Shrutidhara Kakoti

July 9, 2024

Hello! Welcome to Skit.ai. Click here to book a demo.

The auto finance industry, a crucial pillar in the automotive market, experienced a turbulent Q2 in 2024. The rise of delinquent accounts in subprime lending has become a significant concern for industry stakeholders. Subprime lending, which targets borrowers with lower credit scores, is inherently riskier, and recent economic pressures have worsened these risks. This blog delves into the current landscape of the auto-finance industry, especially last quarter Q2, and discusses how the industry can tackle this concern.

Subprime lending involves offering loans to borrowers with lower credit scores, typically below 620. These borrowers are considered higher risk due to their credit history, including previous delinquencies, defaults, or bankruptcies. Lenders often charge higher interest rates and fees to compensate for the higher risk. In the auto-finance industry, subprime loans enable a broader demographic to purchase vehicles. However, this lending segment is also more vulnerable to economic fluctuations.

In 2023, the auto loan delinquency ratio at U.S. banks reached its highest level in the past decade. According to S&P Global Market Intelligence data, the delinquency ratio at U.S. banks was 3.32% at the end of 2023, the highest since 2013. This increase occurred even though the industry’s total amount of auto loans fell to $530.38 billion from $548.40 billion in 2022, marking the first year-over-year decline since 2013.

Fitch Ratings says delinquent accounts and net losses have been trending higher while recovery rates have fallen, signaling weakened performance across the board in Q2 of 2024. Historically, the first quarter of the year benefits from a seasonal boost as borrowers utilize tax refunds to catch up on delinquent loans. However, in 2024, this boost was notably weaker. Economic pressures, coupled with greater outstanding balances from weaker-performing assets, have diminished the positive impact typically seen from January to April.

In April 2024, the delinquent account rate stood at 5.23%, a decline from the all-time high of 6.39% recorded in February. This decrease follows the typical pattern where borrowers use their tax refunds to catch up on loan payments. However, the seasonal improvement this year was less pronounced than in previous years, with delinquent account rates at 4.67% in April 2023 and 3.86% in April 2022.

Recovery rates also suffered in April 2024, dropping to a low of 43.03%, a stark contrast to 54.96% in April 2023 and 62.51% in April 2022. This decline in recovery rates highlights the challenges lenders face in recouping funds from delinquent accounts.

Additionally, the net loss rate in April 2024 was 7.90%, significantly higher than the 6.16% observed in April 2023 and the 4.13% in April 2022. This increase in net losses underscores the financial strain on lenders within the subprime auto loan market.

While the auto-finance industry cannot directly eliminate the rise in delinquent accounts among subprime borrowers, it can take steps to improve recovery rates. This cannot be done by simply increasing the number of collection agents. Although adding more agents might boost recovery rates to some degree, it would also significantly raise operational costs, which is not the way any company would want to go.

The answer is yes.

Technology, particularly Conversational AI, has been a game changer for the auto finance industry. With the rising delinquencies, leveraging Conversational AI has become essential for auto finance companies to enhance their collection efforts and automate processes.

But how does Conversational AI help?

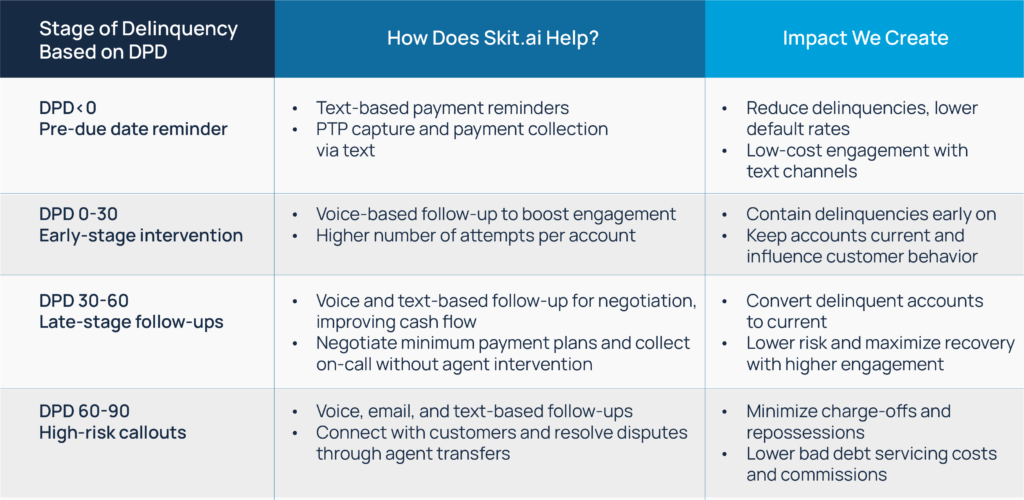

Conversational AI and automation technology can significantly enhance collection processes. By automating end-to-end collections, engaging borrowers, and ensuring compliance with regulatory requirements, these technologies contribute to higher recovery rates. A multichannel conversational AI platform can call and text customers any day of the week, engaging them in human-like conversations while maintaining compliance. It can handle the entire collections process, including customer verification, disposition capture, and payment processing, without needing agent intervention.

Conversational AI can dial thousands of calls per minute and send thousands of SMS, ensuring scalable, comprehensive, and compliant engagement across your consumer portfolio. Conversational AI can handle inbound queries and collect payments at any time, enabling 24/7 collections without requiring agent intervention. Additionally, AI-driven analytics provide valuable insights into borrower behavior, allowing lenders to customize their strategies and enhance overall collection efficiency.

The second quarter of 2024 has been a turbulent period for the auto-finance industry, marked by a rise in delinquent accounts within subprime lending. While economic pressures and weaker-performing assets have aggravated the situation, the industry’s response to adopting conversational AI to help improve collection efforts offers a path to stabilization. As we move into the year’s second half, all eyes will be on how these measures impact the broader landscape of subprime auto lending.

Curious to learn more about how Skit.ai’s Conversational AI can maximize your account penetration? Book a free demo with one of our experts.

The field of AI is advancing rapidly, especially in large language models. Prominent models like GPT-3 and GPT-4 have impressive capabilities in generating coherent, human-like text. However, these models face a significant limitation: they rely solely on the data they were trained on, often leading to outdated or contextually incorrect information. As a result, the […]

You are ready to adopt a Conversational AI or Voice AI solution for your contact center, or you are in the process of adopting one—congratulations! Now is the time to think about integrations. In this article, we’ll discuss the benefits of integrating your Conversational AI platform with various tools and applications to transform your tech […]