When you adopt a Conversational AI solution for your collection business, one of the first challenges is getting it to exchange information with your company’s customer relationship management (CRM) platform. In this article, we’ll explain how you can integrate Skit.ai’s solution with your CRM system using a robotic process automation (RPA) approach. This method can save you time and money while requiring minimal technical expertise.

The Importance of CRM Software for Collection Agencies

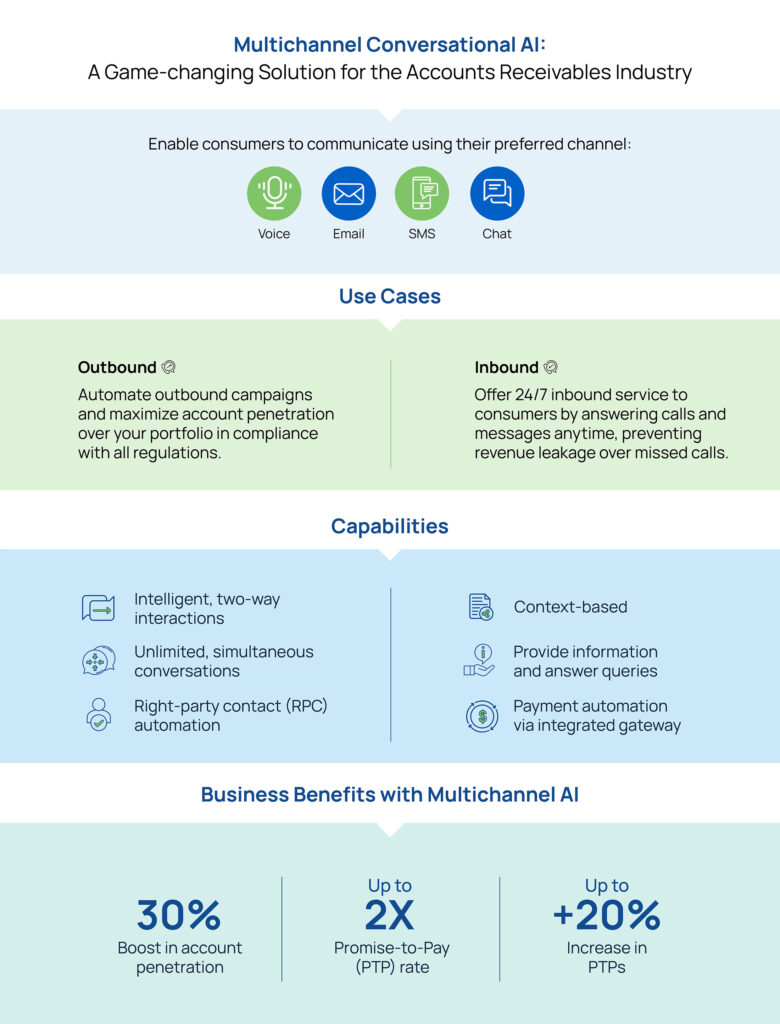

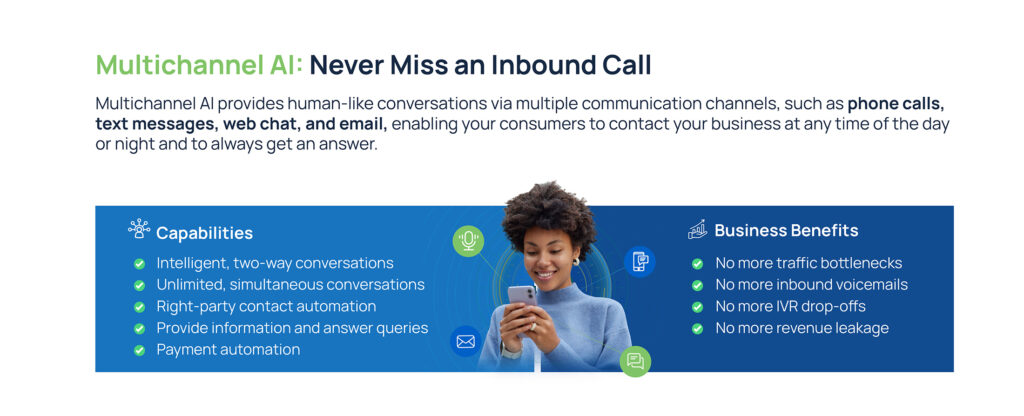

CRM software is essential to gather, organize, and manage your accounts’ information. The benefit of integrating your Conversational AI solution with your CRM system is to easily personalize calls and quickly fetch consumer data in order to achieve end-to-end automation.

