Simone Somekh

February 20, 2024

Hello! Welcome to Skit.ai. Click here to book a demo.

Delinquency rates are on the rise again. While this may have been the perception of many collections professionals over the past few months, the data published by the Federal Reserve Bank of New York’s Center for Microeconomic Data in February 2024 confirms it.

During the last quarter of 2023, the total household debt in the U.S. increased by $212 billion (+1.2%). This can be attributed to the rise in balances for multiple types of debt, including:

As a consequence, delinquency rates have been rising in Q4, with 3.1% of outstanding debt in delinquency at the end of the year.

Delinquencies have been consistently increasing among most types of debt; notably, credit card delinquencies have been rising among younger borrowers. Collection agencies now need to compete with multiple entities to recover payments from consumers, and their communication strategy is key.

The rise in delinquencies signifies a challenging period for collection agencies, as they must navigate an environment where consumers are juggling multiple debts. This increase in late payments can lead to a heavier workload and the need for more resources as agencies attempt to manage an expanding portfolio of delinquent accounts.

With more accounts falling into delinquency, the probability of successful debt recovery diminishes without the adoption of efficient and strategic collection practices. Additionally, with the escalation of competition for repayments among different creditors, collection agencies are compelled to refine their approach to ensure they stand out and effectively reach consumers.

For collection agencies, this uptick in delinquencies also represents an urgent call to innovate and adopt newer technologies. Traditional methods of recovery, through letters and manual calling, no longer suffice in the face of evolving consumer behaviors. That’s where AI comes into play.

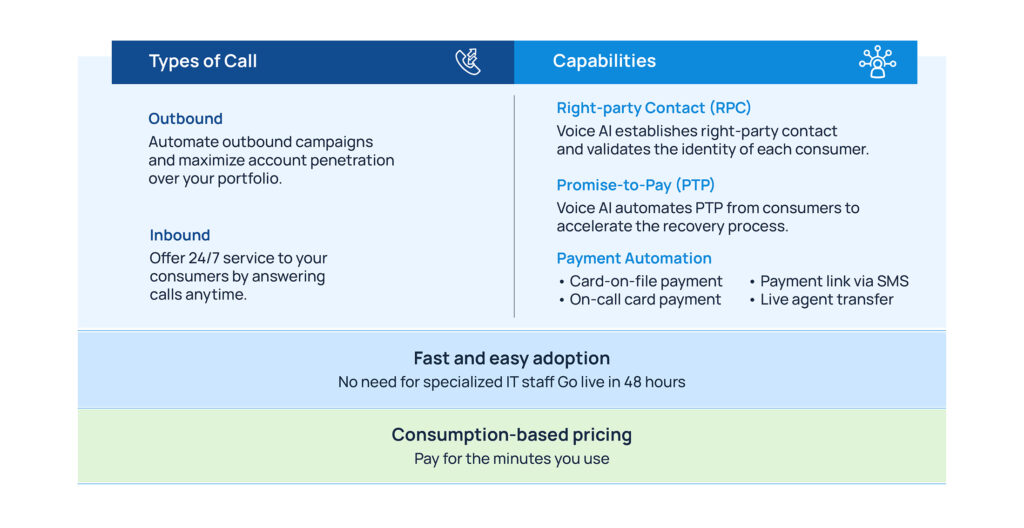

Conversational Voice AI consists of the utilization of voicebots or Interactive Voice Assistants to automate collection phone calls. The benefits of using Voice AI are many:

Personalization: Interactive Voice Assistants offer a personalized and responsive interaction with consumers. The Voice AI solution addresses the consumer by name and knows the necessary contextual information on the due balance, the original creditor, and more.

End-to-End Automation: Voice AI can handle collection calls from start to finish: establishing right-party contact (RPC), providing information on the outstanding balance, answering questions, capturing promise-to-pay, taking payments on-call, and also transferring the call to a live agent whenever necessary.

Scalability and Account Penetration: A high delinquency rate means that agencies have more accounts to contact. This can be challenging in terms of staffing, since you can’t tap into unlimited staffing resources no matter how large your agency is. AI is infinitely scalable, and enables you to penetrate thousands of accounts within minutes.

Reach Younger Consumers: As we explained earlier, credit card delinquencies have been rising among younger borrowers. Younger consumers tend to prefer to interact with voicebots and chatbots rather than human collectors—and are unlikely to respond to a print letter. Meet young consumers where they are—with the latest technology.

The short answer is: no.

No IT staff needed: The adoption of Skit.ai’s Voice AI platform is fast, easy, and painless, not requiring any specialized IT staff on the agency’s end. Our team helps you set up the platform according to the type of campaigns you’re running and the type of debt you’re servicing.

Preset compliance filters: The platform is already preset with all the applicable compliance filters at the federal and state levels, ensuring that calling times and frequency are programmed to be fully compliant.

Go live in 48 hours: You can easily share your first campaign data via a simple flat-file transfer, and you’ll be able to go live in less than 48 hours.

Consumption-based pricing: The pricing model is consumption-based, so you pay for the minutes you use.

Are you ready to take the leap, or do you want to learn more about our solution? Schedule a call with one of our experts using the chat tool below.

The auto finance industry is experiencing significant transformations driven by market dynamics, consumer behavior, and technological innovations. Here are the key trends shaping the future of auto finance, focusing on the implications for Buy Here Pay Here (BHPH) dealers and the role of Conversational AI and contact center automation in streamlining operations, which will help […]

The auto finance industry, a crucial pillar in the automotive market, experienced a turbulent Q2 in 2024. The rise of delinquent accounts in subprime lending has become a significant concern for industry stakeholders. Subprime lending, which targets borrowers with lower credit scores, is inherently riskier, and recent economic pressures have worsened these risks. This blog […]