The rapid growth of the automotive finance market—CAGR of 6.5% [2022-2028] and the likelihood of reaching USD 385 bn with the rapid growth of 42 Billion in market size, indicates the opportunity ahead. But growth needs to be supported by resources, and the skilled workforce is the most scarce.

For decades auto financers have struggled with the shortage of skilled human support executives. Although various automation solutions helped them move closer to automating most of their workflows, it was far from getting realized.

With rapid advancements in voice technology by vertical Voice AI companies such as Skit.ai, we have reached a point of seamlessly automated customer conversations and significantly reduced the dependence on human agents.

We have deep-dived into various aspects of how Skit.ai’s voicebot impacts the Top and Bottom Line. In this piece, we will explore how Skit.ai’s AI-powered Digital Collections Agent will solve one of the most significant scalability problems arising from the skilled labor shortage.

The Challenge of Scalability and Seasonality in Auto Finance

Labor shortages and retaining a skilled workforce are big challenges in auto finance. Like other industries, the pandemic also affected automotive and finance companies, leading to employees’ reluctance to return to their jobs and re-evaluating their life priorities in the post-pandemic stage. As a result of the shortage of skilled human resources, the industry is riddled with the following:

- Higher cost of recruiting, training, and retaining good performers

- Inadequate debt portfolio coverage

- Higher cost of collections or recovery

- The limited scalability of the auto loan portfolio

- Overworked human collectors or agents might lead to compliance breaches

- The direct link between the auto loan recovery team and the number of accounts

- Also, seasonality is a significant issue. For ex., during festive seasons, most collectors or agents are on holiday, so keeping the show running during that phase becomes highly challenging.

In addition, collection agents face many challenges that make their job highly challenging. Here are a few core challenges the agents and companies face while trying to ensure the consumer gets back to the payment schedule:

Disengagement: High volume of dull, low-value, and repetitious calls make it challenging for the agents to be motivated and carry excitement while on the job. Simplistic calls about FAQs, wrong numbers, calls not picked up, call-back again requests, and more create zero value but consume a lot of time for agents. This monotony is at the core of their disengagement from work.

Recruitment and Training: Finding the right person for the job, training them regularly, and giving perks and incentives to retain their cost dearly to the auto financing companies. This cost and management issue can be thoroughly minimized with the deployment of Skit.ai’s voicebot.

Compliance Adherence: Debt, even secured ones like auto loans, come under a regulatory framework, and sometimes overworked agents tend to use coercion or not stick to regulatory restrictions, leading to litigations and non-compliance.

Inadequate Portfolio Coverage: Agent team and bandwidth are limited, and they need to optimize the ones with the maximum probability to pay, and thus others get ignored. This is a loss because a fraction of others will also pay if followed.

Handling Call Spikes: Seasonal fluctuations in calls, inbound or need for processing debt portfolio expeditely, needs seamless scalability else it is a missed opportunity that affects the performance of the auto financer. To have scalability, auto financers have to manage a bigger team of agents, which will be an enormous cost for them, hence an unfeasible alternative.

