Navigating the intricacies of debt collection is no easy feat—even for law firms specializing in the practice.

Creditors’ rights law firms engaged in collections often deal with hurdles such as staffing challenges, account penetration, compliance with the regulatory landscape, consumer engagement, and the high cost of traditional collection methods. Consequently, these firms are turning to cutting-edge technological solutions to streamline processes, aiming for greater efficiency and cost savings.

Like other areas of the accounts receivables industry, the legal collections field is undergoing rapid transformation. As the sector grapples with these changes, artificial intelligence has emerged as a pivotal tool. In this article, we delve into the impact of Conversational AI on creditors’ rights law firms and explore how a multichannel strategy can improve consumer outreach and debt recovery.

Why Law Firms in Debt Collections Are Adopting Conversational AI

The first—and often daunting—task for any organization involved in debt collection is outreach. It’s a multifaceted puzzle that demands not only reaching the consumer but also doing so in an effective and compliant manner. When dealing with large volumes of accounts, it can be challenging to reach every consumer, and it can be even more difficult to do so efficiently.

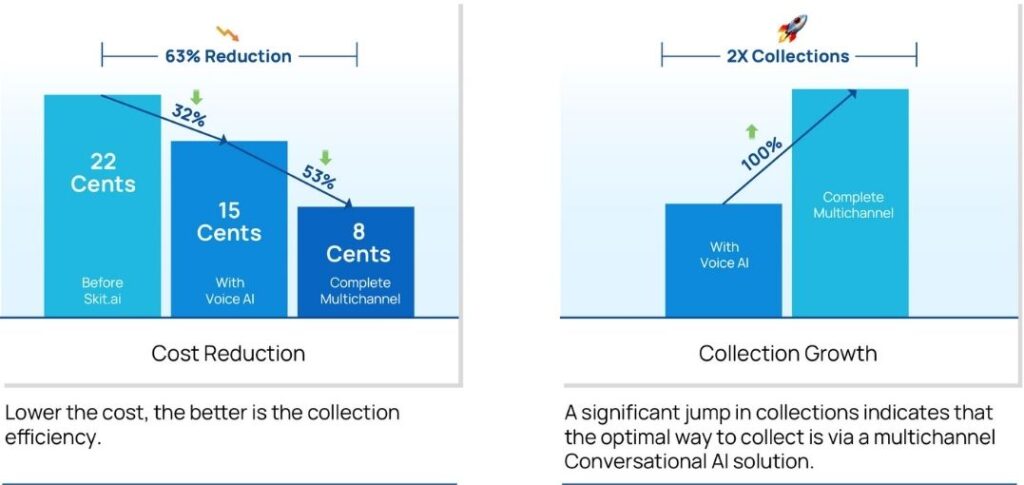

Conversational AI has revolutionized this process by automating consumer outreach, as well as the handling of consumer engagement and interactions via various channels, such as phone calls, emails, SMS, and web chat.A multichannel strategy enables collection agencies and lenders to cut costs, improve processes, and meet the diverse needs of consumers.

Here are some of the most common challenges faced by law firms involved in debt collections:

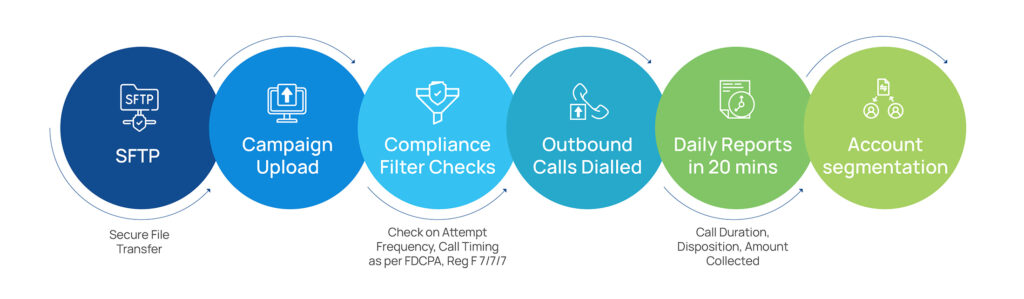

Regulatory Compliance: Law firms and agencies are the most careful and well-informed when it comes to complying with laws and regulations, including the TCPA, FDCPA, and Reg F.

