Early-out collections are a critical phase in which revenue cycle management providers aim to recover outstanding payments from patients within the initial 90-120 days post-bill creation. However, despite its significance, the early-out collection process presents challenges that can hinder the collection efforts and, ultimately, the RCM providers’ cash flow.

In this article, we will explore how multichannel AI solutions can bridge the gaps, expedite collections for RCM providers, and improve the patient experience.

Too Little, Too Late: Why It’s Difficult To Execute a Timely Early-Out Campaign

The phase of early-out collections is crucial. Revenue cycle management (RCM) providers must collect outstanding debts from patients within 90-120 days. This is necessary to swiftly close dues and maintain a stable revenue stream.

The challenge?

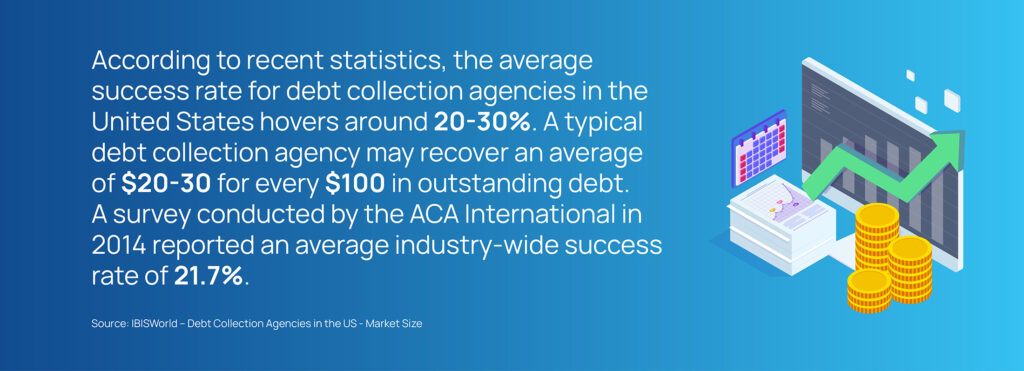

RCM providers face immense pressure to resolve outstanding self-pay dues, knowing that delays can have significant consequences. After the 90-day mark, unresolved self-pay dues may escalate to accounts being written off and passed to third-party collection agencies or legal firms, worsening the strain on an already fragile margin in a challenging market.

However, amidst the flurry of calls and the limited timeframe, RCM agents often struggle to connect with patients holding self-pay dues, managing only a few attempts below the optimal frequency needed for successful collections. RCM providers typically do not have enough agents to handle patient outreach at the scale required to execute an effective early-out campaign.

This issue is compounded by the perpetual rise in agent attrition, which not only hampers smooth operations and continuity, but also escalates the cost of recruitment and training, further squeezing RCM providers’ profit margins.

Let’s have a look at the challenges in detail:

Inadequate Number of Follow-Ups

Revenue cycle management providers struggle to effectively engage patients despite most of the accounts being very recent, primarily due to limited scalability. This results in missed opportunities to resolve patient dues, ultimately leading to revenue losses.

Complex Bill Disputes

Patients frequently raise inquiries regarding their bills, requiring time-consuming interactions to address their queries and alleviate concerns. This intricate process demands significant time and resources from RCM providers to ensure accurate explanations and satisfactory patient resolutions. Addressing these queries is essential for maintaining transparency and trust in the healthcare providers.

Thin Margins

With the rise in popularity of high-deductible health plans (HDHP), many patients are left with significant self-pay dues. When patients are unable to complete their self-payments, healthcare providers are forced to write off these dues and a large share of their revenue, therefore affecting profit margins.

Staffing

Most sectors are undergoing struggles related to staffing, caused also by high inflation rates. Revenue Cycle Management (RCM) providers are no different. Hiring channelges are worsened by increasing attrition rates and the expenses tied to hiring and training. This directly affects the efficiency of managing early-out collections and incoming patient inquiries, impacting profits and patient satisfaction.

