Shrutidhara Kakoti

May 23, 2024

Hello! Welcome to Skit.ai. Click here to book a demo.

Multichannel Conversational AI automates interactions across various communication channels—such as voice, text, chat, and email—to engage with consumers through their preferred mode of communication and assist them in resolving their debt.

This significantly improves the consumer experience throughout the recovery journey. Consumers can seamlessly switch between channels without losing the context of their previous interactions.

What benefits have early adopters of Multichannel AI seen in the accounts receivables industry?

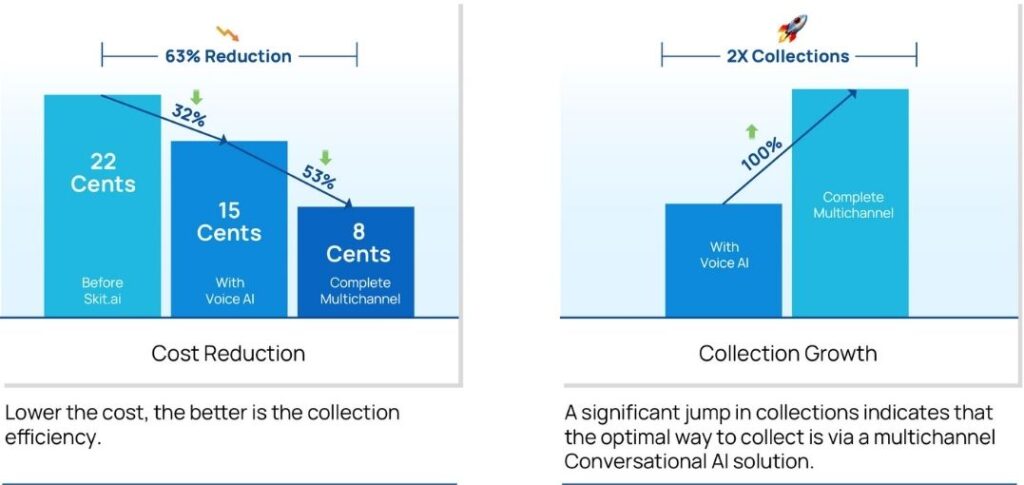

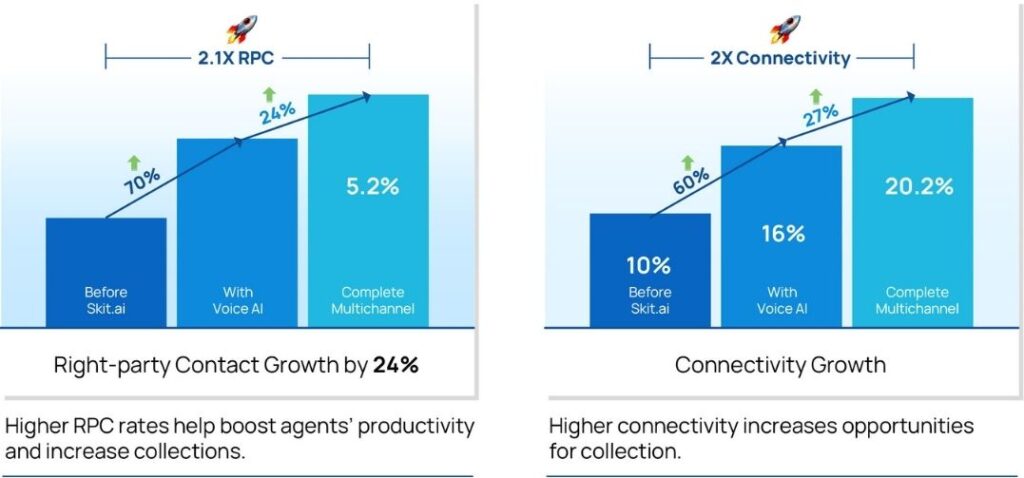

Implementing a multichannel strategy has enabled industry-leading organizations to drastically reduce the cost of collections. Thanks to the technology, live agents can focus on more complex, revenue-generating tasks, while AI handles the most repetitive and routine tasks. This strategy boosts agent productivity and decreases agent dependency, solving the staffing and resource challenges many financial services organizations face.

Here are some examples of the overall improvements in collections a Missouri-based collection agency experienced by leveraging Skit.ai’s suite of Multichannel Conversational AI.

Curious to learn more about how Conversational AI can enhance your collections strategy? Book a free demo with one of our experts.

The auto finance industry is experiencing significant transformations driven by market dynamics, consumer behavior, and technological innovations. Here are the key trends shaping the future of auto finance, focusing on the implications for Buy Here Pay Here (BHPH) dealers and the role of Conversational AI and contact center automation in streamlining operations, which will help […]

The auto finance industry, a crucial pillar in the automotive market, experienced a turbulent Q2 in 2024. The rise of delinquent accounts in subprime lending has become a significant concern for industry stakeholders. Subprime lending, which targets borrowers with lower credit scores, is inherently riskier, and recent economic pressures have worsened these risks. This blog […]