How Skit.ai’s Digital Collection Agent Solves Skilled Agent Shortage

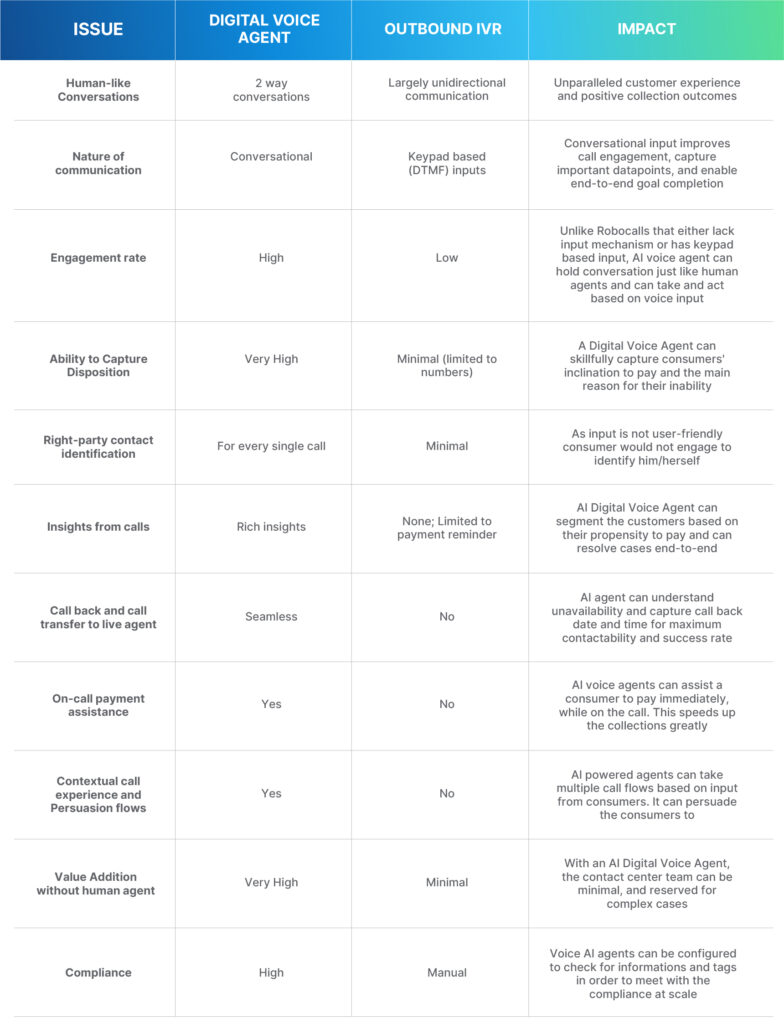

At present, tools at the disposal of auto financers involve dated technology such as IVRs, and telephony that can not decouple incoming calls from human agents. At best, the tech solutions just alleviate the core problem to the slightest.

Voice AI, the most cutting-edge voice technology, on the other hand, holds the most promise. There are various kinds of Voice AI solutions available in the market. Still, only voice-first Vertical Voice AI companies such as Skit.ai deliver voicebots that perform under the most testing of situations.