Can Multichannel Conversational AI Help in Early-Out Collections?

The answer is yes.

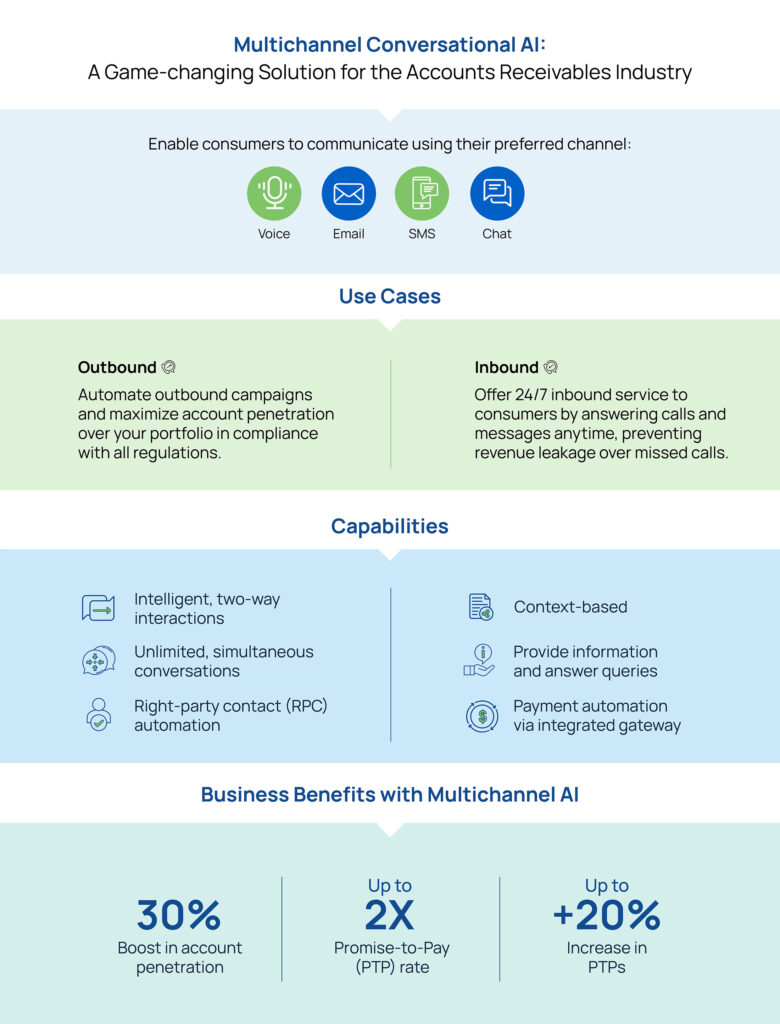

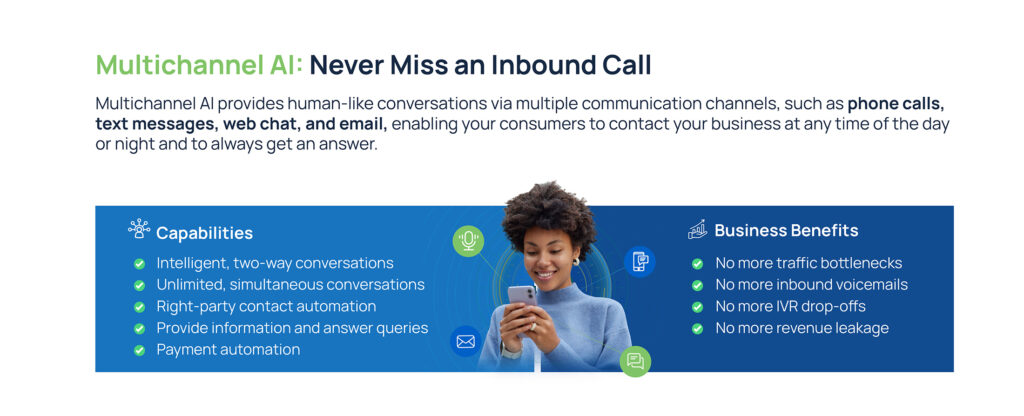

But what exactly is Multichannel Conversational AI? In simple terms, it’s a technology that leverages multiple channels like email, SMS, phone calls (Voice AI), and web chat to handlehuman-like, two-way conversations with consumers.

