The auto finance industry is experiencing significant transformations driven by market dynamics, consumer behavior, and technological innovations. Here are the key trends shaping the future of auto finance, focusing on the implications for Buy Here Pay Here (BHPH) dealers and the role of Conversational AI and contact center automation in streamlining operations, which will help the industry navigate turbulent times.

Key Trends

Increased Vigilance Required for BHPH Players

The demand for used cars has surged, putting pressure on BHPH players to be more cautious and vigilant about their loan approvals and collection processes. With the rise in used car sales, BHPH dealers must maintain stringent oversight to mitigate risks associated with subprime auto loans. Effective loan management and collection strategies are crucial in ensuring financial stability and minimizing delinquencies.

Negative Equity and Rising Debt

Negative equity on car loans is emerging as a major concern. As car prices stabilize, many buyers are left with higher-than-average debt, resulting in them being underwater on their loans.

Rising Used Vehicle Loan Rates

Used vehicle loan rates have increased, averaging a 23 basis point (bps) rise year over year. This could potentially lead to higher delinquency rates and higher repossessions.

Longer Loan Terms at Record Levels

Both 60-month and 48-month auto loans are at their highest levels in the last 15 years. This shift towards longer loan terms makes monthly payments more affordable and may extend the repayment period. Without an efficient collection strategy, it may become difficult for auto finance companies to recover the loans.

Near Record-High Amounts Financed

The average amount financed for auto loans is nearing an all-time high of around $40,000 USD, reflecting the rising costs of vehicles.

Affordable New Car Rates and Transaction Trends

According to Moody’s Affordability Index, while the average transaction price for new cars has declined in 31 months due to more affordable rates in 2024, it remains one of the highest in a decade. This indicates a shifting market where affordability is improving, but high transaction values persist.

The Solution to Overcome the Current Environment: Contact Center Automation with Conversational AI

As the auto finance industry faces various challenges—from rising loan rates to increased negative equity—innovative solutions for a compelling collection are more critical than ever. Contact center automation with Conversational AI has emerged as a powerful tool for auto finance and BHPH companies.

Inbound Contact Center Automation: Enhancing Consumer Experiences

Zero Wait Time: Traditional Contact centers often frustrate consumers with lengthy IVR menus and extended wait times, leading to high drop-off rates. With an average of 15% to 20% of consumers dropping off at the IVR menu, there is a significant loss of collection opportunities. Implementing conversational AI systems like Skit.ai, which provide contact center automation, can eliminate wait times and enhance consumer satisfaction by providing immediate assistance.

Personalized Consumer Interaction: Conversational AI integrates with existing CRM systems to offer a personalized approach to consumer service. This integration allows the AI to recognize the consumer’s identity and recall previous interactions, providing a seamless and customized experience. Such systems can fetch consumer profiles in milliseconds, improving the efficiency and effectiveness of the service.

Best Engagement Channels: Today’s consumers are less likely to answer calls from unknown numbers, with over 90% ignoring such calls. Engaging consumers through SMS and voice can lead to higher response rates, as text messages have double the response rate of voice calls. Offering payment channels through both mediums can improve engagement and collection rates.

Read our blog: Automate Your Auto Finance Collections with AI-Powered Text Messaging

24/7 Inbound Support: The lack of support over weekends often leads to missed collection opportunities. By providing 24/7 consumer support, auto finance companies can ensure continuous engagement and reduce the chances of delinquencies.

Outbound Contact Center Automation: Maximizing Engagement and Recovery

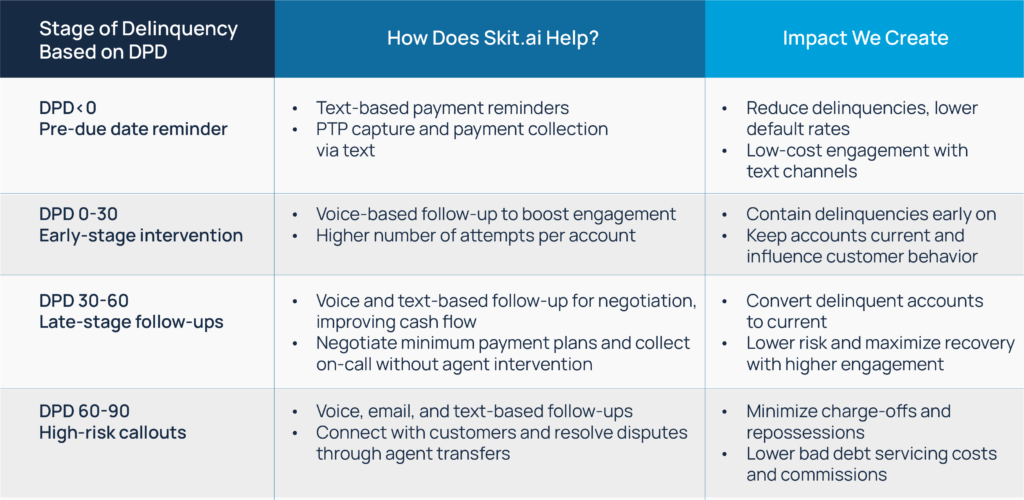

Increased Attempts and Engagement: Higher engagement is essential for ensuring timely payments. Infinite scalability in outbound contact center automation allows for more attempts to contact consumers, which is crucial for BHPH players who cannot afford prolonged delinquent cycles. Increased engagement during the DPD 0-21 phase can significantly enhance recovery rates.

Prioritizing Loan Payments: Engaging consumers over weekends can prevent auto payments from being deprioritized. Most consumers get paid on Fridays, and without engagement, they may spend on non-discretionary items. Automated calls over the weekend can remind consumers of their auto payments, reducing Monday delinquencies.

Multichannel Payment Integration: Offering multiple payment channels and automating collections through phone payments can streamline the process. Integrating card-on-file or user-defined card options and setting up auto payments can improve collection efficiency.

Payment Negotiations and Alternative Plans: Consumers facing unforeseen events such as job loss or medical expenses need proactive engagement. Offering alternative payment plans based on their payment history can enhance consumer satisfaction and ensure better recovery rates.

Benefits of Using Skit.ai for Contact Center Automation

Experience and Trusted Name: Skit.ai is a trusted name in the auto finance industry, featured among the top 500 companies in Auto Remarketing. It collaborates with renowned names such as Veros Credit, PeakBHPH, and Sensible Auto, ensuring credibility and reliability.

Low Lift Integration Effort: Skit.ai offers seamless integration with built-in dialer platforms and CRMs like DealerSocket- IDMS and Automaster. It also integrates with common payment gateways such as PayNearMe, making the transition to automated systems smooth and efficient.

Conclusion

Integrating Conversational AI and contact center automation is not just a technological upgrade but a strategic shift toward a more efficient, consumer-centric, and financially robust collection model. Companies that embrace these technologies will be better positioned to navigate the complexities of the modern auto finance landscape, stay ahead of the competition, and deliver superior experiences to their consumers and stakeholders.

As the auto finance industry evolves, adopting conversational AI and contact center automation will be key to enhancing operations, providing a better consumer experience, and improving recoveries with minimal effort.

Curious to learn more about how Skit.ai’s Conversational AI can maximize your account penetration? Book a free demo with one of our experts.