Tax season is the busiest time of the year for collection agencies. According to a recent report, 44% of Americans say they earmark their tax refunds to pay off their debts or bills. With 3 in 4 U.S. residents receiving a tax refund from the government during this season each year, the number of people who will wisely take advantage of the reimbursements to pay off their debt is high.

In 2023, the average tax refund for individuals in the U.S. was $3,054.

Collection agencies know it’s important to take advantage of this window of opportunity to maximize their recovery rates and agency margins. During tax season, the industry usually experiences a peak in payments, paired with a general openness of consumers to engage with collectors. Many consumers will be relying on tax refunds to pay off their debt at this time of the year.

Now is the perfect time for agencies to prepare for tax season and the volume surge in outbound and inbound calls. In this article, we’ll explain how Voice AI (the technology behind a voicebot) can transform tax season for the better, making it a less stressful and more profitable time for collection agencies.

The Challenges Collection Agencies Face Before and During Tax Season

While tax season undoubtedly represents a window of opportunity, it also presents several challenges for collection agencies. The best way for management to tackle these challenges is to prepare in advance and to involve their collectors on the floor in these preparations.

Here are some of the most common challenges collection agencies face before and during tax season:

Hiring new collectors: To handle the surge in call volume, collection executives often seek to hire new collectors to join their staff. Hiring takes time and resources; since the COVID-19 pandemic, it’s become more challenging to find new talent, as people are inclined to seek more flexible jobs, and salaries have become more competitive. You’ll need ample time to find new talent and train new hires.

Training staff to prepare for the season: Whether newly hired or seasoned, all collectors should receive the appropriate training before the beginning of tax season. All training materials should be easily accessible, focusing on the challenges and skills specific to this time of the year.

Updating the agency’s compliance management system: Every agency should have a compliance management system — often found within the collections management software. This system is used to store and organize the current laws and regulations of the ARM industry. Before tax season begins, the agency’s compliance officer or manager should ensure that the system is up to date with the latest regulations, including state laws; outdated regulations should be removed. Additionally, this system should be easy to access and browse for collectors.

Planning a successful settlement campaign: The surge in collection volume encourages some agencies to offer small discounts for a limited time; other agencies take it to the next level by planning a wide-scale settlement campaign. For a settlement campaign, the agency focuses on a specific group of accounts, typically consumers with higher recovery rates and debt whose age falls within a specific timeframe. If the agency services third-party debt, then it also must coordinate the campaign with the original creditors. Executives must decide what balance reduction they are going to offer those consumers and the running time of the campaign. The entire process can make the agency extremely busy, and things are likely to get hectic for the collectors on the floor.

How Voice AI Can Make Your Life Easier During Tax Season

Voice AI, the technology behind voicebots, has become one of the favorite automation technologies in the accounts receivables industry. Voice AI enables collection agencies to automate collection calls, both inbound and outbound, making it much easier for executives to scale their collection campaigns without the need to hire additional or seasonal agents.

