Skit.ai’s Augmented Voice AI Platform is now powered by Generative AI. With the incorporation of Generative AI, we are taking a giant step forward and boosting the capabilities of our Conversational Voice AI solution. The interactions with consumers are about to become more natural-sounding and complex, leading to an improvement in customer experience (CX) and better results for collection agencies using Voice AI.

At Skit.ai, we embrace the future and go beyond industry standards and expectations.

How Generative AI Impacts the Capabilities of Skit.ai’s Augmented Voice Intelligence Platform

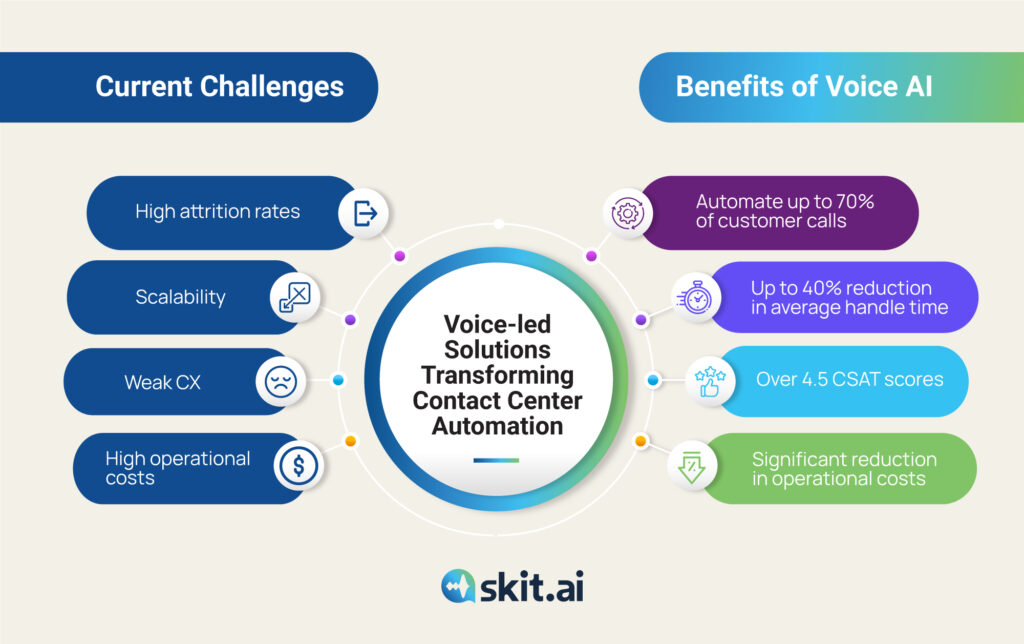

With the ongoing application of large language models (LLMs), we are seeing a big jump in the conversational capabilities of our solution:

Higher Conversational Accuracy: LLMs are capable of understanding consumer interactions through an improved understanding of context, sentence parsing, and response accuracy, leading to significantly higher conversational accuracy.

Better Handling of Complex Conversations: Generative AI enables our voicebots to better handle more complex interactions that were earlier escalated to human agents. This improvement can reduce the percentage of call transfers from the Voice AI solution to the company’s human agents.

Out-of-scope Calls: The LLM’s ability to grasp a wide range of questions and topics enables our voicebots to better handle out-of-scope utterances and calls.

Natural Utterances: The Voice AI solution is able to express a wide variety of natural-sounding utterances that improve the quality of the interaction.

Faster Voicebot Creation: Incorporating Generative AI give a big boost to the speed at which new voicebots can be created as the inherent complexity and effort involved in the design, and creation is a fraction of earlier effort.

Massive Performance Gains with Generative AI Springboard

In addition to the massive gains we are seeing thanks to LLMs, we intend to take this exercise even further and enable our voicebots to outperform human agents and collectors.

Going Beyond Human Agent Performance

An agent’s performance rests on two things: the ability to communicate and technical skills. At Skit.ai, we’ve seen that, with current LLMs, we can achieve superlative communication skills, and by training extensively with end-user data, we can achieve a high degree of technical skills. Hence our solution can excel on both fronts.

To share a rough estimate: the best-performing agent finds success on 5% of the calls (out of all connected calls), while low performers convert about 2% of the calls.

With Generative AI, we take a big jump. From the current voicebot conversion capability of around 1-2%, we expect the performance to jump 3-4 folds. Beyond this, our Reinforcement Learning platform learns from outcomes to personalize the conversation to figure out the ideal strategies, learning from thousands of daily conversations.

Better and More Natural Spoken Conversations

Generative AI, with its unparalleled conversational capabilities, needs to be complemented with equally capable speech synthesis and understanding systems that produce the right speech given the output from LLMs. And that is one of the major areas from the many below:

- A more natural-sounding TTS (text-to-speech) voice

- Conversational context handling prosody of generated audio

- Full duplex and backchannels in speech conversations

Ultimately, we will be able to deliver the most engaging conversations that delight consumers by solving their problems faster and better than human agents.

The Business Outcomes of Incorporating Generative AI

Below are five major impact areas we will move the needle on:

Higher Collection Rate, ~5%: This is a difficult number to quantify, but as the incorporation of Generative AI matures, we expect its collection capability to move beyond 5%, surpassing even the best of human agents.

Lower Agent Dependency, reduction by 50-80%: As the voicebot will be able to handle more complex queries, we expect a 50-80% reduction in agent touch points.

Higher Resolution Rate, ~100%: Better accuracy and conversations with higher engagement will help us achieve a conversational resolution rate close to 100%.

Creating New Voicebots: The effort to create new voicebots will see a significant dip, as the complexity will be remarkably lower.

Entering New Markets with Ease, 15X faster: Entering new markets and training for new use cases and applications will require less effort and resources. We are estimating the process to be 15X faster.

What’s Next

Though the improvements in our Augmented Voice Intelligent Platform are visible and clear, we will further our efforts to achieve greater performance gains and stay ahead of the curve.

To learn more about how Voice AI can help support your collection efforts through call automation, schedule a call with one of our experts using the chat tool below.