Shrutidhara Kakoti

May 6, 2024

Hello! Welcome to Skit.ai. Click here to book a demo.

Are you grappling with the challenge of reaching out to a vast number of accounts with limited staffing resources?

Is the task of engaging meaningfully with each consumer proving to be a daunting feat?

One of the most significant hurdles in collections is the sheer volume of accounts that need attention. Traditional methods involve reaching out to thousands of consumers, which is time-consuming and resource-intensive.

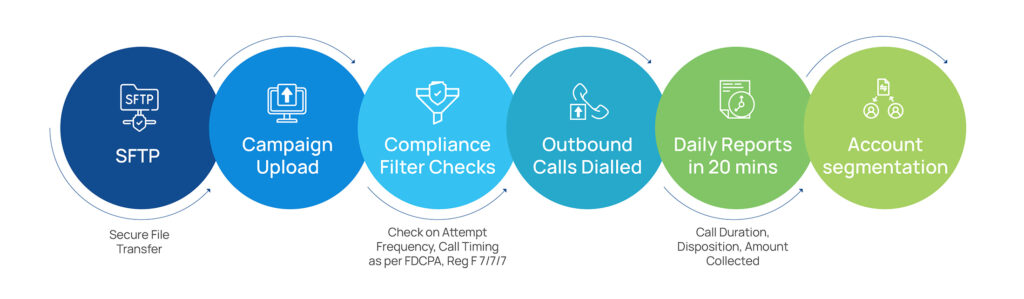

Skit.ai enables collection agencies of all sizes to reach thousands of accounts within minutes. You can automate compliant outbound outreach of your consumer portfolio and ensure 100% account penetration.

Skit.ai doesn’t just enhance outreach efforts; it also enables you to connect with consumers during weekends and after work hours when agents are usually unavailable for outreach campaigns, yet consumers are more inclined to pick up the phone and engage.

Why give apples to your consumers when they’ve clearly said they want oranges?

Consumers nowadays have diverse preferences when it comes to communication channels. Depending on their demographics and behavior, they will prefer to use different channels.

Skit.ai offers multichannel engagement capabilities, enabling collections agencies to connect with debtors through their preferred mode of communication.

Whether it’s sending personalized emails, automated SMS reminders, or initiating interactive voice calls, Skit.ai ensures that agencies can engage with debtors on channels they are most likely to respond to. This strategic approach significantly increases the chances of meaningful engagement and debt resolution, ultimately driving higher recovery rates.

Skit.ai provides collections agencies with many actionable insights to guide their decision-making process. It uses debtors’ response patterns to recommend best practices, such as when and how to reach out to effectively engage with debtors.

Merely increasing the frequency of contact with debtors doesn’t always translate to higher connection rates. Skit.ai’s software analyzes data and recommends the optimal number of engagement retries (while ensuring compliance with regulatory bodies) to achieve an optimal connection rate. It can also suggest the optimal mode of communication for better engagement.

Curious to learn more about how Conversational AI can maximize your account penetration? Book a free demo with one of our experts.

The auto finance industry is experiencing significant transformations driven by market dynamics, consumer behavior, and technological innovations. Here are the key trends shaping the future of auto finance, focusing on the implications for Buy Here Pay Here (BHPH) dealers and the role of Conversational AI and contact center automation in streamlining operations, which will help […]

The auto finance industry, a crucial pillar in the automotive market, experienced a turbulent Q2 in 2024. The rise of delinquent accounts in subprime lending has become a significant concern for industry stakeholders. Subprime lending, which targets borrowers with lower credit scores, is inherently riskier, and recent economic pressures have worsened these risks. This blog […]