“Mr. Watson – Come here – I want to see you,”

said Alexander Grahambell for the first time ever on the telephone.

And the world has never been the same again.

Speech-tech intersection has always been and will be revolutionary. Why? Maybe because speech is hardwired into our DNA and is one of our most natural, intuitive ways of communication.

While text largely connects humans and tech at present, it is very different—and in many ways, premeditated and poker-faced—extension of communication when compared to its primal, spontaneous counterpart – speech. The coming together of our most basic natures and tech, our most advanced pursuits, seems inevitable (and utterly exciting, of course!). Speech tech is key to opening the doors of accessibility for machines, complete with their own unique strengths, to truly be part of functional human ecosystems of interactions.

Understandably, with this kind of scope, Voice AI has made incredible strides in the last decade and continues to grow. True to AI’s brilliance, it is also further fueled by that very growth and is getting better and more human-like everyday, driven by advancements in Machine Learning, Data Science and NLP.

Which brings us to a question though – Is becoming as ‘human’ as possible the end goal for Voice AI? If not, what is? Existential ponderings aside, our exploration of the potential value of Voice AI led us to something that could empower human interactions, make them more meaningful and not replace but augment the human workforce. We call it Augmented Voice Intelligence.

What is Augmented Voice Intelligence?

At Skit, we have always worked with the belief that AI could evolve to seamlessly plug into businesses and augment the work of the human workforce. With the goal being smooth conversations that solve problems, technology has to clear hurdles, not create new ones. It cannot be achieved with a platform that handles every channel out there with the same underlying technology. It cannot be achieved with a solution that’s simply a chatbot with speech engines duct-taped to it. And it cannot be handled as mere voice commands, with no orientation to the nuances of conversational speech. If an enterprise wants to provide the best experience in every voice touchpoint, in every call, they need to invest in a solution that was purpose-built to handle conversations.

Rather than replace humans by doing what they do better, we wanted to intercept cognitively routine tasks and allow humans to focus on more intricate challenges. Our technology stack has also fast evolved to meet this vision, and out of it came the philosophy of Augmented Voice Intelligence. This is the new paradigm of expanding your workforce to combine the power of humans and AI. It is collaborative in nature—a collaborative effort in service of customers. Essentially, it is a purpose-built voice intelligence platform that is not just a point solution, but a system that integrates with businesses to make the most out of every single conversation. It is flexible, scalable and very versatile.

What Does it Mean for CX and Business Transformations?

Businesses today understand that how they deliver to customers is just as important as what they deliver. The focus is more on customer experience over just customer service; journeys over just touchpoints. Conversations are becoming more powerful than ever. Similarly, customers are also viewing their engagement with brands as end-to-end experiences rather than separate interactions.

At Skit, we took it up a notch higher with Augmented Voice Intelligence and have been working on layering just the right solutions for businesses to enhance not just customer experience but overall business experience and employee experience too.

Particularly within customer service, Augmented Voice Intelligence is here to set new standards for user-agent interactions and exponentially widen the scope of value-creation for businesses.

How Does Augmented Voice Intelligence Work?

While Augmented Voice Intelligence opens up endless possibilities across domains, our primary focus has been within contact centres. The biggest pain point call centers have today is creating smooth IVR experiences (the unending frustrations of which need no introductions). Customers, who are likely to be calling with an issue at hand, are frustrated handling the long menus with confusing options. They lack a direct way to reach a human agent.

From an agent’s perspective, IVR often doesn’t route the right kind of calls to the right agent. When the agent receives the call, there is a lack of context and the customer has to repeat themselves all over again. The more complex the calls become, the bigger impact it has on the business as well. Instead of maximizing on customer conversations, businesses end up struggling to resolve basic issues.

