For debt collection agencies, debt recovery is a labor-intensive effort that typically relies more on human effort than capital investments. Even with the adoption of newer digital communication tools that promise to scale manual efforts, the ARM industry invariably struggles with one major issue — human resource turnover.

Across all industries, average attrition rates in contact centers vary between 30 to 40%.

It’s hard to know the exact attrition rate in the ARM industry. Agencies reported a monthly quit rate of 2.9% in 2021. Before the pandemic, in 2016, large collection agencies reported experiencing an average turnover rate of 75% to 100%, according to the Consumer Financial Protection Bureau.

The high attrition that characterizes the collections space makes third-party debt collection agencies vulnerable to several challenges, like loss of domain expertise, risk of non-compliance, lawsuits, and increased cost of hiring and training new talent. In the United States, with nearly one in four citizens having at least one debt in collections, recovery has become an increasingly costly endeavor.

Most Common Reasons for Collection Agent Attrition in the Debt Collection Industry

Here are some of the most common challenges that make it so difficult for agencies to retain collectors:

- Too Many Accounts, Too Much Work: Given the growing debt delinquency in the U.S., one can only imagine the amount of verification and debt-related communication work that can drive collectors to overwork.

- Collectors’ Commission is Dependent on Recovery: Third-party debt collection agencies are involved when credit card issuers or creditors’ collection representatives cannot recover overdue balances. Collection agencies face thinning profit margins, and human agents’ commissions for debt recovery further burn holes in their pockets. There is no set rule or guarantee on the time the human agents need to recover outstanding loans successfully.

- The Great Resignation: While all contact centers face high attrition rates, many people have been rethinking their careers and seeking opportunities in new fields over the last two years. This also applies to the ARM industry, where collection agents face acute stress from chasing after customers over the phone while adhering to a wide array of regulations, making attrition an even bigger challenge.

- Empty Promises to Pay: It is common to find consumers dodging debt-related interactions. When confronted directly, they are likely to make promises to pay that may only sometimes be honored, which is another detractor for collectors to stick to their roles.

- Debt Shame: Debt collection calls are direct and can sometimes make the debtors uncomfortable delving into the details of their unpaid loans. According to a study by Webio, people can be much more honest when communicating via text messages than in voice interactions for difficult scenarios. In the case of debt collections, textual conversations can reduce stress for both debtor and collector.

- Efforts Often Don’t Justify Conversion Rates: When it comes to debt, the devil is in the details. To invest too much attention and time in each customer who needs a detailed overview of their loans and debts is unrealistic. It is extremely costly and leads to operational overkill, another reason for collectors’ resignation.

- Debt Collection is Not for Everyone: Employee turnover in any field results from the nature of the job/employer and the employee’s capabilities. Working conditions, perks, quality of work, and benefits will fix the collector’s morale. But employees’ capabilities for the job determine how much they are willing to stick to it.

- Rapid Changes in Regulatory Framework: Many regulatory agencies like FTC and rules like Fair Debt Collection Practices Act dictate how collection agencies can approach consumers without violating consumer protection laws. It requires constant staff training and procedural approaches like obtaining debt verification requests, debt validation, forbearance, and foreclosures that rely on unique expertise. When agencies adopt a manual route or use restrictive debtor communication methods, errors and inaccuracies are expected.

The Rising Role of Voice AI in the Debt Collections Industry

These challenges highlight the urgency for digital transformation in collection agencies; in particular, agencies are looking at automation as the primary solution to their attrition crisis.

In our previous articles, we discussed the unique capabilities of Voice AI technology in reducing contact center agent labor costs via call automation. Concurrently, Gartner’s estimates from their survey also suggest that labor expenses represent 95% of contact center costs, and adopting Conversational AI helps cut expenses by $80 billion. The customer-facing side of ARM, particularly the debt collection agencies, can capitalize on this trend to reduce staff shortages, curb labor expenses and make human resources more efficient and effective.

Skit.ai’s Voice AI platform is at the forefront of transforming the ARM industry with its Digital Voice Agents and augmenting collection agencies’ workforce to focus on resolving complex use cases.