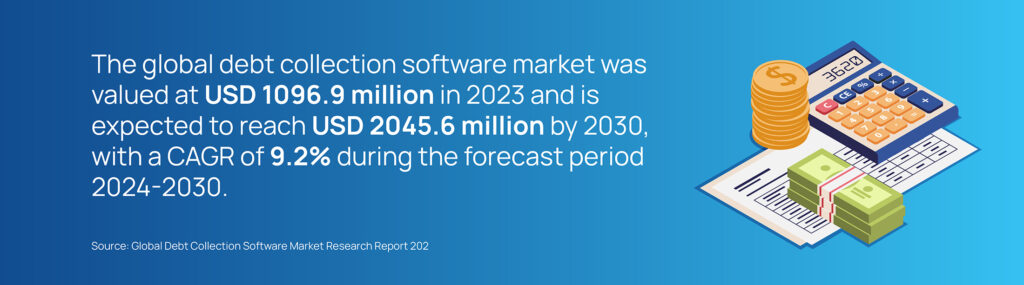

Multichannel AI offers a promising avenue to address the pain points in early-out collections and optimize revenue recovery efforts.

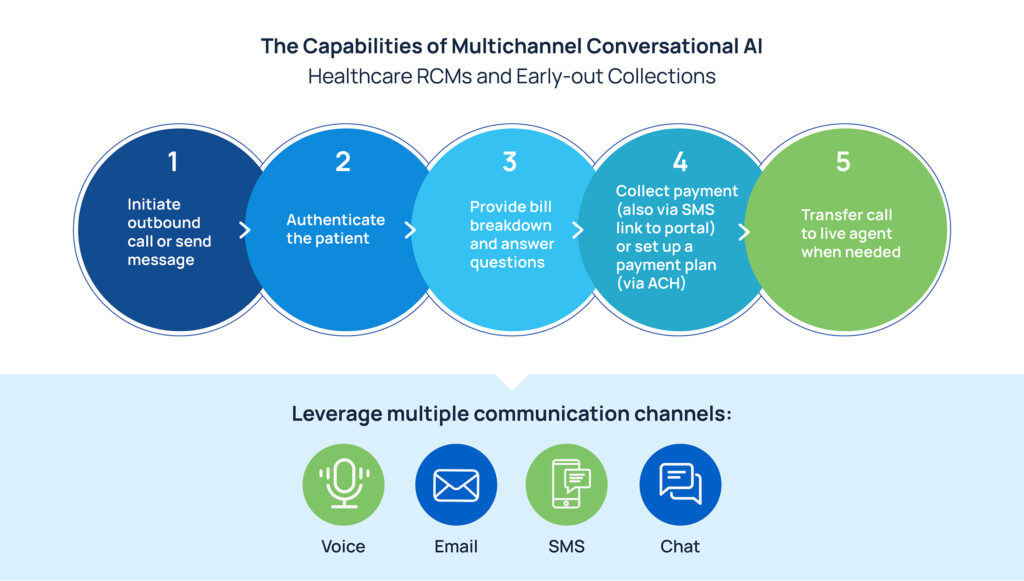

Here’s precisely how Skit.ai’s Multichannel Conversational AI solution can help in early-out collections:

Scalable Automated Patient Outreach

Skit.ai’s AI bot can initiate personalized outreach to patients via multiple channels, such as phone calls (Voice AI), text messages, emails, and chatbots, ensuring effective communication and engagement from the outset. This ensures swift connection and meaningful engagement with patients and, at the same time, offers scalability to RCM providers to reach out to numerous patients in bulk.

