Debt Collection and Positive CX: Is It an Oxymoron?

Discussing customer experience and debt collection in the same sentence might sound like an oxymoron: for most people, the experience of being reminded about an outstanding debt is not particularly thrilling. Yet, the fact that collection calls are not the most welcome calls a customer may receive does not mean their experience should be dry—even negative.

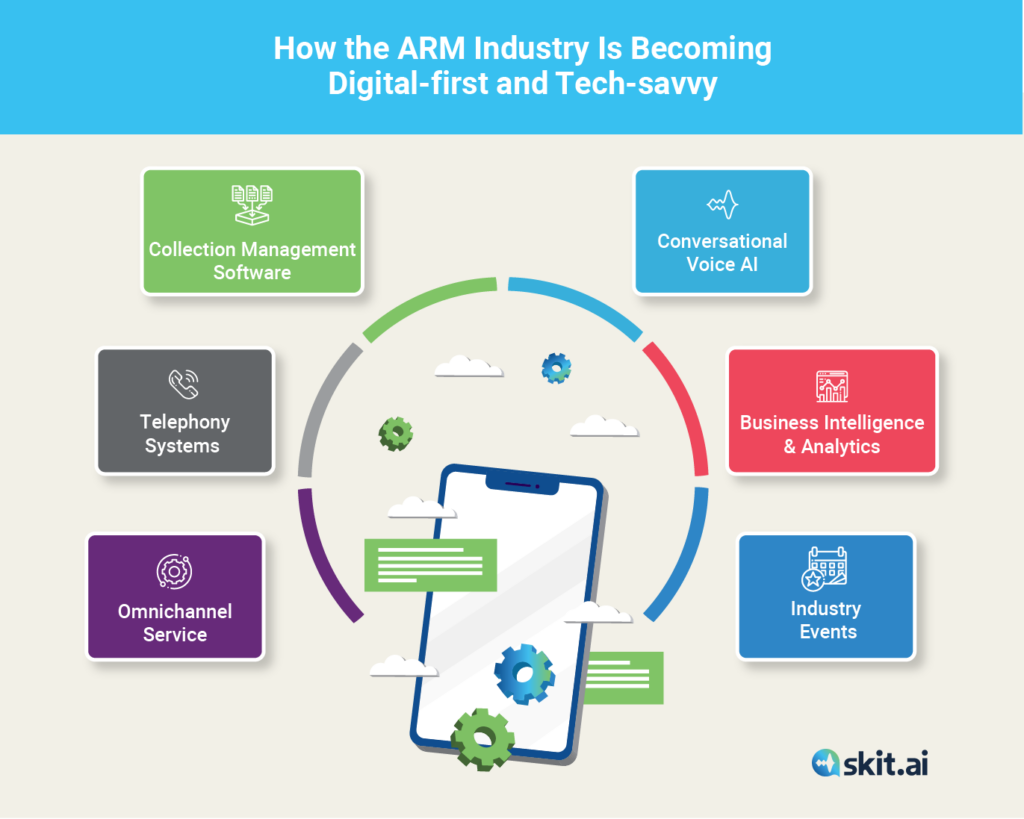

At Skit.ai, we offer an effective and easy-to-deploy conversational voice AI solution for the ARM industry. There are many ways to make the interaction between a user and a voice AI efficient, easy to navigate, and painless.

What is the role of Conversation User Experience (CUX) Design in fostering a positive customer experience (CX) in AI-powered debt collection calls? In this blog post, we’ll share the best practices we’ve adopted to enhance CX in our automated collection calls.

The Role of CUX Design in Improving the Customer Experience

When creating and configuring our conversational voice AI solution for collections, our designers prioritize three components, all of which are essential and will ultimately influence the customer experience when interacting with the voicebot: voice, verbiage, and interaction.

Voice is the audio component of the voicebot: Does it sound male or female? Young or old? What accent does it have? What’s the inflection of the voice? How does it sound—friendly, professional, clear, direct? How fast does it speak? Fast enough to keep the user engaged, but slow enough for the average user to understand? All these questions are taken into consideration when designing the voice AI solution. There are no correct answers, as different use cases and demographics require different characteristics.

Verbiage is the content of the voice AI’s communications during the call with the user. The aim is to make the voice AI solution speak in a natural language so that the interaction can flow smoothly and naturally. Designers take into account grammar, choices of terminology, and other utterances to ensure that the voicebot sounds natural.

Regarding terminology, designers usually seek to balance industry-specific jargon and simple terminology to accommodate users lacking the background and context around the call.

Voice and verbiage, paired together, contribute to creating the digital agent’s “Persona.” For example, that could be a 30-something-year-old female agent, with a confident yet empathetic voice, sounding efficient and eager to help the customer; she could have a midwestern accent and a friendly, yet professional attitude.

The interaction capability of the voice AI solution is the third key element that defines the user experience. This element is the voicebot’s ability to handle an effective back-and-forth with the user. Timing, here, is crucial: when does the AI pause, and for how long? The devil is in the details: missing a comma can change the meaning of a sentence and make it difficult for the user to understand.