Staffing: Collecting in-house requires hiring and retaining full-time staff, including legal assistants and live transfer agents, which is costly and time-consuming.

Outsourcing: Outsourcing collections to a third-party agency is a common practice, yet it’s an expensive option for law firms.

Call Volume: Maximizing the number of consumers reached, known as account penetration, can be a pain point that some companies end up compromising on, especially when dealing with hundreds of thousands of accounts.

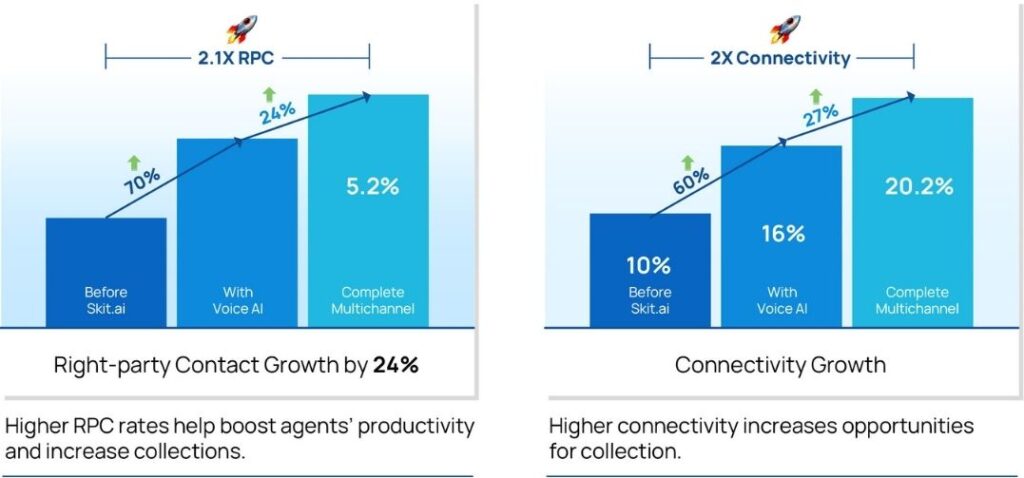

Time and Resources: The last calling attempts before pursuing legal action cost time and resources, including establishing right-party contact (RPC).

How Multichannel AI Can Help Creditors’ Rights Law Firms

Conversational AI handles human-like conversations with consumers; here are some of the benefits it offers in the legal collections space.

