Shrutidhara Kakoti

April 4, 2024

Hello! Welcome to Skit.ai. Click here to book a demo.

The term “AI” is being thrown around a lot these days. Anyone and everyone is trying to integrate AI into their businesses. Similarly, the debt collection industry has adopted AI and is catching on quickly. From automation to data analytics, AI has taken over the ARM space. However, there’s often a lack of understanding about the fundamentals of this emerging technology.

Recently, Skit.ai hosted a panel discussion in collaboration with Accounts Recovery.net. The discussion featured four renowned experts: Heath Morgan of Martin Golden Lyons Watts Morgan, Lucas Brown of NLP Logix, and Amit Ambre of Skit.ai, who answered pressing questions related to AI and its impact on the ARM industry.

The panel covered topics such as the various types of AI and their applications in the industry, compliance regulations for AI, the use of LLMs for improved customer experiences, and the advantages of agencies using AI—the discussion aimed to help non-IT professionals better understand AI technology and its potential benefits for collections.

In this article, we’ll revisit some of the insights from the event.

“The evolution of AI has been a long time in the making. At its core, AI refers to computers mimicking human behavior, but it’s a broad concept with many applications and iterations over the years. We can even trace the roots of AI back to early statistical methods like linear regression.” — Lucas Brown, Senior Data Science Advisor for NLP Logix.

“The recent boom in computing power is the real game-changer. It’s not just storage; advancements in transformers, neural networks, and deep learning have enabled AI to learn and adapt, exceeding mere information processing. AI can now predict text or anticipate actions with human-like skills. This adaptability is why AI creates such a stir – a stark contrast to its earlier limitations.” — Amit Ambre, VP at Skit.ai.

“Previously, AI was primarily used at the enterprise level by companies like IBM Watson. However, with the release of tools like ChatGPT a year and a half ago, AI became available to individual consumers and developers. This open approach, where users could experiment and find their applications, led to rapid adoption. This shift in accessibility, with tools available for free or at low cost, has flooded the market in the last year.” — Heath Morgan, Attorney, and Partner, Martin Golden Lyons Watts Morgan.

“From a holistic perspective, when forming an AI policy or committee, it’s wise to encompass everything under the “AI umbrella” initially. Then, as you delve deeper, you can determine if you’re dealing with a true black box algorithm, a generative process, or something more akin to a rule-based system.” — Heath Morgan, Attorney and Partner, Martin Golden Lyons Watts Morgan.

“AI is a broad term. While ML focuses on building algorithms that can be trained to predict future actions or outcomes, RPA, in its technical sense, deals with coding specific processes to be replicated in the same way repeatedly. Machine learning can adapt. Deep learning is a further subset of machine learning. Transformers allow deep learning models to work with unlabeled data, come up with a model, and then be further refined for specific tasks. This is how large language models (LLMs) came into play.” — Amit Ambre, VP at Skit.ai.

The ARM industry is embracing AI to streamline processes and improve efficiency. This technology takes a few forms: AI can analyze vast amounts of data to predict a debtor’s likelihood to repay, allowing collectors to prioritize their efforts. AI-powered bots can handle initial contact with debtors, answer questions, and facilitate payment arrangements. Additionally, AI can sift through documents and communications, extracting key information and identifying the best course of action for each case.

“Let’s categorize the four main types of AI technology impacting our industry.

Here’s a high-level breakdown:

These four categories are seeing significant adoption and impacting the debt collection space.” — Heath Morgan, Attorney and Partner, Martin Golden Lyons Watts Morgan.

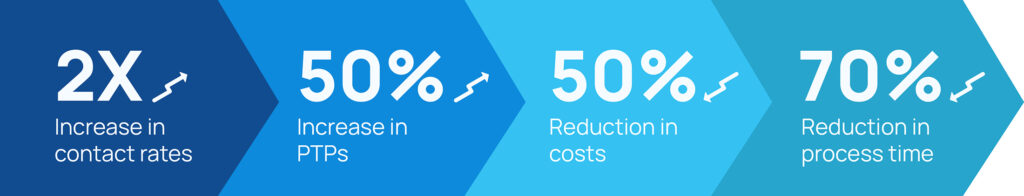

According to the report on “Next-gen Collections Contact Strategy” by BCG, financial institutions using AI have seen:

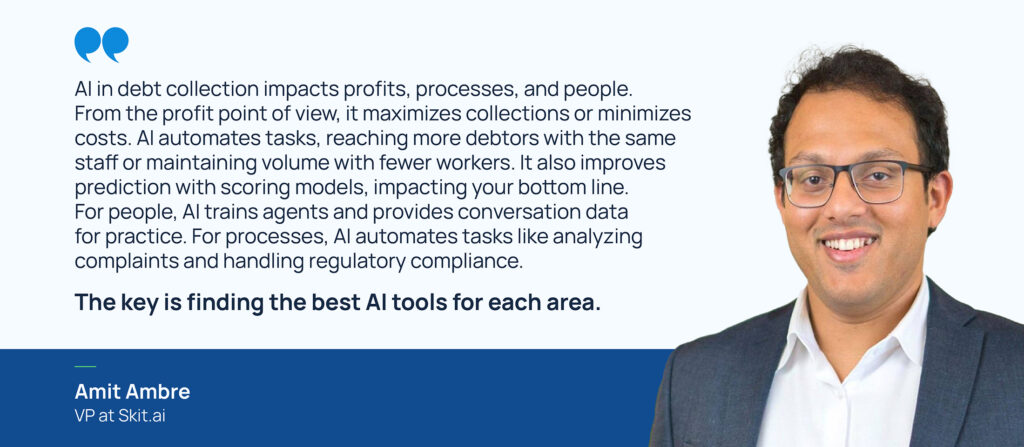

“I can’t put a number on it, but I’ll break it down into 3 categories:

1) In agencies where account penetration is a problem, Conversational AI can ramp up the scale and achieve maximum account penetration. Agencies with 70-80% untouched accounts leveraged conversational AI to boost collection rates by 30-40%

2) Inbound bots with 24/7 availability for non-working hours are another impactful application. They address the challenge of missed opportunities to speak with consumers and collect payments.