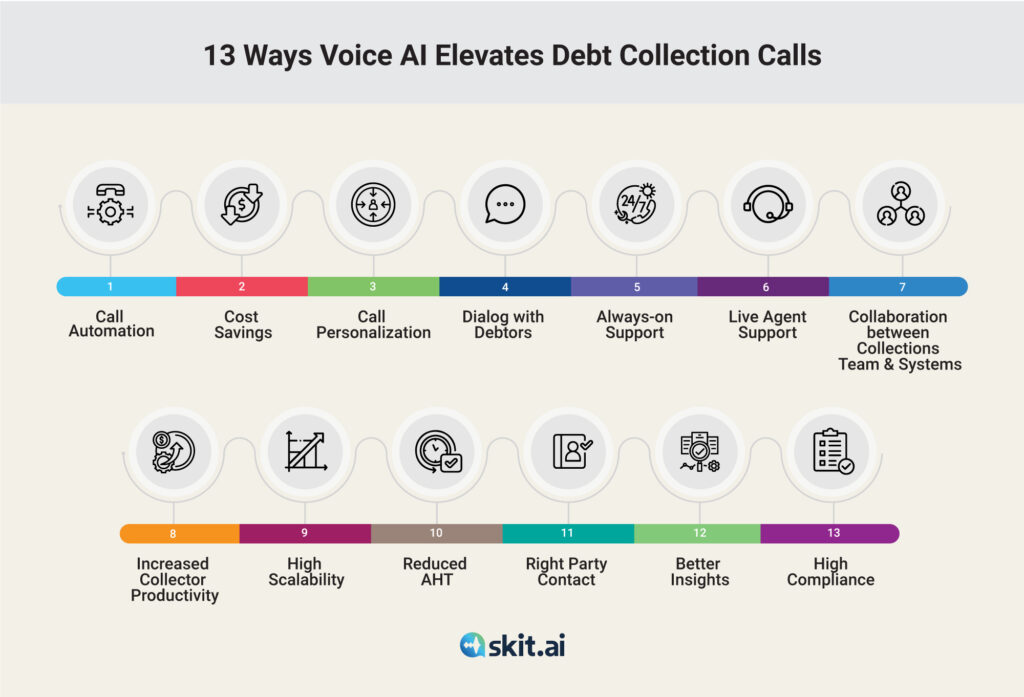

Voice AI’s value-adds are in areas that impact collectors’ productivity and bandwidth which further determine talent retention in this space. Here’s the rundown of its merits that help address agent attrition challenge in the debt collections industry:

- End-to-end Call Automation: Voice AI helps automate 70% of calls (inbound and outbound), allowing prompt query resolution. Also, agencies can leverage automation to identify consumers, policy numbers, and other debt-related information. This reduces the effort and time it would take to call and follow up with each debtor manually.

- Reduce High Cost of Collection by 1/5th: Digital Voice Agents that plug into contact centers and take over calls by holding human-like conversations can execute calls at less than 1/5th of the actual cost of manual calls. Collection agencies can lower operation costs with intelligent voice agents in lieu of collectors by concurrently calling over thousands of defaulters.

- High Scalability: Agencies can scale their debt collection efforts and consumer outreach by leveraging call automation and Digital Voice Agents that can handle and answer tier-1 caller queries by automating up to 70% of calls, reducing dependency on human agents.

- Higher Portfolio Coverage Intensity: Collectors can cover many more debt files when they leverage Voice AI’s ability to handle multiple calls simultaneously. With minimal effort, cost and time, agencies expand their scale of reach of debt collection practices with minimal human intervention.

- Strict Adherence to Compliance: Fear of lawsuits or going off track by the debt collectors will be alleviated by the Voice AI platform, which is purpose-built and specific to the domain and use case. Digital Voice Agents can be tailored to hold and attend calls as per the laws governing consumers’ preference for call frequency, tone, language, and time to receive debt collection calls.

- Solve Diverse Use Cases: The recovery process in the collection agencies involves rigorous reviews, checking outstanding balances, sending demand and acknowledgment letters, and arranging for telephone contact. It is humanly impossible to keep track of all details, numbers, and sensitive information about different types of debt and cases at their fingertips. Digital Voice Agents can be optimized to address various debt-related queries and use cases without time, cost, and human effort constraints, reducing work stress and dissatisfaction for debt collectors.

- Enhance Human Agent Productivity: Debt collectors can experience higher and faster conversion levels by leveraging Voice AI’s analytics and caller data insights. The pre-call verification, call automation (inbound and outbound), and routing features enable real-time agent augmentation, boosting productivity and performance. Also, the Digital Voice Agents are capable of intelligent call transfers to human agents only for complex cases, allowing the human workforce to focus on efforts that help retrieve debts faster.

- Voice AI Calls are Free of Human Biases: Holding debt recovery conversations is a sticky collection practice that most consumers tend to avoid out of pressure, discomfort, shame, and fear of judgment. Voice AI’s call automation capability eliminates direct voice interaction between defaulters and collection agents, making collection calls free of human biases. Also, Digital Voice Agents can hold persuasive, contextually accurate, and proactive conversations and keep interactions direct and objective. This way, collection agents can experience higher work quality without job stress, dissatisfaction, and the chances of misdemeanors while talking to consumers.

Collection agencies rely entirely on outstanding loan payments to survive. Voice AI helps collection agencies strike a balance between meeting their recovery targets and making debt collection efforts more intuitive in a way that doesn’t come at the cost of operational burnouts and resignations. Voice AI eliminates bottlenecks in debt recovery and improves the overall customer experience.

To learn more about how Voice AI can help you solve attrition challenges, schedule a call with one of our experts or use the chat tool below.