How long does the AI wait to reply after the user has spoken?

How does the AI express its prompts? For example, at the beginning of the call, the voicebot will want to verify the user’s identity for authentication purposes; to do this, it will likely suggest the preferred format of the user’s response:

Example: Can you please verify your date of birth? For example, “July 1st, 1985.”

If the AI pauses between the question and the suggested response, the user might respond before the suggestion, leading to mistimings, disfluencies, interruptions, and a potentially failed interaction. To optimize the interaction, a CUX designer will configure the prompt so that the back-and-forth can take effect as smoothly as possible.

The success of the voice AI solution depends on these three pillars. But the customer experience goes well beyond that—let’s explore more aspects in the following sections.

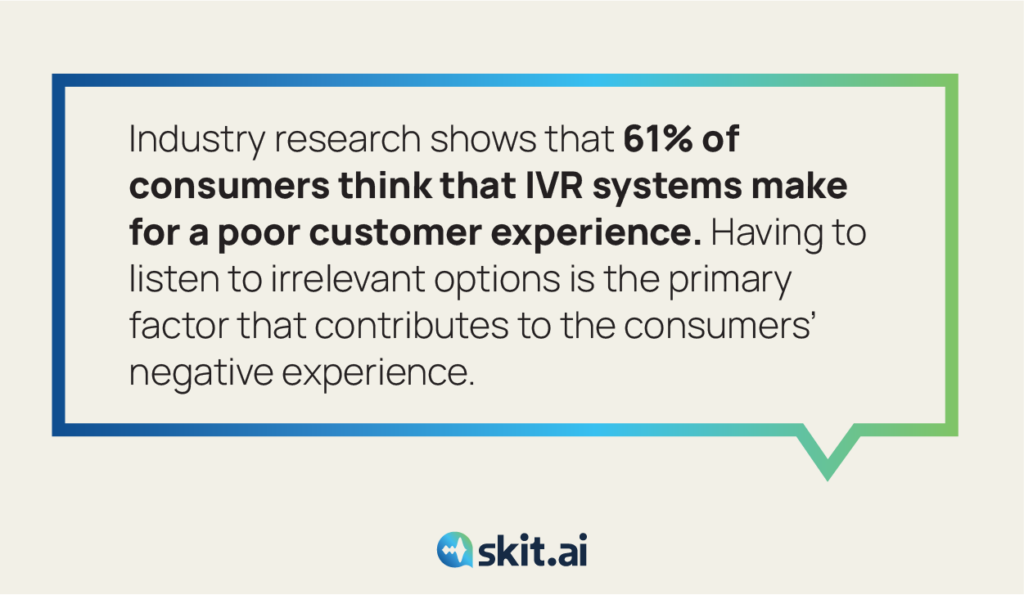

Common CX Concerns: Quality of Speech Recognition and Agent Transfers

One common concern related to customer experience with conversational voice AI is the quality of the ASR, i.e., speech recognition. The fear is that the technology won’t understand the user’s responses and extract the correct “intents” and thus fail to deliver a smooth, natural-sounding interaction. The technology behind speech recognition and natural language understanding has dramatically evolved over the last few years. While this used to be a major problem a few years ago, today it’s less of a concern.

Of course, poor connection or background noise can still hinder the tech’s ability to understand what the user is saying. That’s where a repair strategy comes into play to take the conversation back on track and prevent misunderstandings. Whenever the AI fails to hear the user’s response, it can politely ask them to repeat or rephrase it. Similarly, when the user is uncertain about how to respond, it can offer to repeat it more clearly or rephrase it using different words.

Another common concern relates to agent transfers. Users often fear that the voice AI solution won’t let them easily transfer the call to a live agent if requested. That’s not the case with Skit.ai’s solution. Whenever the customer’s needs are too complex for the AI to handle, and whenever the customer requests it, the solution will always transfer the call to a live agent from the collection agency.

The Role of Personalization as an Effective CX Tool

To achieve a seamless customer experience, a company must know its customers. That is why, in addition to outlining the voice AI’s persona, we also consider the user persona, i.e., the user demographics. Incorporating personalization into the conversation with the voice AI solution helps make it more engaging and fosters trust. However, it’s important to maintain a balance—while personalization is great, you also don’t want to overdo it in order to protect the user’s privacy. This was recently highlighted in data showing that the majority of consumers expect personalization, as long as the data is handled responsibly.

One small touch is incorporating the user’s first name throughout the conversation. For example, after the user authentication is completed, the voicebot can say: “Thank you, Sarah,” to confirm that it’s verified the user’s identity.

Showing that the voice AI solution is aware of the context of the conversation can also improve CX. For example, during an inbound call, the voicebot may say: “I see that you have an outstanding balance of 241 dollars and 50 cents. Is this what you are calling about?”

After the user has made a payment, the voicebot can express enthusiasm like this: “Good news, Sarah! I received your payment of 241 dollars and 50 cents.”

