What Are Connect Rate and Right-Party Contact (RPC)?

Making contact with the right consumer—right-party contact—is crucial for debt collection agencies, but it’s often more challenging than it seems. One might think a simple phone call is all it takes to speak to the consumer who owes the debt; but oftentimes, the phone number is wrong, the consumer does not answer the phone, or the wrong person picks up the phone, leading to wasted time and resources.

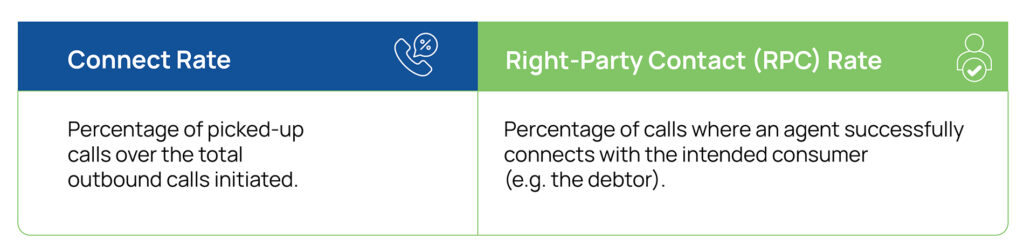

Connect rates and right-party contact rates are two metrics that significantly affect the outbound contact operations of a collection agency. What are these metrics?

The connect rate measures the percentage of calls that are picked up over the total outbound calls initiated. The right-party contact rate is the percentage of calls where an agent is able to connect with the target consumer, which could be either the debtor or a relative who has been given permission to handle the debt, as opposed to reaching the wrong person (wrong-party contact) or leaving a message.

Right-party contact (RPC) is the most accurate measure of the effectiveness of an agency’s outbound calling efforts.

In this article, we will explore how Conversational AI technology in its various forms can efficiently automate right-party contact verification, leading to significant time and cost savings for collection agencies.

Why Right-Party Contact Can Be a Challenge for Collection Agencies

Collectors know it very well: reaching consumers can be tricky.

Given the limitations imposed by local regulations—such as the TCPA and the FDCPA in the U.S. and Canada’s Key Unsolicited Telecommunications Rules—collectors can’t call debtors at any given time of the day. While timing is everything, even a well-staffed agency can only contact consumers so many times in order to reach them, as the number of available collectors is limited and you don’t want them to spend too much time trying to reach the same numbers too often.

Right-party contact can be a serious challenge for collection agencies. Collectors (and their managers) want to spend as much time as possible actually speaking to consumers and collecting payments — and as little time as possible trying to reach people on the phone. Calls not resulting in RPC don’t lead to a collection and result in an overall waste of resources.

This is where automation and artificial intelligence come into play.

How Conversational Voice AI Solves the RPC Issue for ARM Companies

With shrinking margins, high attrition rates, high inflation, and an overall competitive landscape, accounts receivables companies performing collections are looking at digital transformation and automation as valid solutions to their operational challenges.

Contact centers in all industries have been relying on automatic dialing systems (or auto dialer software) for decades. These systems make the dialing process faster and easier, boosting agent productivity; in addition to queueing calls and dialing the target number automatically, they also screen out inactive numbers, busy lines, and answering machines, drastically improving the contact center’s connect rate.

But what about right-party contact?

Once the collector reaches a consumer on the phone, they must establish whether the person they are speaking to is the right party (the consumer or debtor) or not. The right party could also be a third party (a person authorized to handle the debt or an attorney representing the debtor). This process can take a few minutes.

A Conversational AI solution can handle the actual call — rather than just the dialing process — and interact directly with the consumer, easily verifying their identity.

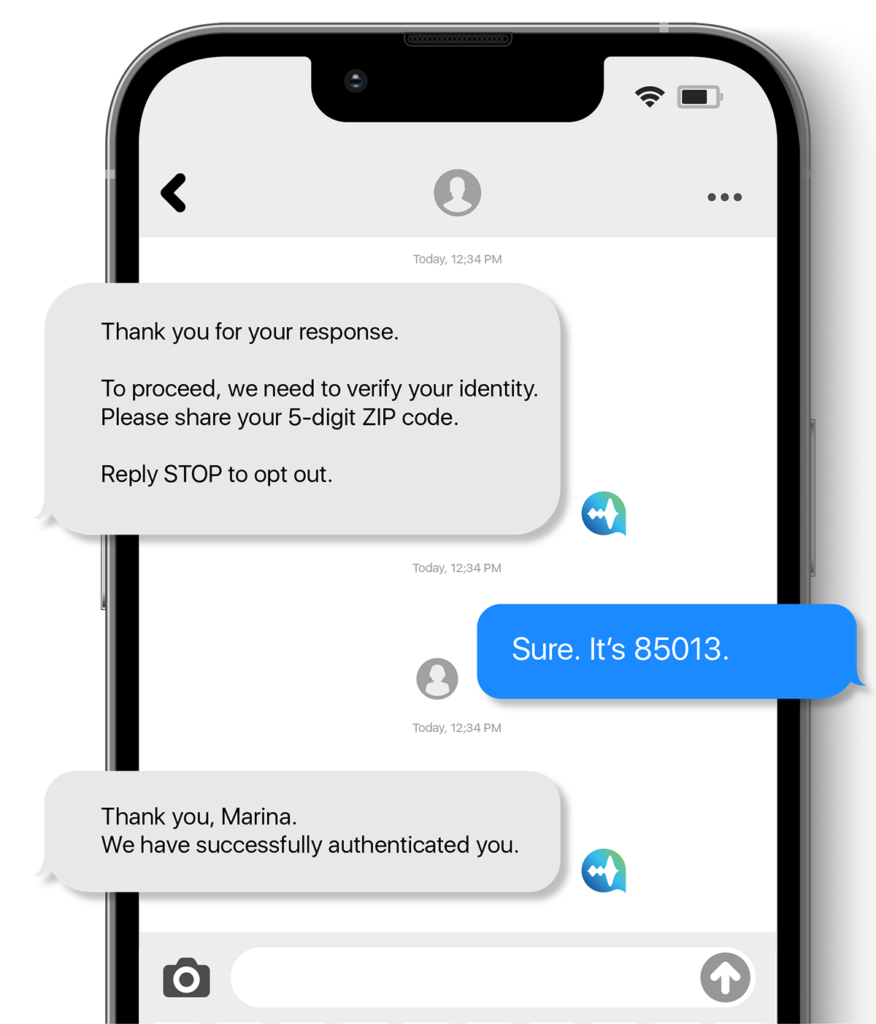

Once the consumer picks up the phone, the virtual agent confirms right-party contact and authenticates the consumer through their zip code, date of birth, or the last four digits of their social security number. Once the authentication is complete, the solution engages with the debtor, offering ways to pay off their debt. If needed, the solution will negotiate a payment plan or transfer the call to a live agent.

The entire process is faster and cheaper, allowing the collection agency to save on resources. It also enables live agents to focus on more complex calls and engage with consumers who are already authenticated.

You Can Automate RPCs Across All Communication Channels

Nowadays, consumers prefer to interact with businesses through various communication channels. It’s become essential for financial services institutions to offer multiple channels, such as text messaging (SMS), chat, and email, in addition to traditional phone calls.

A Multichannel Conversational AI solution can establish RPCs via any channel. As you can see in the graphic below, Skit.ai’s SMS bot establishes RPC via text message:

Are you interested in learning more about how Conversational AI can streamline your collection strategy? Schedule a free demo with one of our experts.