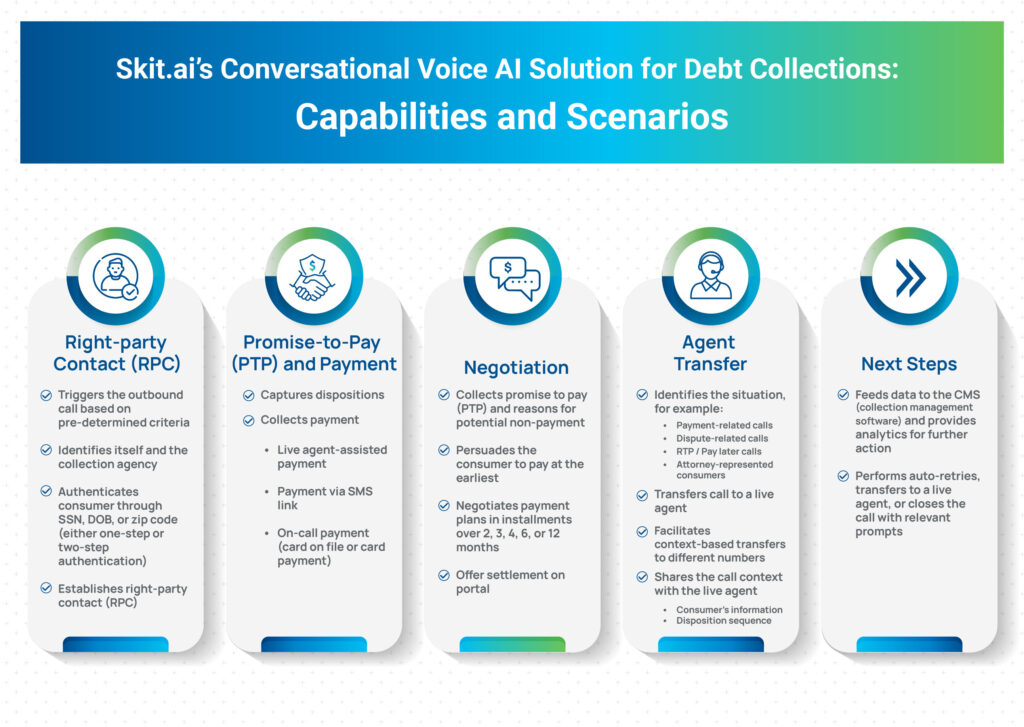

Skit.ai’s Voice AI solution initiates thousands of calls to consumers within minutes, establishes right-party contact, reminds them of the outstanding balance, and encourages them to make a payment or captures promise-to-pay. The solution easily transfers calls to your live agents so they can speak to the most engaged consumers and collect payments on-call.

It’s important to note that Voice AI is not IVR (interactive voice response), an outdated and unpopular solution commonly used in customer service. Unlike IVR, Voice AI can handle intelligent, two-way conversations with consumers.

Call automation with Voice AI is transforming collections across the board, as it enables collection agencies to handle many more accounts simultaneously, recovering payments at a fraction of the cost. Additionally, this technology augments the work of live collectors, who are empowered to handle more complex cases and focus on more revenue-generating tasks; whenever agents get a transfer from Voice AI, they receive the context on the consumer’s previous interaction with the voicebot in real time.

While this technology is helpful all year round, during tax season it becomes particularly essential. Here’s why:

Make it super easy for consumers to pay. Any roadblock in the payment process can significantly hinder the recovery of the debt. That’s why customer experience plays an important role, and making the payment as easy and frictionless as possible is a priority for your agency. Voice AI makes the process smooth and pleasant for consumers.

No need to hire additional collectors during tax season: Voice AI enables executives and managers to scale their operations, without the need to hire additional collectors during this busy season. This way, they can continue to rely on their trusted team and get the extra help they need from the Digital Voice Agents, who are unlimited in number and can handle thousands of calls simultaneously. Collections with Voice AI are significantly cheaper; additionally, voicebots don’t take any commission!

Fewer concerns about compliance thanks to Voice AI: Executives can worry less about complying with laws and regulations since the solution is fully trained to comply with regulations at the state and federal levels. Unlike live collectors, the automated agent is always compliant and does not go off script.

Execute a smooth settlement campaign at scale: With Voice AI, collection agencies can execute a settlement campaign at scale, reaching thousands of consumers in a very short amount of time to offer the settlement and collect the payments.

When Should You Start Preparing for Tax Season?

While it’s never too early to get started, we see many agencies evaluate partners and vendors before Thanksgiving, just as the holiday season approaches and many U.S. residents are known to use their credit cards for holiday spending.

However, make no mistake: it’s also never too late! At Skit.ai, we pride ourselves on our fast and efficient implementation process. From the moment you adopt our Voice AI solution, you can go live and start using the platform in as little as 48 hours.

Are you ready to take the next step toward call automation with Conversational AI? Schedule a free demo with one of our experts using the chat tool below!