Regional languages and dialects also ensure that the solution is tailored to specific markets. For example, Skit.ai’s voice AI solution speaks over half a dozen languages along with understanding several regional accents.

Incorporating Empathy in Automated Collection Calls

When it comes to sensitive use cases such as debt collection and medical-related calls, empathy is an important component of the voice AI solution’s capabilities. The choice of words, tone, and inflection used by the voicebot can greatly affect the voicebot’s ability to convey empathy, particularly when a user expresses their inability to pay off their debt.

For example, the user may say: “I just lost my job, I can’t deal with this right now.”

How should the voice AI solution respond? The role of empathy in AI is a complex matter: If the voicebot says, “I’m sorry to hear that,” it might irritate the user, given that a computer cannot truly grasp the emotions of someone who has lost their job. However, a common phrase like “I completely understand the situation” is a conventional expression to indicate that the AI solution has acknowledged the user’s challenge.

The voice AI solution is designed to offer options to reach a satisfactory resolution. If the user can’t pay off the debt right away, the solution can offer a few alternatives, such as a payment plan or the ability to connect again in the future.

When designing the voicebot to express empathy, we want to avoid the so-called “uncanny valley” effect. If the voicebot switches abruptly from an overly empathetic statement to a neutral tone, it can cause the user to experience unease and irritation. Therefore, there needs to be consistency in the voicebot’s naturalness and tone, avoiding excessive variation and unexpected changes in its behavior.

And Finally… Regular Quality Checks

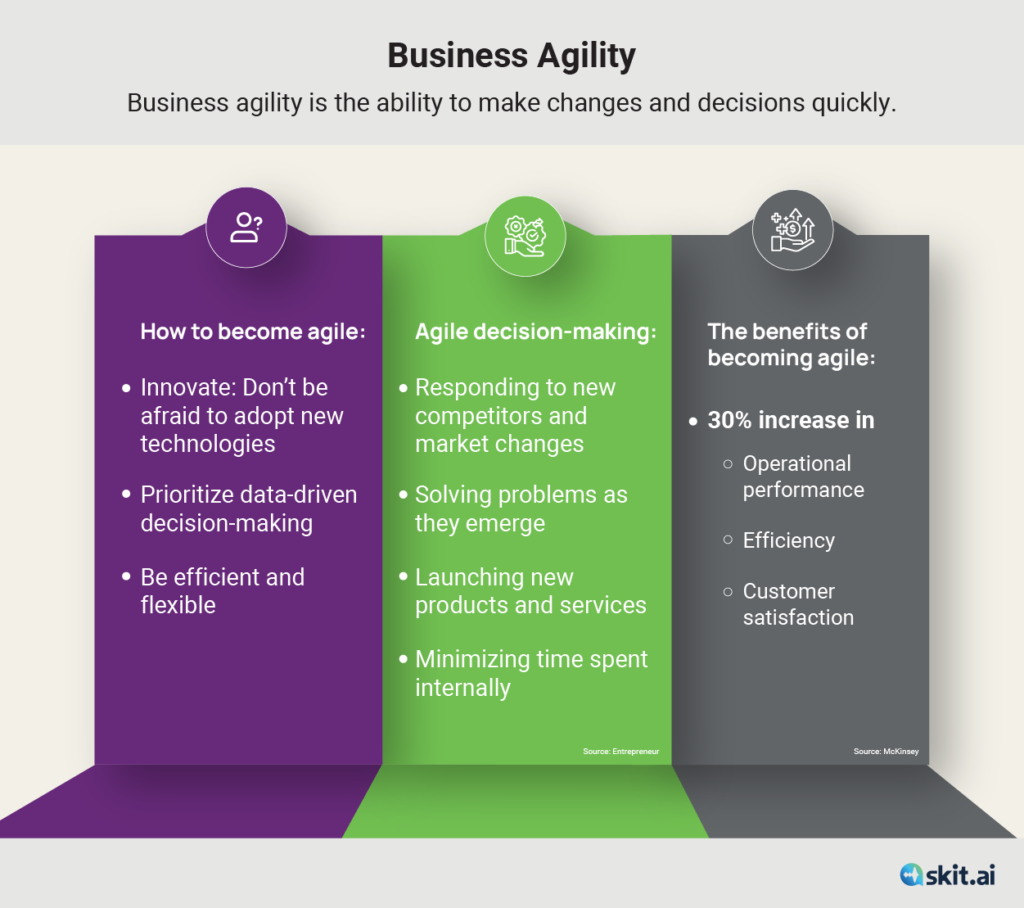

While old systems were static and rigid, new-generation conversational voice AI solutions like Skit.ai are dynamic and adaptive. The solution is built to improve over time. Additionally, after the solution is implemented, CUX Designers regularly perform quality checks and listen to calls with customers to ensure that the voice AI functions correctly. This way, they’re able to regularly train the solution to add new capabilities, understand more user utterances and intents, and offer the most appropriate responses.

Are you curious to watch Skit.ai’s Conversational AI solution for collection calls in action? Contact us using the chat tool below and schedule an appointment with one of our collection experts!