Handle Payments and Inbound Queries

Skit.ai’s AI bot can authenticate patients, clarify bill breakdowns, answer patient queries, facilitate on-call payments and text-based payment links, and even set up payment plans, enhancing convenience and reducing barriers to receiving payment.

Improved Efficiency and Reduced Agent Costs

Skit.ai’s AI bot augments human efforts by automating repetitive and time-consuming tasks, enabling RCM staff to focus on resolving complex disputes and providing personalized patient assistance. This includes clarifying bills, patient follow-ups, payment assistance, and post-call activities.

How Will RCMs Benefit from Skit.ai’s Multichannel Conversational AI?

Now that we have explained in brief how Skit.ai’s multichannel conversational AI solution can help RCM providers expedite early-out collections, let’s look at how RCM providers can benefit from the adoption of this technology:

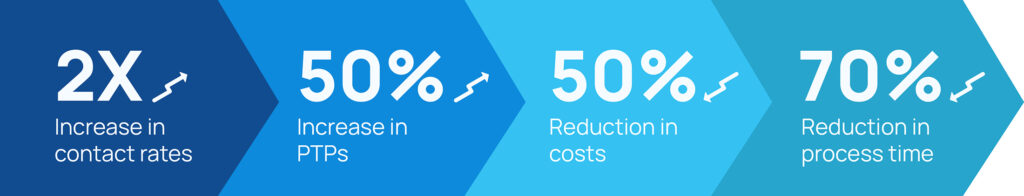

Increased Cash Flow: Extensive outreach through multiple channels boosts patient engagement, leading to higher payment rates.

Shortened Recovery Cycle: Targeted outbound campaigns powered by AI accelerate the collection process, improving cash flow.

Reduced Charge-Offs: By minimizing the number of bills sent to collections, AI helps mitigate bad debt losses.

Solved Staffing Challenges: AI augments human resources, enabling RCM teams to handle larger volumes of accounts efficiently.

Cost Savings: Automation reduces operational expenses and maximizes revenue recovery, contributing to overall financial health.

The Effects on Patient Experience and Compliance Concerns

For healthcare providers,the patient experience is of utmost importance. From reaching out to patients regarding their self-pay dues to collecting payments, your technology partners must ensure that patients have a top-notch experience, and the same applies when they interact with Skit.ai’s virtual assistants.

With Skit.ai, RCM providers elevate patient experience by:

24/7 Inbound Support: Skit.ai’s bots can quickly clarify bill details, alleviating confusion and building trust among patients. Patient queries are promptly addressed whenever they reach out, be it on weekends or after work hours.

Multiple Channels: Patients expect and appreciate the flexibility to communicate through various channels according to their preferences. Skit.ai provides multiple communication channels that enhance engagement and cater to diverse consumer needs and preferences, fostering a positive customer experience.

Convenience: Seamless payment options (on-call and link-based payments) and quick responses to payment queries improve satisfaction and reduce friction in the billing process. Our bots can also negotiate payment plans and set up payment plans for ease of collection.

In addition to delivering exceptional patient experiences, we recognize the significance of compliance for RCM providers, particularly in handling patient information. That is why we are proud to comply with all federal and state regulations, including HIPAA, the TCPA,TCPA, HIPAA, and more; additionally, Skit.ai has data security certifications such as PCI-DSS, SOC 2 Type II, and ISO 27001:2022

Conclusion

Integrating multichannel Conversational AI solutions into early-out collections processes offers a transformative approach for RCM providers. Conversational AI empowers RCM providers to navigate challenges effectively and achieve sustainable financial outcomes in a rapidly evolving healthcare landscape by addressing pain points, enhancing efficiency, and improving patient satisfaction.