Over the past year, debt collection agencies have started using Conversational AI as part of their AI adoption strategy to enhance their collection processes. Early adopters have already seen significant benefits from adopting this technology.

Recently, there has been a substantial advancement in the AI industry with the introduction of large language models (LLMs). These models and Generative AI-powered communications are enabling businesses to leverage Conversational AI solutions for even more strategic, personalized interactions with consumers.

This new approach to consumer communication stems from the need for a more focused and optimized collection strategy tailored to each account. By personalizing strategies based on an account’s payment and response behavior, agencies can achieve maximum results with minimal input. This strategy also guides agencies on which channels to use and the optimal times of day for engagement.

Multichannel Conversational AI platform powered by Generative AI represents the next significant leap for the collection industry. In this blog post, we’ll explore how this technology is evolving and how collections can benefit from these advancements.

How is Conversational AI Changing Debt Collections Forever?

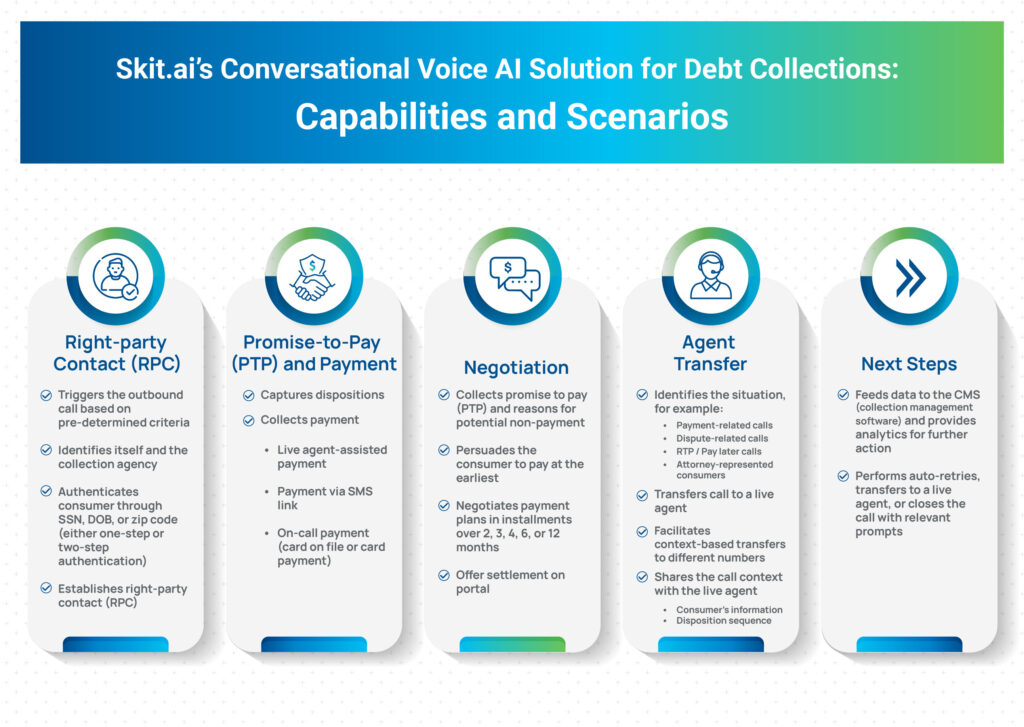

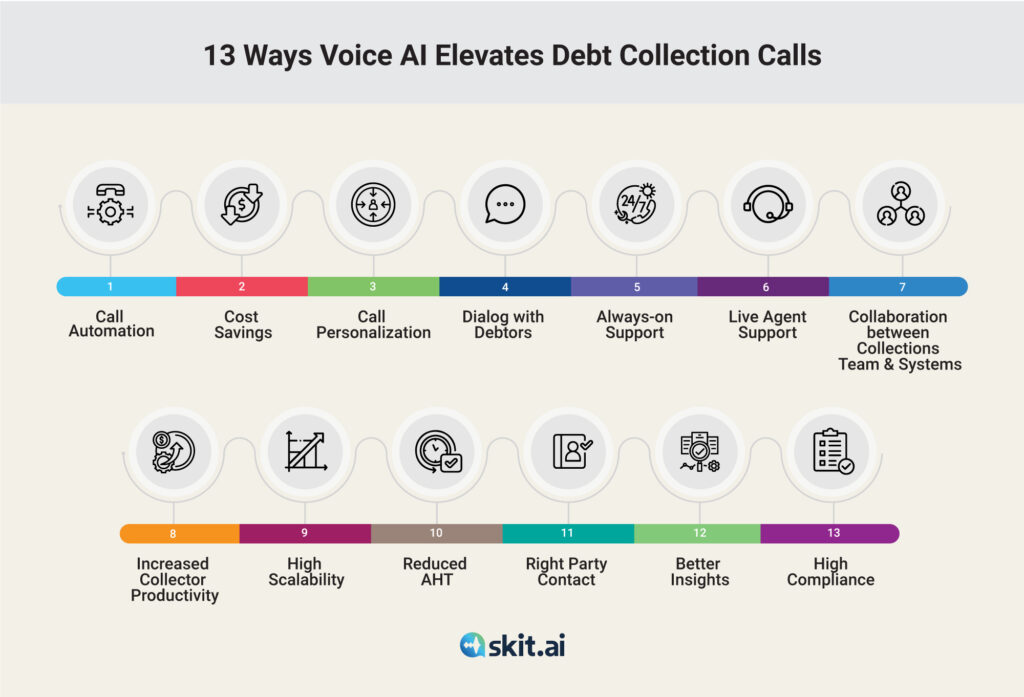

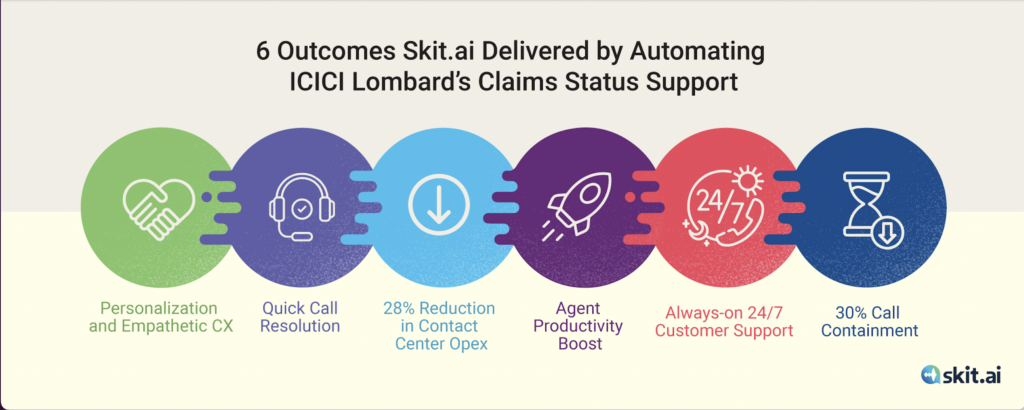

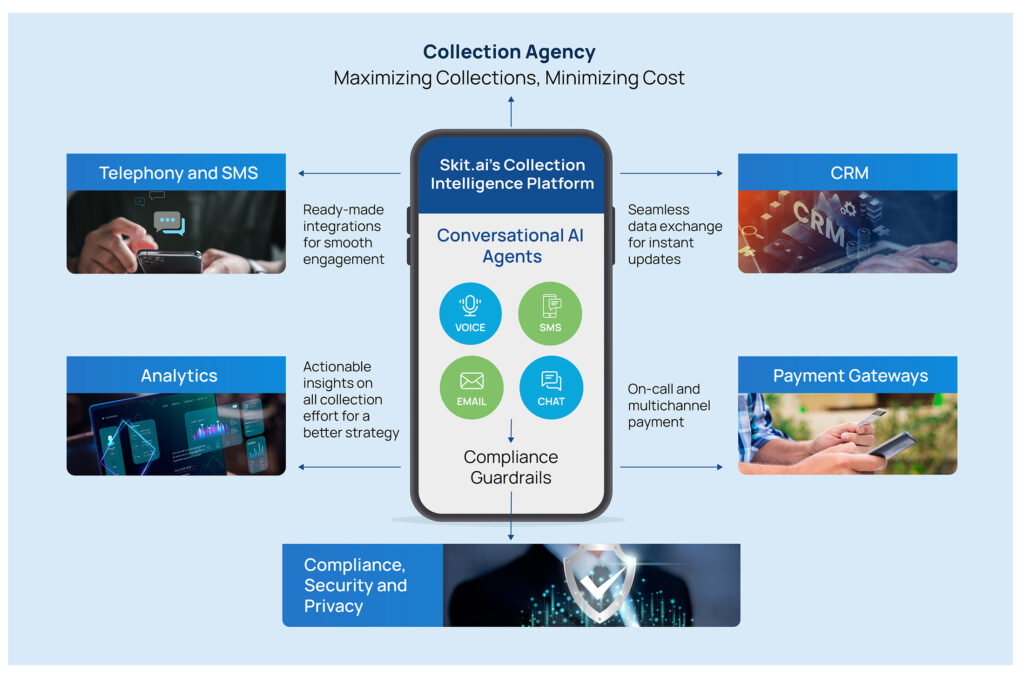

Improved Collections with Enhanced CX: Creditors and collection agencies can increase contact rates and engagement levels by leveraging multiple communication channels. This improved communication strategy, in turn, fosters a positive customer experience, as debtors receive timely responses and can resolve their accounts more easily. Enhanced customer experience facilitates debt resolution and strengthens the agency’s reputation and strategic relationships.