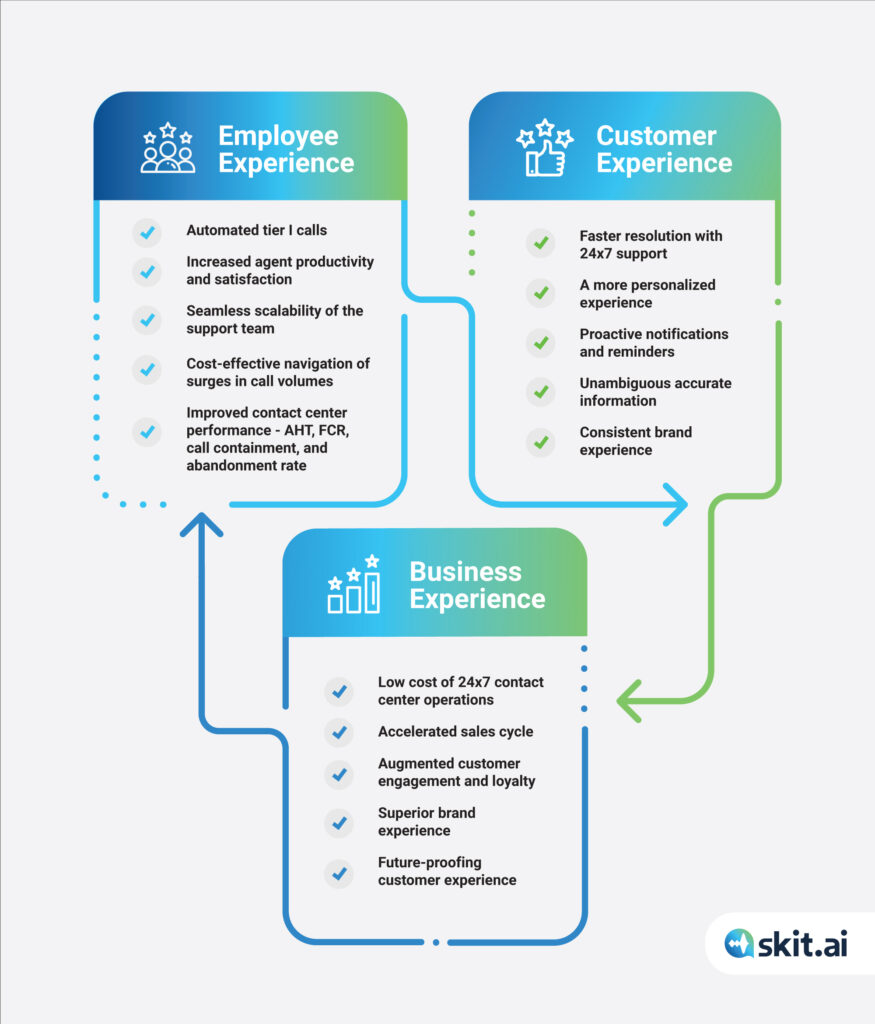

Here is how the Voicebot of Skit.ai empowers auto finance companies, solving 7 core challenges. You may also want to explore how Skit.ai’s Digital Collectors impact the top and bottom lines of auto finance companies.

As promised, let’s deep dive into how our voicebot will help your company solve the problem of a shortage of skilled human agents forever:

- End-to-End Automation: Our voicebot is extensively trained in the domain of collections and is capable of answering over 70% of customer queries without escalating them to the human agent. These simplistic queries are mostly a waste of human agent time, and when the customer expresses the willingness to pay, the voicebot can enable on-call payment.

- Potential for Much Higher Collections: Since the voicebot frees a significant amount of agent bandwidth, it can be used to process additional or new loan portfolios; thus, there is the possibility of a higher top line. In short, the same team of human agents can now deliver much higher collections revenue.

- Reduction in Average Handling Time: The shorter the calls escalated to a human agent, the more productive they will be. Skit.ai’s Digital Collection Agent collects relevant information such as:

- Seeks information to verify the identity of the consumer

- Captures the disposition or the problem

- Solves a part of the question and then escalates the complex part to the human agent

- Improves the accuracy of information divulged by the agent as it already furnishes factual information pulled from the CRM and other systems.

- Focus on Real Issues for Better Collections: The human agents can focus on the highest value and complex cases where they can use their expertise to troubleshoot and improve repayment rates.

- No Call Volume Spike for a Balanced Work-life: Since Skit.ai’s AI-powered voicebot can answer any volume of calls, and since the voicebot entirely answers a majority of them, the actual increase in the workload is a fraction of the total increase. This improves the quality of work in real terms.

- Lower Concerns for Compliance and Litigation: For auto finance companies that deploy Skit.ai’s voicebot, the possibility of entering into litigation is very low because

- For one, the voicebot does not go off script.

- The probability of a person filing a litigation being irked by a machine is very low. This is a big plus.

- Thus when the voicebot engages a majority of calls, the chances of litigation are negligible.

- Better Customer Relations: Customer relations are built on touch and connection. The human agents can use the voicebots to schedule interaction touchpoints that foster a deeper relationship. The result of this is better collections due to customer satisfaction.

Voicebot for Limiting Dependence on Human Agents

From the above list of unique benefits, it is clear that the voicebot, by answering a majority of calls and making outbound calls with end-to-end automation, reduces the dependence on human agents significantly.

Today, auto finance companies can deploy Skit.ai’s state-of-the-art voicebot in less than 45 minutes and see their collection outcomes improve within weeks, not months. Many debt collectors have realized our solution’s indispensability and gained a competitive leg up. It is time to change!

To learn more about how Voice AI can help support your human resources and scale their collection efforts with call automation, schedule a call with one of our experts or use the chat tool below.