Whether it’s an outbound call—and your bot is calling a consumer to collect payment—or an inbound call—in which a consumer may call to request information on their account—you’ll need the bot to have access to the data.

The Challenges of Achieving a Conversational AI & CRM Integration for Collection Agencies

Collection agencies that want to adopt Conversational AI have a options to give the solution access to their CRM data.

To get access to CRM data, flat-file transfers and middleware are two ways to avoid a complex integration requiring building new APIs. It’s important to note that flat-file and middleware are not considered actual integrations.

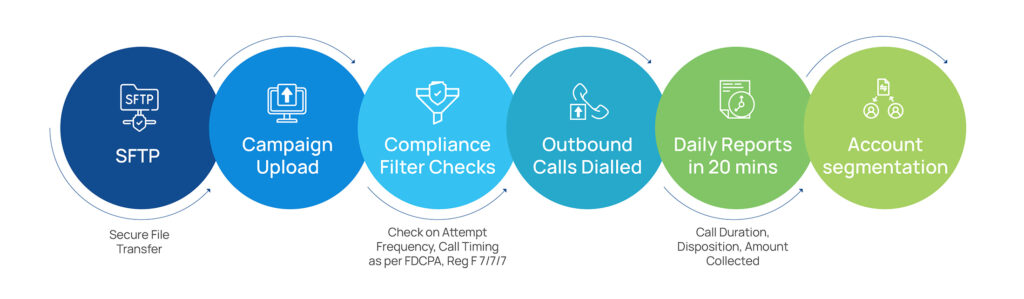

SFTP Flat-File Transfer:

- What it is: Campaign files are transferred directly from one system to the other—from the agency’s systems to the Skit.ai servers—usually via a Secure File Transfer Protocol (SFTP).

- The advantage of flat-file transfers: This approach is very simple to execute, especially for basic data exchanges, requiring no IT effort and resources.

- The disadvantage of flat-file transfers: This method does not provide real-time updates and is not automated, requiring the collection agency to handle file uploads on a regular basis.

Middleware Approach:

- What it is: The middleware approach enables the Conversational AI platform to access the collection business’ CRM platform and store its encrypted data in the platform’s database. Additionally, every time the AI solution handles an inbound call with a consumer, it creates an SFTP file on the call and then uploads it on the client’s server.

- The advantage of the middleware approach: It’s a more scalable solution and it’s good for inbound use cases, as it enables the Conversational AI solution to access consumer data.

- The disadvantage of the middleware approach: It requires setup and maintenance and does not provide real-time updates, as the transfers only occur at regular intervals (e.g., once a day). It also can’t be used for outbound use cases.

API Integration:

- What it is: An Application Programming Interface (API) enables different software applications (such as a CRM and a Conversational AI platform) to communicate with each other.

- The advantage of API: It allows the Conversational AI solution to seamlessly access CRM data in real-time and in a structured manner. The CRM is updated in real-time with the outcomes of each interaction. Another benefit is that once the API is built and implemented, no further manual intervention is needed.

- The disadvantage of API: APIs need to be available or custom-built, and they require programming expertise to implement and manage. CRM platforms usually don’t provide ready-made API integrations. This method requires a longer go-live timeline.

Due to the disadvantages of each method, we’ve adopted an alternative approach to solving this challenge.

What Is Robotic Process Automation (RPA)?

Robotic process automation (RPA) involves using bots to automate repetitive tasks and workflows by mimicking human actions to interact with systems and applications.

With RPA, the Conversational AI platform can automatically access a CRM without requiring an API setup. The collection business grants the bot access to the CRM platform and whitelists it to ensure that the server is recognized as secure. The RPA bot functions as a live agent, logging into the CRM system and interacting with it directly, without the need for integration.

This approach requires no IT effort on behalf of the collection business utilizing Conversational AI, resulting in significant cost savings.

How Does an RPA Bot Impact Debt Collection Use Cases?

An RPA bot with access to a collection agency’s CRM can do the following:

- Fetch account information such as due balance

- Update the CRM with promise-to-pay (PTP), payment date, and other outcomes

- Add notes to the CRM, e.g. reminder to call consumer on payment date

All this can be automated and executed without any human intervention.

The RPA method only works with cloud-based CRM platforms, such as Finvi, Collect!, and Debtrak. It does not work with on-premises CRMs, such as CollectOne, Debtmaster, Latitude, and Gcollect.

Curious to learn how Skit.ai can integrate with your existing CRM? Request a demo with one of our experts!