Simone Somekh

October 13, 2023

Hello! Welcome to Skit.ai. Click here to book a demo.

October 13, 2023

It’s unlikely, for anyone working in the accounts and receivables industry, to not have heard about Voice AI. Whether you’ve attended an industry event or you’ve visited an industry website, you’ve encountered this technology, which many collection agencies across the country have been adopting to accelerate and improve their collection strategy.

There are many benefits to using conversational Voice AI for debt recovery. Automation, compliance, business growth, cost-effectiveness—different organizations benefit from it differently. Many agencies have reported that, since adopting Voice AI, they’ve been able to acquire larger debt portfolios, thanks to the increased call volume. Others have reported that the consistency of the technology has been a game changer; after all, artificial intelligence “never has a bad day.”

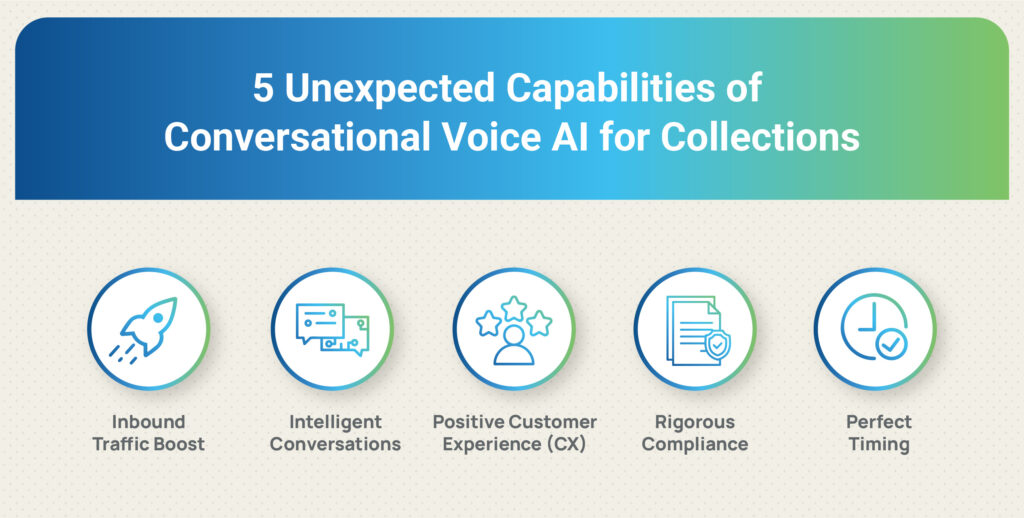

But what are some of the lesser-known benefits of adopting Voice AI for collection calls?

This is every collector’s dream—increasing the inbound traffic from consumers who want to speak to an agent and resolve their debt. Thanks to Voice AI, which acts as a first line of communication with consumers, you can automate most of your outbound traffic, RPC, and even PTP. The solution can easily transfer calls to your agents, informing them of the relevant context and previous interactions.

“Skit.ai is helping us optimize agent bandwidth, as it enables our agents to spend more time answering high-value inbound calls,” said one of our clients, Rebecca Roberts-Stewart, COO of LJ Ross Associates. “With Skit.ai as our first filter, our long-term goal is to ramp up call automation and increase inbound calls. The Voice AI platform has already helped us take steps in that direction, with the 40% boost in inbound traffic as a testimony to the solution’s efficacy.”

Both our clients and the consumers interacting with our conversational AI solution are positively impressed with how intelligent the bot sounds. No matter what the user on the call says, the solution knows how to handle it, offering relevant and timely information and finding ways to solve problems in real-time.

The solution is context-rich, meaning that it keeps track of previous interactions to offer the best possible experience to the user.

Consumers who have interacted with one of Skit.ai’s virtual assistants can testify to its ability to deliver a positive customer experience.

First of all, with Voice AI, consumers don’t have to wait—they get the assistance they need right away, without having to listen to a Mozart symphony or to a time-consuming IVR menu.

Voice AI establishes right-party contact (RPC) in less than a minute; if the call is transferred to a live agent, consumers won’t need to repeat the RPC step, as their identity has already been authenticated.

According to industry data, the vast majority of consumers (88%) expect organizations to provide self-service support. We’re not surprised: the back-and-forth with Voice AI is easy and painless.

With a multitude of ever-evolving federal and state regulations, collection executives and collectors often struggle to keep up with the changes. Compliance is one of the most significant pain points and concerns for the industry, as non-compliance can result in major financial losses for creditors and agencies.

Artificial intelligence can make your compliance more rigorous and your collection strategy more secure. Skit.ai’s Voice AI solution adheres to all telephony, data security, and collection-related regulations, such as the FDCPA, Reg F, and TCPA, among others.

Voice AI never goes off script or forgets a regulation; you can trust that, with all the correct compliance filters in place, the solution will rigorously follow every rule, including the Mini-Miranda and call frequency restrictions.

You can always count on artificial intelligence to be timely and precise.

An important aspect of the regulatory environment for debt recovery is call frequency, as outlined by Reg F and other state-level laws. Voice AI always complies with those rules, only initiating calls at the right time of the day and never exceeding the maximum number of call attempts allowed by the applicable regulations.

Additionally, follow-up timings with AI are always precise. If a consumer tells the AI that they’re not able to speak at a given moment and asks the solution to call back at a different time, you can be sure that the AI will call back at the exact time requested by the consumer.

Are you interested in learning how Conversational AI can accelerate your collection strategy? Use the chat tool below to schedule a call with one of our experts.

The auto finance industry is experiencing significant transformations driven by market dynamics, consumer behavior, and technological innovations. Here are the key trends shaping the future of auto finance, focusing on the implications for Buy Here Pay Here (BHPH) dealers and the role of Conversational AI and contact center automation in streamlining operations, which will help […]

The auto finance industry, a crucial pillar in the automotive market, experienced a turbulent Q2 in 2024. The rise of delinquent accounts in subprime lending has become a significant concern for industry stakeholders. Subprime lending, which targets borrowers with lower credit scores, is inherently riskier, and recent economic pressures have worsened these risks. This blog […]