Analytics for Optimized Scalable Outreach: With GenAI-powered communications, collection agencies can engage with consumers at scale using a strategy tailored to each account’s payment and engagement history. This approach guides agencies and creditors on the optimal channel and time of day for engagement.

Contextual Conversations Across Channels: Multichannel communications enable collection agencies to interact with consumers through various channels such as voice, SMS/text, and email. More importantly, with Multichannel Conversational AI, agencies and creditors can maintain context across all channels, ensuring consistent and coherent communication.

Compliance and Risk Mitigation: Utilizing a multichannel approach for debt collection not only promotes efficiency and effectiveness but also helps businesses comply with evolving regulations in a fast-changing industry. Every communication is documented and traceable and remains within regulatory limits with centralized consumer interactions.

Agencies can stay compliant in many ways with the multichannel approach for communication with consumers. For instance, the 7-in-7 rule mandates that debt collectors cannot contact consumers more than seven times within seven consecutive days. Similarly, the Mini Miranda rule stipulates that collectors must disclose their identity and the purpose of their communication during contact.

Agencies can drive campaigns through various channels, stay compliant with these laws, or even efficiently track and regulate outreach frequencies with each consumer.

Managing Inbound Queries and Ensuring 24/7 Availability: Multichannel communication ensures that consumer queries are promptly addressed whenever they reach out, be it on weekends or after work hours. Whether it pertains to payments or other inquiries, AI software can answer consumer queries, ensuring zero wait times and seizing every collection opportunity. Chat options provide consumers with a self-serve menu, enabling them to address basic FAQs and clarify queries easily.

Cost of Collection: Multichannel Conversational AI significantly reduces the cost of collection by streamlining workflows, optimizing agent bandwidth, and minimizing manual intervention. By automating repetitive tasks and leveraging multiple communication channels, AI-driven software enhances operational efficiency and reduces overhead costs associated with debt collection processes.

Why You Should Consider Conversational AI

A Conversational AI platform comes with other remarkable benefits. Here are a few:

