates consumers on-call. Responds to all inbound consumer inquiries 24/7, after business hours and even holidays. Captures promise-to-pay (PTP) or negotiates payment plans. Transfers calls to live agents and empowers agents to focus on high-value tasks and accounts.

AI Assistants: Verify and authenticate consumers over email, chat, or text. Remind consumers of due payments and capture promise-to-pay (PTP). Respond to queries, 24/7 and enable consumers to use the channel of their choice.

Voice AI: Payment Automation: Payment plan negotiation, s ettlements, e nable payments via SMS or on-call. Live Agent Transfer: After capturing PTP, transfer the call to a live agent to help the consumer complete their payment.

AI Assistants: Payment Automation: Payment gateways enable consumers to make payments via their preferred channel. Schedule callbacks whenever requested.

From Small Talk to Smart Conversations with Our State-of-the-Art Generative AI Models

Disposition Capture

Seamless Scalability

Portfolio Segmentation

Rapid Account Penetration

Conversational AI & Agent Collaboration

Large Language Model

Our solution has become significantly more capable with the incorporation of Generative AI, giving it the unprecedented ability to handle complex conversations, resolve all queries, smartly negotiate debt, capture disposition better, and accelerate recovery. Entry into new markets, changing conversations with changes in regulations, and understanding even the most bizarre of consumer replies - our LLMs are game changers.

Context portability across channels reduce AHTs, and superior performance on all fronts lead to higher collections.

Compliant with All Federal and State Regulations

The conversational design’s compliance filters ensure regulatory compliance with the FDCPA, Reg F, and more, including Mini Miranda disclosure.

Our solution triggers campaigns in sync with regulatory guidelines, respecting the industry’s compliant outreach frequency at the federal and state levels.

Our solution adheres to industry-specific regulations and certifications, such as PCI-DSS, SOC2,ISO 27001:2022, HIPAA, and more