An Outreach Revolution

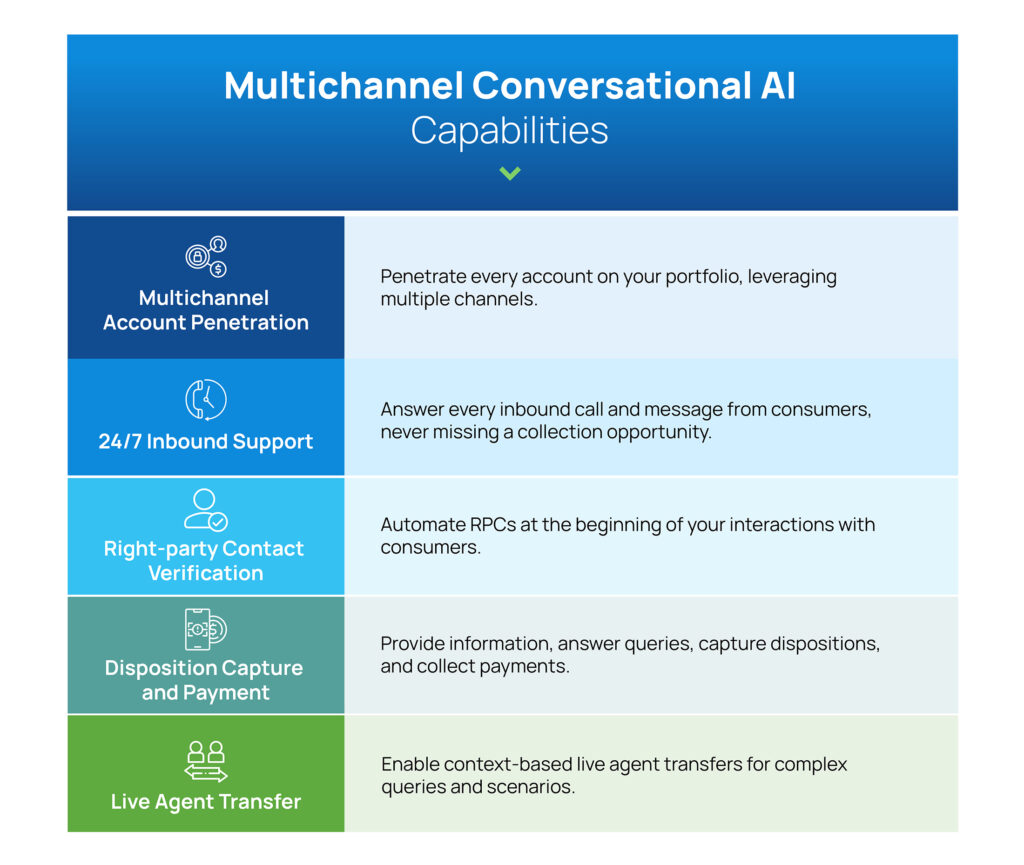

Any entity performing collections must first perform consumer outreach. Multichannel Conversational AI has revolutionized this step by automating a diverse range of outbound communications tactics across multiple channels.

Conversational AI enables companies to automate thousands of consumer interactions within minutes at a fraction of the cost of a traditional collection call. Collection agencies have been relying on this solution for both outbound and inbound collection calls, successfully cutting costs and accelerating the recovery process. The bot can trigger the communication based on pre-determined criteria and identify itself and the collection entity.

This technology must not be confused with an IVR system. An IVR forces users to listen to lengthy menus that are mostly irrelevant. Research has consistently shown that IVRs are not popular among consumers. Unlike IVR, an AI-powered solution like Skit.ai handles intelligent, personalized, and effective conversations with consumers, eliminating wait times and cutting costs.

Multichannel capabilities enable companies to offer multiple channels to consumers, boosting engagement by enabling them to utilize their preferred mode of communication.

24/7 Inbound Support

Conversational AI can answer every single call or message from consumers at any hour of the day and on any day of the week, unlocking 24/7 inbound support for your consumers calling to ask questions or make a payment. Thanks to this technology, you won’t have to miss a single collection opportunity coming your way.

Right-Party Contact Verification

AI can save a significant amount of time and resources invested in performing right-party contact (RPC) verification. Bots can easily verify RPCs at the beginning of an interaction with a consumer by using the last four digits of their social security number, date of birth, or zip code.

Disposition Capture and Payment

Given the bot’s ability to handle human-like, two-way, and multi-turn conversations with consumers, Conversational AI can provide information on the consumer’s debt and offer ways to pay it off. The bot can therefore capture promise-to-pay and collect the payment in multiple ways: via a live agent transfer, an SMS link leading to an online payment portal, or an on-call card payment.

Live Agent Transfer

Interactions with consumers are not always straightforward, and that’s why the bot is built to identify complex queries and scenarios in which a live agent transfer is necessary. The benefit of live agent transfers is that they’re context-based, as the solution shares the context and history of the interaction with the live agent.

Do you want to learn more about how Multichannel Conversational AI can help your company automate and streamline your collection process? Book a demo with one of our experts.