The Skit Solution : Augment human workforce with digital intelligence

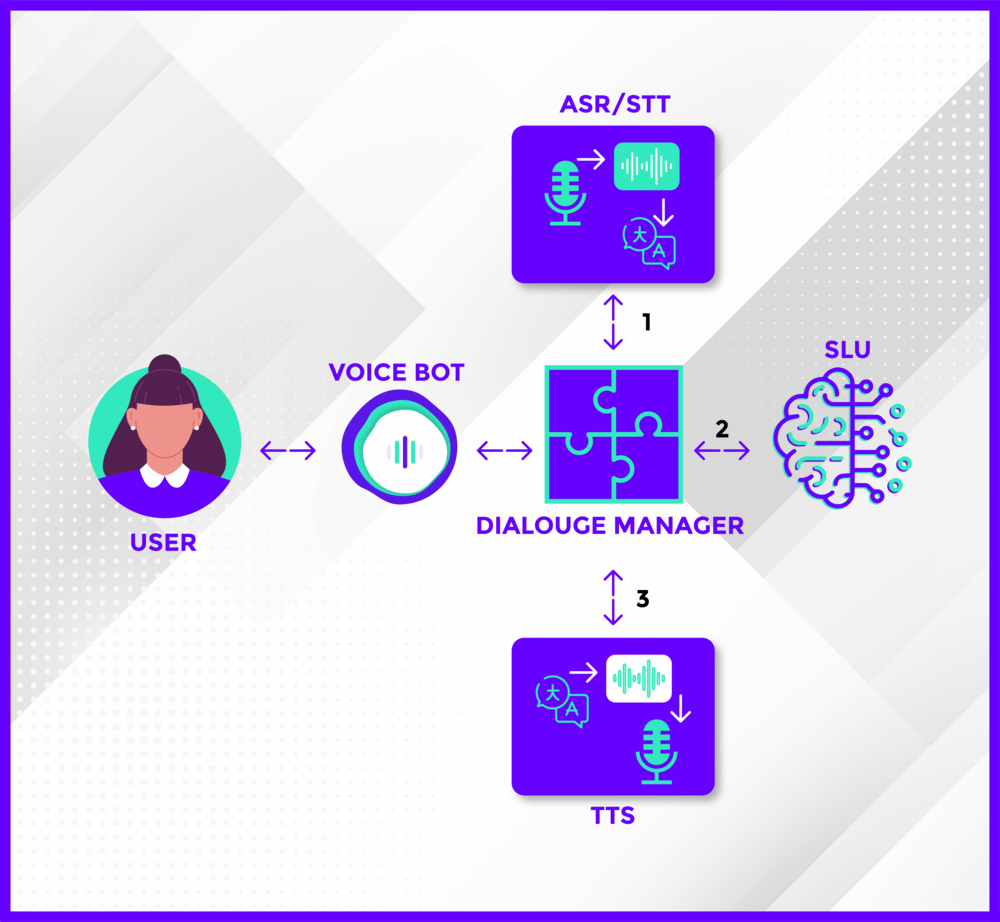

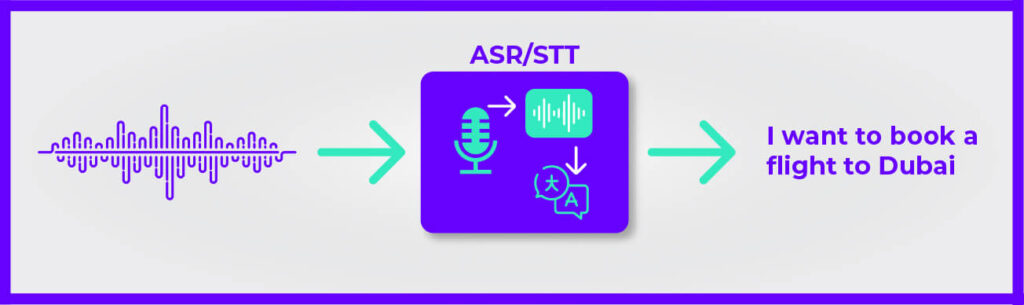

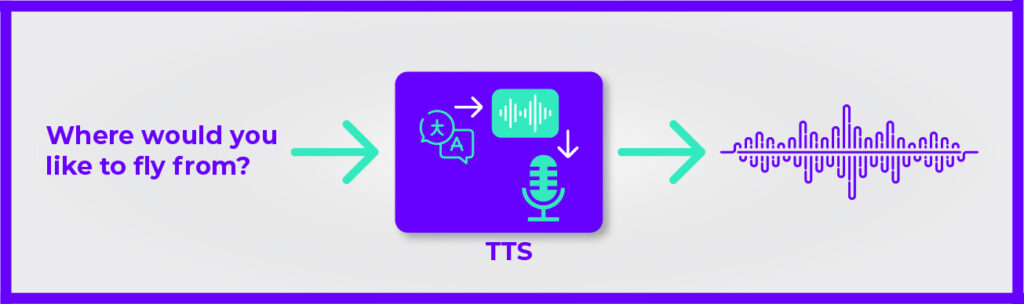

Towards our vision of building tech that entwines human interactions, we designed and built a Digital Voice Agent that resolves tier 1 customer service issues, and automates cognitively routine work while human agents can focus on more complex customer problems.

The Digital Voice Agent works in a custom-built environment of conversation design that is modeled on the nuances of human interactions, vertical, domain-specific Voice AI, and integrated business logic that lends direction. This enables contact centres to provide a seamless experience to customers and employees alike while also taking care of scaling and efficiency issues and optimizing costs.

Machines are not superhuman, neither are humans inferior to machines. Rather than one replacing the other, the future will be defined by human-AI partnerships. With Augmented Voice Intelligence, that path has opened up to a very promising start for us here at Skit.

So now, what else does Augmented Voice Intelligence have to offer? How can we make it better? What other businesses can it impact? Well, we are exploring every single day as we dream of the perfect friendship between humans and machines.