Voice-first platforms are here to stay and without doubt, they will play an important role in accelerating the adoption of technology across personal and commercial spheres. Users are growing increasingly comfortable with voice-first platforms as they are much more hassle free when compared to traditional written modes of communication, and this is reflected in consumer behaviour across industries.

Data from OC&C Strategy Consultants shows that voice-shopping is expected to jump to $40 billion by 2022 from $2 billion in 2018, suggesting that voice-first platforms might be the next disruptive force in the retail industry.

Voice-activated virtual assistants like Siri or Cortana have become an integral part of our daily lives and enterprises have started implementing Voice AI platforms for enhancing business processes.

There have been several recent breakthroughs in the field of Spoken Language Understanding (SLU) and this has enabled the rise of SLU-enabled Voice AI platforms that are capable of holding seamless human-like conversations.

One of the industry sectors that illustrates a supremely successful use case for intelligent virtual assistants is the field of customer service.

“…businesses across industries are also aware of this on-going shift in the technology and customer behavior. In fact, many have already begun their voice journey and are transforming the way how customers interact with their brand.” (Trantor Inc)

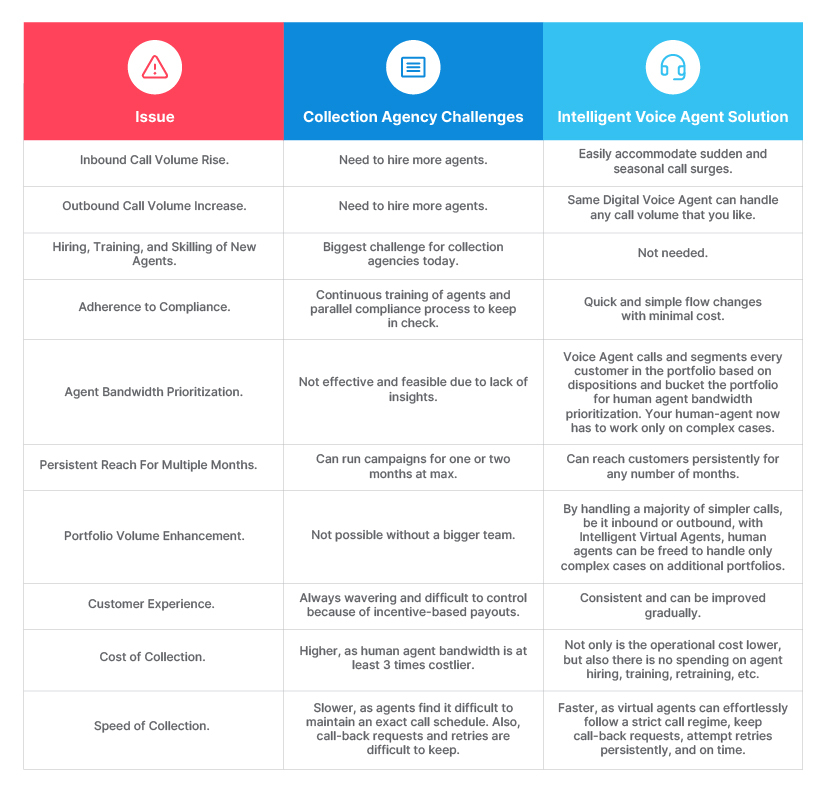

With an increasing base of digital consumers worldwide, contact centers have been reeling under the pressure of ensuring good customer service while efficiently handling the immense call load that contact centers face. This has led to the adoption of Voice AI platforms for contact center automation- and advances in SLU have allowed such voice assistants to turn into quality customer service agents.

Here is how SLU-enabled voice AI platforms deliver superior customer experiences:

Increased Ease of Usage

Since the beginning of human history, voice has been the primary mode of communication for people and has been around for much longer than written communication systems. It is no surprise that humans tend to be “voice-activated” naturally and find it much easier to interact with technology through voice commands.

Now, with rapid progress in AI-enabled speech-to-text and text-to-speech services, seamless voice-driven customer experience is a reality. As the ecosystem around voice enabled technology matures, customers are starting to rely more on voice. (PwC)

SLU has helped the development of such voice-first platforms, allowing your customers to easily connect with virtual assistant platforms in your contact center.

Such platforms do not require your customers to trudge through the interminable IVR options, enabling them to easily express their concerns or queries in simple spoken language statements, leaving your customers happy about their experience with your brand.

Understanding the Customer

Spoken Language Understanding has taken voice AI to a new level with the ability to simulate a near-human understanding of speech by such platforms. SLU-enabled platforms don’t merely react to a fixed set of commands but rather use various techniques and algorithms to arrive at the true purpose of the customer in making the call.

- Intent Recognition– No matter how customers frame their queries and statements, intent recognition algorithms are able to decipher the customer’s intent at one go using keywords or action words, without requiring multiple clarification from customers.

- Named Entity Recognition– These algorithms extract important information from the customer’s speech to recognize important names, places or times that the customer talks about.

All these SLU techniques have enabled voicebots to easily achieve human-like “understanding” capability that allows them to easily converse with the customer, eliminating the machine-like qualities from a conversation.

Innovation in voice technology is reshaping consumer behaviour and brands need to pursue creative approaches to accelerate the adoption of Voice AI to align with customer expectations and maintain a competitive edge

Quick Query Resolution

In a world where each second matters, time is of the essence – for you and your customers. If they spend precious time on hold with your contact center while agents are busy, it can only be expected that customers will get frustrated with their experience and shift their loyalties to other competitors.

SLU enables voice AI platforms, which act as virtual agents, to easily access the required information from databases and respond quickly to customer queries. Intelligent solutions like Skit’s Digital Voice Agent have been shown to result in a 50% reduction in average handling time in contact centers.

A Zendesk Research Survey discovered that 69% of respondents associated good customer service experience with a quick resolution of their issue.

This will result in improved customer satisfaction and increased customer retention rates, translating into increased revenues and goodwill for your enterprise.

Consistent Service Experiences

Every time customers engage with your brand, they develop an opinion about the brand. To ensure that the impression your brand gives to consumers is excellent, consistency is key. No matter when and where your customers approach the contact center, their service experience needs to be consistent.

According to Forbes, 71% customers desire a consistent experience across any channel, but only 29% receive it. About 76% receive conflicting answers to the same questions from different agents which leads to loss of customer confidence.

Advances in SLU have enabled voice AI platforms to maintain a uniform dialog flow across the board in all customer interactions. From a standard welcome greeting to the last goodbye, everything progresses in a pre-planned flow which gives customers a sense of stability and familiarity. Every time they get in touch with your contact center, they know exactly what to do and how to do it.

Customers will come to trust your brand as the reliable option and will increasingly engage with your enterprise and not your less-consistent competitors.

There are, thus, several ways in which SLU has enabled voice bots to deliver superior customer experiences that keep your customers pleased and induce loyalty in them.

Keeping customers happy not only helps enterprises increase customer retention, but also helps reduce customer acquisition costs by increased word of mouth marketing and recommendations from loyal customers.