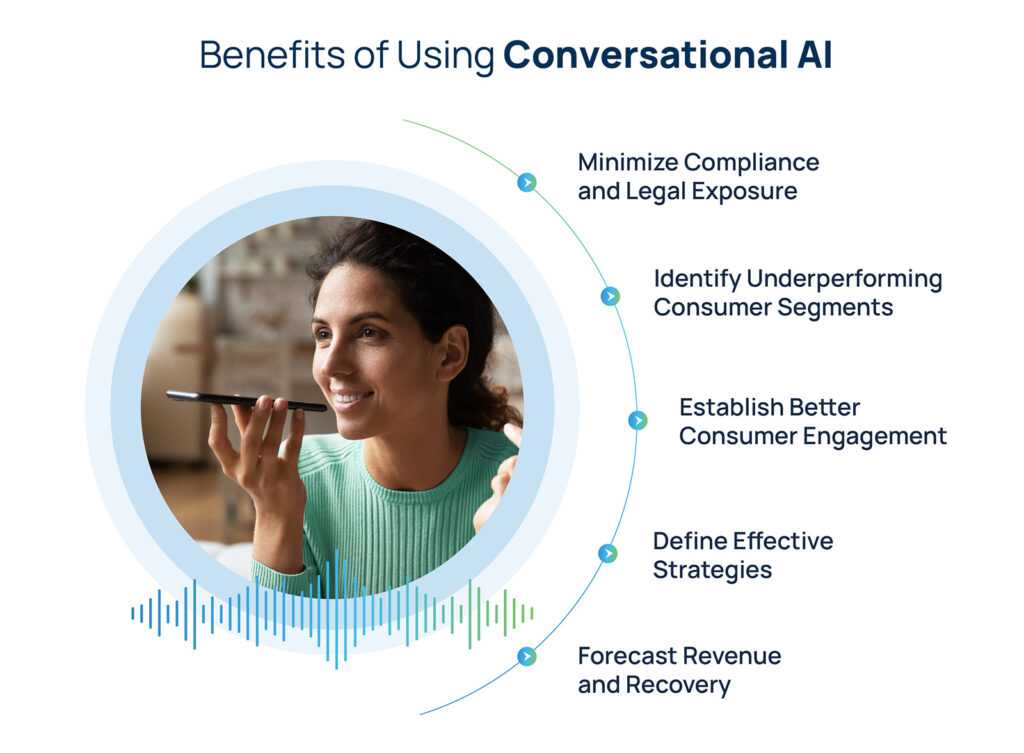

Minimize Compliance and Legal Exposure

Conversational AI has the potential to improve compliance and reduce the risk of legal issues for agencies. The debt collection space is heavily regulated, and collectors must follow strict compliance rules. With our Conversational AI platform, compliance rules and guidelines such as call frequency, the Mini-Miranda, and other important regulations — both at the federal and state levels — are built into the technology to ensure the Conversational AI solution follows them. Conversational AI never goes off-script and never has a bad day, protecting both the consumers and the agencies.

Identify Underperforming Consumer Segments

With a Conversational AI platform, agencies can balance outreach efforts more effectively by identifying which consumer segments are underperforming. This enables businesses to allocate resources where they can have the most impact, increasing overall collection efficiency.

Establish Better Consumer Engagement

Businesses can identify the optimal channels and times to reach consumers, enhancing engagement. By understanding consumer behavior and preferences, the Conversational AI platform ensures that outreach efforts are more likely to succeed, leading to higher collection rates.

Define Effective Strategies

The Conversational AI platform helps define optimal strategies for collection campaigns, whether through automation, human outreach, or a combination of both. This tailored approach ensures that each campaign is designed to maximize its effectiveness based on the specific needs and behaviors of the target audience.

Forecast Revenue and Recovery

The Conversational AI platform can accurately forecast revenue and recovery rates, helping agencies plan and budget more effectively. It also aids in reducing charge-offs by predicting which accounts are most likely to be collected and focusing efforts accordingly.

Unlock Unprecedented Automation

One of the main benefits of Conversational AI in debt collections is that it automates much of the manual work involved in the recovery process. Debt collectors can use AI to automate tasks such as calling consumers, sending out payment reminders, and recording consumer interactions. This saves time and allows collectors to focus on more complex tasks, such as negotiating payment plans and resolving disputes.

How to Choose the Right Conversational AI Platform for Your Company

Thanks to large language models (such as ChatGPT and Google’s Gemini), it’s never been this easy for Conversational AI providers to build new bots. Since these LLMs are available to all, conversational quality has become a simple function of cost.

Below are some of the things you want to consider when onboarding a Conversational AI platform for your collection operation:

The Conversational AI solution…

- Speaks to Your Customer Base: An essential criterion for a Conversational AI platform is that it needs to be able to talk to your customers. If your customers are primarily Spanish-speaking, for example, you need to ensure that your provider has the capabilities to cater to a multilingual customer base.

- Integrates to Existing Infrastructure: Personalization is crucial. Your AI provider needs to be able to integrate with your CRM platform, whether you are using Automaster or Dealersocket. Only then can it engage using your customer’s updated information. An integrated platform can also record details of customer interactions in CRM, removing a lot of agent effort.

- Processes Payments Securely: The platform needs to integrate with your payment gateway and secure sensitive transaction information to collect payments from customers. The provider should be able to integrate with standard payment gateways such as PayNearMe. You can verify transaction data safety by ensuring that they have PCI-DSS certification.

- Is Familiar with the Debt Collection Industry: A referral is always an excellent way to gain trust with the platform provider. You can always find out if your provider is working with any of your peers; either ask for feedback directly from your peers or ask the provider to arrange a reference call.

- Offers After-Sales Service: Just like when you purchase a car, it’s important to check if there is an after-sales service for your Conversational AI platform. Ask for SLAs to understand the response time in case of any issues. You should verify if a Customer Success team will be assigned to you. Arrange a regular meeting with the Customer Success team to help them understand your expectations.

- Provides a Timeline of Deployment: Before onboarding a vendor, explain your existing call center infrastructure (dialer, CRM, payment gateways) and ask for a timeline of deployment. It is critical to gauge any kind of IT effort or roadblocks to a seamless integration. Extended timelines and extensive IT effort increase costs and lead to loss of estimated value.

Make the Right Choice

Conversational AI technology is remarkable and has proven invaluable in our industry and beyond. With the widespread availability of LLMs, numerous companies are now offering GenAI-powered Conversational AI solutions with various marketing buzzwords.

However, for a collection agency, choosing the right Conversational AI vendor is crucial. They must carefully evaluate their options to gain a competitive edge and achieve tangible results within weeks.

Conversational AI platforms powered by LLMs and Generative AI is poised to change how collections are done in the modern world — don’t miss out!

Are you ready to take the next step toward call automation with Conversational AI? Schedule a free demo with one of our experts to learn more!