Compliance First Approach

- Timings

- Frequency

- Customer Consent

- Mini Miranda

- Validation Letter

- Identity Disclaimer

- Data Storage

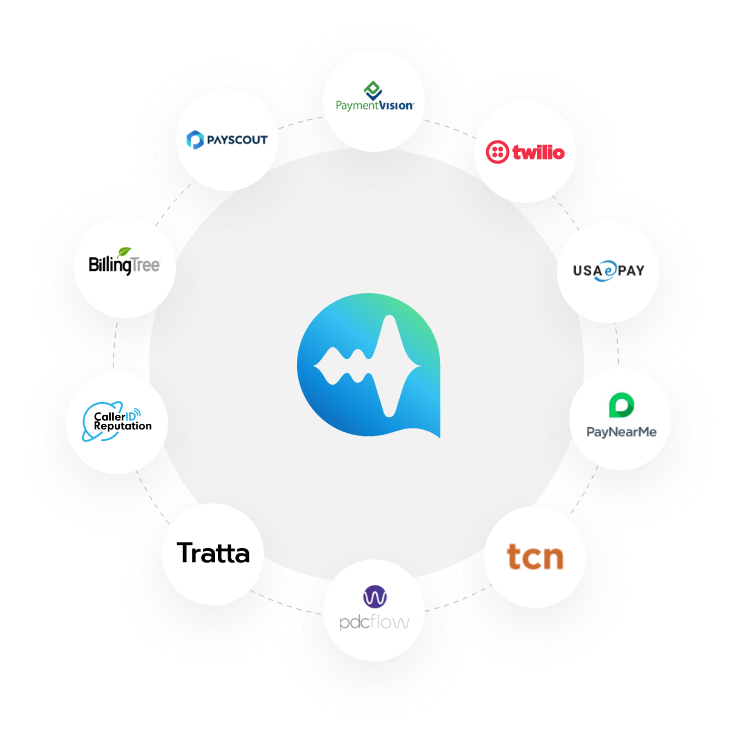

Out-of-the-box Integrations

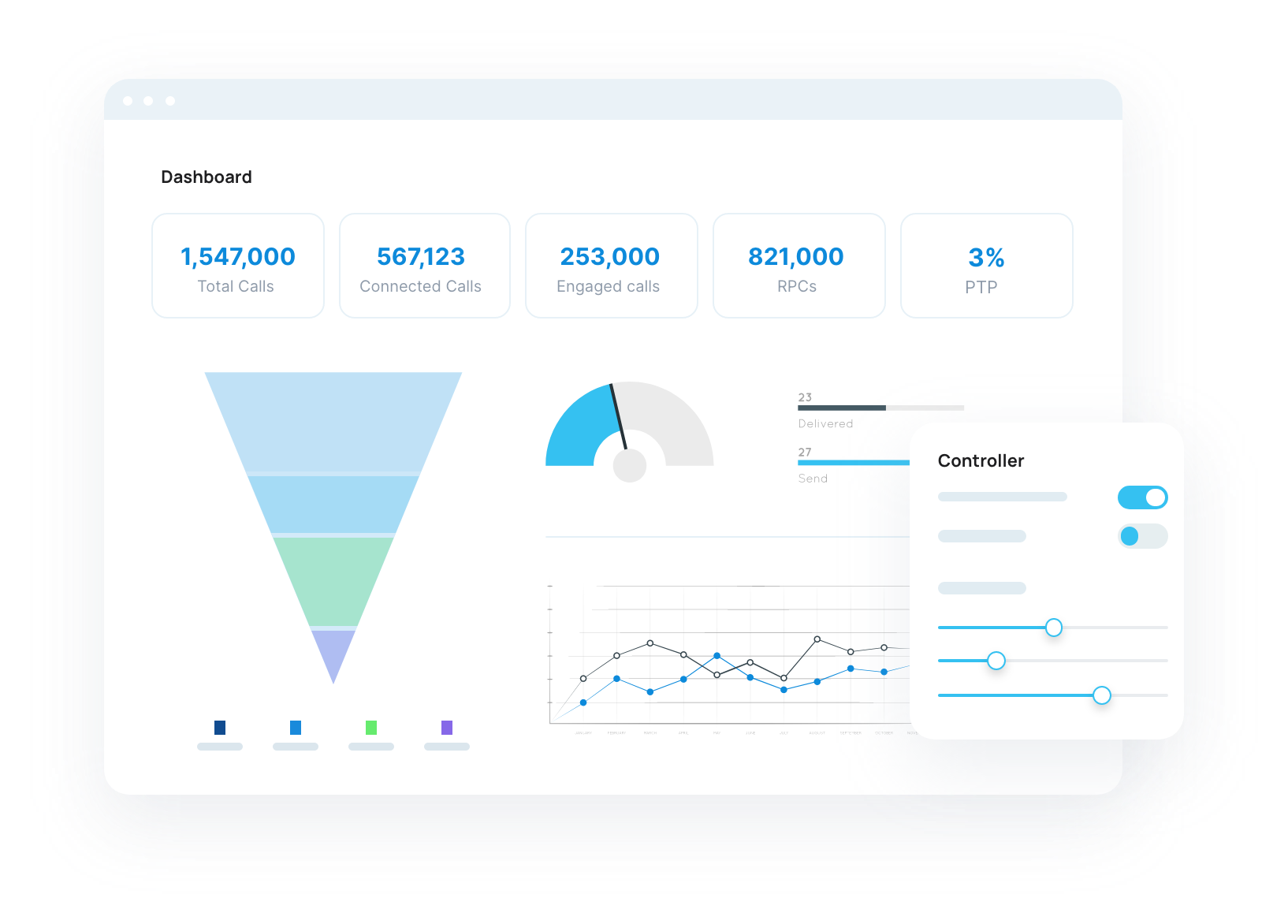

Control Center and Analytics

-

Performance monitoring and course correction

Get real-time insights on conversation data—both call drivers as well as granular call data—for proactive and continuous improvement.

-

Portfolio Segmentation

By utilizing essential information and gaining visibility into RPCs, PTP, and other relevant dispositions, a collection agency can improve its collection strategy.

-

Intuitive Campaign Management

Run end-to-end outbound campaigns at scale with full visibility and control over campaign settings—such as call triggers, customer cohort management and personalization.

GO LIVE IN LESS THAN AN HOUR

Conversational AI for scalable consumer conversations that are easy to deploy and compliant