Simone Somekh

December 19, 2023

Hello! Welcome to Skit.ai. Click here to book a demo.

December 19, 2023

Companies offering Buy Now, Pay Later solutions have been in business for over a decade; in recent years, with the boom of e-commerce, BNPL has become an established vertical within financial services and consumer lending.

This past Cyber Monday, a record number of holiday shoppers used BNPL services to relieve stress on their wallets; the surge in popularity amounted to a 19% increase from the previous year, according to a report by Adobe Analytics. As more consumers struggle to make ends meet but don’t want to forgo their shopping, companies offering BNPL services are gaining popularity.

How do Buy Now, Pay Later services work, and what role is artificial intelligence playing in this promising industry? How can BNPL companies leverage the power of Conversational Voice AI to streamline and accelerate their collection processes? In this blog post, we’ll dive into the answers to these questions.

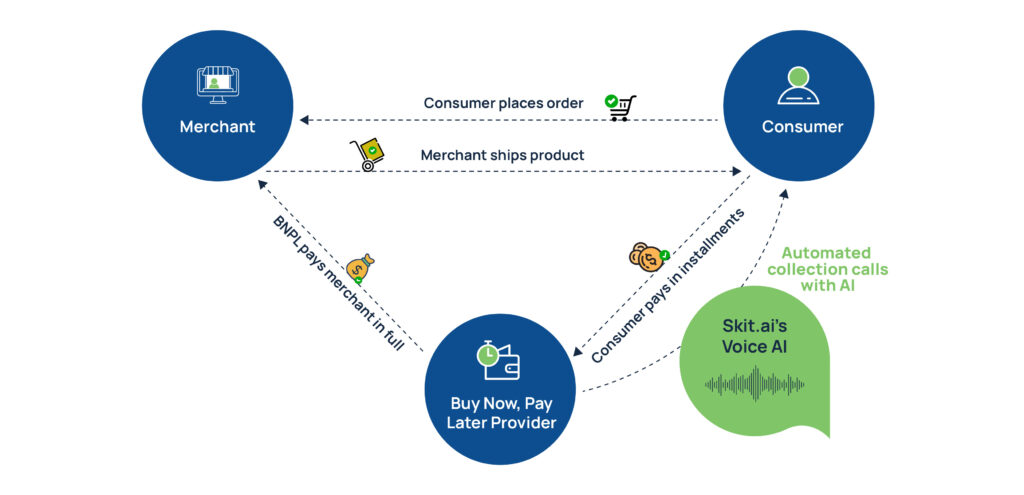

Buy Now, Pay Later solutions usually offer consumers (mostly online shoppers) highly customizable payment plans to purchase products so they can pay in installments rather than upfront. Here’s how it works: The BNPL provider pays the merchant the full product’s price, indirectly lending the money to the consumer. Transactions through BNPL are easy and fast to execute; they’re highly customizable, so the consumer can choose the plan that works best for them.

What’s appealing is that BNPL are often interest-free. The longer the time range for the installments is, the higher the interest rate becomes. However, consumers will be charged a late fee whenever they miss a payment.

Affirm, Afterpay, Klarna, and Sezzle are some of the most renowned BNPL companies; tech giants like Amazon and Apple have recently jumped on the bandwagon and unveiled their own solutions.

For Buy Now, Pay Later businesses, payment recovery is vital. To improve business operations, figuring out how to optimize the recovery process is the key to long-term success.

Most BNPL companies handle collections in-house, with a team of agents or collectors who reach out to consumers to remind them to pay and collect their due payments. This process can present some serious challenges if done manually and without AI.

Being part of the fintech industry, BNPL companies are usually pretty agile and fast at adopting new technologies. There are many different uses of artificial intelligence (AI) in this industry, from fraud detection to data analysis, from credit scoring to AIOps.

Given the importance of collections for BNPL businesses, employing AI to streamline the recovery process and automate interactions with consumers is the answer to the challenges we explored earlier. In particular, Conversational Voice AI has emerged as the collections industry’s preferred recovery channel, as it enables companies to automate thousands of consumer interactions within minutes at a fraction of the cost of a traditional collection call.

Here’s how Voice AI can streamline the collection process:

Here’s what one of Skit.ai’s clients has said: “Skit.ai’s technology has proved very effective. The platform smoothly integrated with our payment gateways, effortlessly handled high call volumes, and strictly adhered to compliance standards. Consumers have begun to prefer interacting with the Voice AI solution, marking an improvement in the overall consumer experience.”

As another client of Skit.ai put it: “When it comes to collections, most consumers don’t want to have to interact with another person. We wanted to make the process easier. Skit.ai’s solution allows consumers to choose; they can interact with the voicebot, ask to speak to one of our agents, or visit our website to make a payment.”

Are you curious to learn more about how Conversational AI can accelerate your collection efforts? Use the chat tool below to schedule an appointment with one of our experts!

The auto finance industry is experiencing significant transformations driven by market dynamics, consumer behavior, and technological innovations. Here are the key trends shaping the future of auto finance, focusing on the implications for Buy Here Pay Here (BHPH) dealers and the role of Conversational AI and contact center automation in streamlining operations, which will help […]

The auto finance industry, a crucial pillar in the automotive market, experienced a turbulent Q2 in 2024. The rise of delinquent accounts in subprime lending has become a significant concern for industry stakeholders. Subprime lending, which targets borrowers with lower credit scores, is inherently riskier, and recent economic pressures have worsened these risks. This blog […]