Harshad Bajpai

November 16, 2022

Hello! Welcome to Skit.ai. Click here to book a demo.

November 16, 2022

Newer forms of communication, like email and instant chat tools, have replaced more traditional tools. The same phenomenon may seem to occur in the ARM space, with collection agencies and customers now interacting via email, text messages, chat, and IVR systems. But while each tool has its specific value, phone calls for debt collection and reminders are hardly dying!

In the U.S., about 28% of consumers have at least one debt in collection. Debt delinquency has grown dramatically during the COVID-19 pandemic, and collection agencies are tasked to chase after thousands of loan defaulters and slow-paying customers. Imagine persistently following up with debtors with back-and-forth emails to detail debt information that mostly goes unread or ignored at every stage! Or think of sending a combination of payment reminders via messaging systems that are usually one-sided and restrictive in terms of options to answer debt-related queries. Digital interaction methods unquestionably have their merits, and challenging them sounds flaky. But there are aspects to the good-old phone call which make it the best bet for high-performing collection campaigns:

1. It takes longer to text or type than to speak, and speech-based dictation is faster with speech recognition systems on mobile devices.

2. Phone calls are great for establishing an immediate connection within seconds of calling.

3. Voice calls are direct, personal, and confidential.

4. Phone calls allow for effective two-way communication. They are suitable for active listening, asking questions, troubleshooting, clarifying and sharing relevant debt-related information, and even reaching an agreement.

5. A phone call is an active way of engaging with debtors, unlike text messages, emails, or notices which are passive at best.

Manually Calling Each Debtor is Impractical

Typically, debt collection follows through a sequential flow of interactions across different modalities. Voice calls are not the first step of debtor contact. Collectors must tread carefully with a list of ‘avoidant’ defaulters to emphasize the immediacy of calls and prompt a favorable response without annoying them. Without digital tracking and real-time dashboards for delinquent lists, keeping a tab of debt statuses is challenging. This makes phone calls somewhat of a hit-and-miss method.

As for the debt collection agencies, even after scaling their collection teams, it becomes difficult to maintain speed, cost, and quality consistencies and also achieve conversion goals with just phone calls. Manual phone calls are expensive and exhausting. Here’s what a daily debt collection humdrum looks like:

To address the scalability and cost factors involved in manual debt collection calls, some firms choose an automated route that can be restrictive and risk missing out on the core purpose—debtors’ promise for payment. Automated debt collection systems with complex IVRs menus or robotic voices communicating debt information are generally an instant turn-off for customers. Therefore, the need of the hour is a combination of automation and human-like intervention to manage very high-volume debt collection calls while also empathetically reminding and aligning debtors to debt-related conversations.

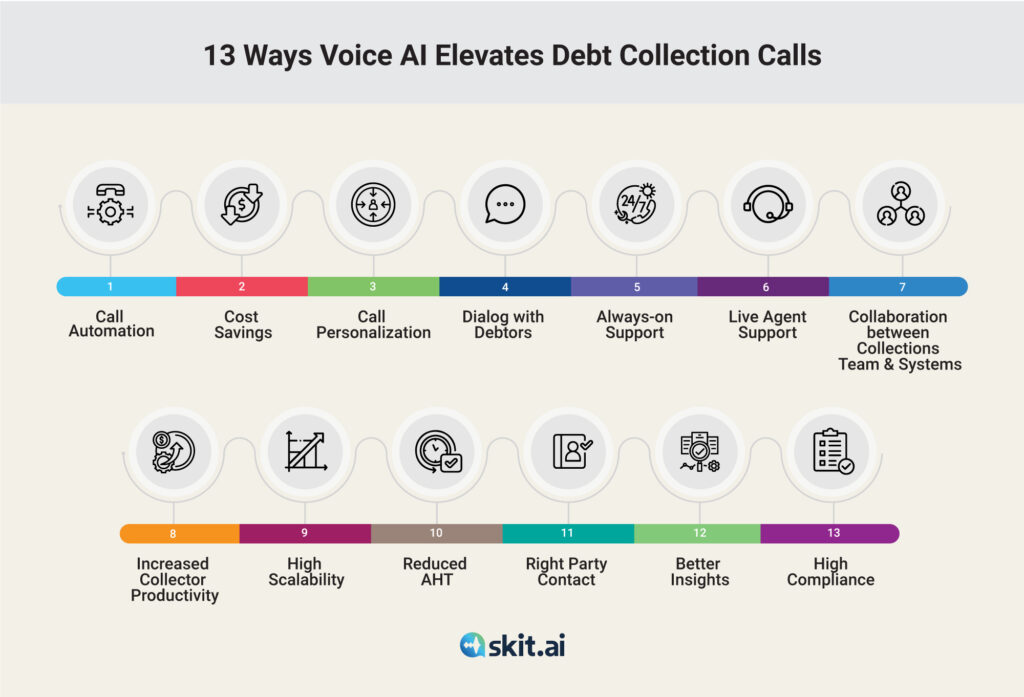

Voice AI technology helps elevate the significance of phone calls as an effective debt recovery tool. Skit.ai’s purpose-built and domain-specific Voice AI platform helps debt collection agencies to adopt meaningful approaches to customer interactions over phone calls with strikingly accurate and intelligent multi-turn conversations.

Dive deeper: How Call Automation Impacts Debt Collections

The intelligent Digital Voice Agents are modeled on human interactions and plug into contact centers to automate responses for repetitive, zero-value queries. These voice agents can hold human-like conversations and resolve tier-1 caller/customer queries without needing any intervention by a human agent. Only complex customer/caller queries that the Digital Voice Agents cannot handle are transferred to human agents. Augmented Voice Intelligence focuses on expanding the collection agencies’ workforce by combining the power of human voice and machines.

Buyer’s Guide: Digital Voice Agent for Debt Collections

Voice AI works with the adage that voice interactions are the most natural communication forms. With the platform built, designed, and optimized for voice interactions, collection agencies can realize the full potential of their debt recovery initiatives by automating calls and augmenting the workforce to involve only in complex scenarios that need detailed articulation and communication parameters that go beyond basic texts, emails or automated responses.

How TCPA Impacts Voice AI in the Collections Industry?

Our Two Cents:

In reality, it is tricky to remind people to repay their debts. In the current stage of piling deliquescent debts in the U.S. adoption of Voice AI is necessary to create strategies that convert potential conflicts and confusions into meaningful conversations on outstanding loans and payments.

Voice AI will continue making a strong impact in the debt collection industry by transforming a simple phone call into a prolific tool to manage debt-recovery cases without going overboard with time, cost, and human effort.

To learn more about how call automation with Voice AI can transform your debt collection agency, schedule a call with one of our experts or use the chat tool below.

The field of AI is advancing rapidly, especially in large language models. Prominent models like GPT-3 and GPT-4 have impressive capabilities in generating coherent, human-like text. However, these models face a significant limitation: they rely solely on the data they were trained on, often leading to outdated or contextually incorrect information. As a result, the […]

You are ready to adopt a Conversational AI or Voice AI solution for your contact center, or you are in the process of adopting one—congratulations! Now is the time to think about integrations. In this article, we’ll discuss the benefits of integrating your Conversational AI platform with various tools and applications to transform your tech […]