3) Improving Scoring strategy: AI can incorporate a wider range of parameters to predict who to contact and the most effective communication channel and strategy, leading to greater payment predictability and a 10-20% collection rate jump in some cases.” — Amit Ambre, VP at Skit.ai.

“AI adoption requires a scientific approach. Test your ideas, challenge assumptions, and be skeptical. This helps you adapt faster – to new projects, changing customers, or internal shifts. You’ll integrate models quicker, identify consumer behavior changes faster, and adjust more efficiently. A culture of scientific exploration is key to successful AI adoption.” — Lucas Brown, Senior Data Science Advisor for NLP Logix.

“AI should be seen as a digital assistant, handling mundane tasks and freeing employees to focus on higher-level work. This approach creates a co-working environment where humans and AI work together. Employees will upskill to become data-driven decision-makers, leveraging the insights generated by automation and AI.” — Heath Morgan, Attorney and Partner, Martin Golden Lyons Watts Morgan.

With the newest FCC language classifying AI Bots as pre-recorded, how does this impact compliance when using services like Skit.ai or other AI-powered outbound calling systems?

On February 8, the Federal Communications Commission (FCC) unanimously adopted a Declaratory Ruling stating that calls made with AI-generated voices are “artificial” under the Telephone Consumer Protection Act (TCPA). The Ruling clarifies the Commission’s intent to further regulate the use of voice cloning technology used in connection with robocall scams targeting consumers.

“I don’t think you need AI for this. All you need is a well-defined process – a human demonstrates the steps, and Robotic Process Automation (RPA) can automate it.” — Heath Morgan, Attorney and Partner, Martin Golden Lyons Watts Morgan.

“In the past, you needed a data engineer who would code for you. Now, there’s a plethora of tools, some potentially leveraging AI, that can streamline this process. These low-code/no-code options empower you to build the pipeline without extensive coding expertise.” — Lucas Brown, Senior Data Science Advisor for NLP Logix.

“One of the most critical ones is protecting confidential consumer information (PII). When using a service like ChatGPT, you’re essentially disclosing information to a third party. While you might be able to pay for some level of privacy, you lose control over deleting or managing that data. That being said, with proper safeguards in place, using ChatGPT as a tool within the customer complaint response process can be a viable option.” — Heath Morgan, Attorney and Partner, Martin Golden Lyons Watts Morgan.

“ChatGPT presents a data privacy concern. Any information you input can be considered public. It all goes into a database, and you relinquish control over it. This lack of control can lead to various challenges down the line.” — Lucas Brown, Senior Data Science Advisor for NLP Logix.

“You can use it to make the process more efficient. If it’s an activity that involves 10-20 people, it might make sense to build your own model to monitor the responses. Just keep data confidentiality under control.” — Amit Ambre, VP at Skit.ai.

“The rapid evolution of AI, with future advancements (GPT-5.0) on the horizon, presents a significant opportunity. Each iteration brings remarkable improvements in capability. The key takeaway is for every agency, vendor, and company to embrace AI. This involves understanding how to best integrate AI technologies across various processes, adhering to compliance boundaries, and fostering a culture of continuous learning within your organization to maximize the benefits of AI.” — Amit Ambre, VP at Skit.ai.

“The vast potential of AI applications can be overwhelming. Remember, there’s a spectrum of options. Some require significant organizational changes and investment, while others offer easier adoption and lower costs. The key is to find those “sweet spots” – opportunities where you can experiment with AI at a low barrier to entry. These initial successes can then become the springboard for further AI adoption within your organization.” — Lucas Brown, Senior Data Science Advisor for NLP Logix.

“AI adoption is a two-way street: intentional or unintentional. Without a clear AI policy, you risk employees and vendors using AI tools without your knowledge. Do you want unregulated AI use or a policy that dictates how employees can leverage this technology? An AI policy is essential for intentional AI adoption within your organization.” — Heath Morgan, Attorney, and Partner, Martin Golden Lyons Watts Morgan.

Use the chat tool below to book a demo or learn more about Skit.ai’s Conversational AI solutions.

The auto finance industry is experiencing significant transformations driven by market dynamics, consumer behavior, and technological innovations. Here are the key trends shaping the future of auto finance, focusing on the implications for Buy Here Pay Here (BHPH) dealers and the role of Conversational AI and contact center automation in streamlining operations, which will help […]

The auto finance industry, a crucial pillar in the automotive market, experienced a turbulent Q2 in 2024. The rise of delinquent accounts in subprime lending has become a significant concern for industry stakeholders. Subprime lending, which targets borrowers with lower credit scores, is inherently riskier, and recent economic pressures have worsened these risks. This blog […]