How Human Cognition Impacts the Way Users Interact with Voice AI

When developing and configuring a conversational Voice AI solution, it’s imperative to take into account the experience that end-users will have when interacting with the solution. No matter what the use case is, users should be able to utilize the voicebot to reach a satisfactory resolution, while also having a pleasant experience.

CX is one of the elements that drive the work of Conversational User Experience (CUX) Designers, who ask themselves multiple questions when designing a Voice AI solution: Who is the client and what is its brand identity? What target persona will be interacting with the voicebot, and what use cases will the solution help them with?

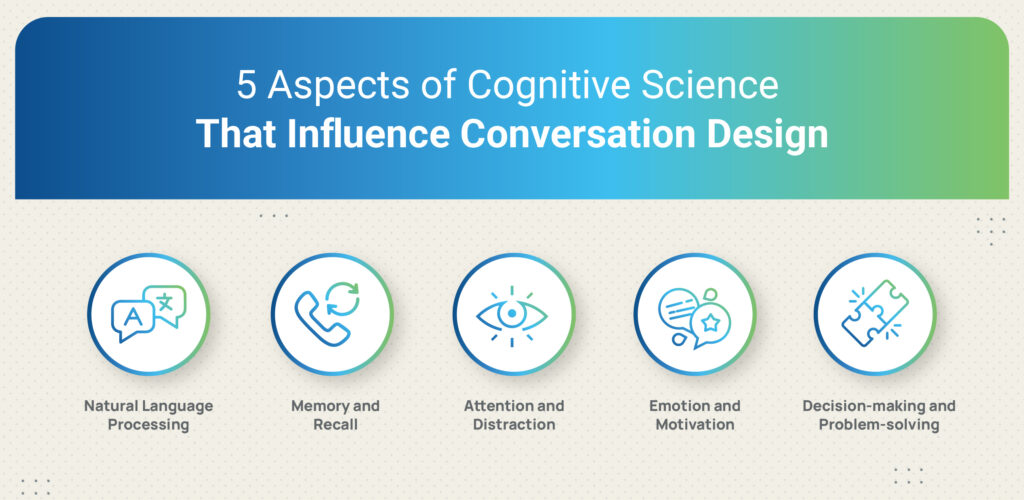

To maximize the quality of the user experience and the consequent CX, conversation designers take into account cognitive science. The goal is to design intuitive, effective, and engaging interactions; cognitive science can provide insight into how users process information, make decisions, and interact with technology.In order to understand the role of cognitive science in CUX, we must first define the term “cognitive load.” According to the American Psychological Association, cognitive load (or mental load) is the “relative demand imposed by a particular task, in terms of mental resources required.” As humans, we can only hold so much information in our minds at any given time; our minds are limited, and we can’t overload them. That is why minimizing the cognitive load plays an important role in ensuring a positive user experience.

Let’s analyze these aspects one by one:

Natural language processing: CUX designers take into consideration the way users process language, including speech recognition and text-to-speech conversion, as well as the interplay between different elements of speech, such as prosody, pitch, emphasis, and the consequent tonality, which further contributes to perceptual and contextual semantics. NLP is essential for building effective conversational systems. This process also includes researching and implementing algorithms that accurately recognize and respond to human speech.

Memory and recall: The user’s ability to remember and recall information when necessary is essential to conversation design. The cognitive load is directly affected by the complexity and quantity of the information given to the user. Designers consider how the information is presented and stored, and ensure that users can easily and quickly retrieve it.

Attention and distraction: Understanding how people allocate their attention, what contributes to selectivity in attention in a given context, and how easily users can be distracted. Designers must structure the conversation to keep the user’s attention focused on the task at hand, resulting in better engagement and performance.

Emotion and motivation: Emotions play a significant role in shaping human behavior and decision-making. Designers consider how users may feel about the interaction and how to motivate them to engage with the voicebot. Secondary UX research about user demographics and socio-economic and geo-cultural backgrounds can provide valuable insights to improve CX.

Decision-making and problem-solving: Conversations often involve decision-making and problem-solving, and understanding how people process information and make decisions is crucial for effective conversation design. Factors include biases, heuristics, and cognitive load.

How Do You Reduce Cognitive Load in Conversation Design?

What are the best ways for conversation designers to reduce the users’ cognitive load in a conversation with a Voice AI solution, consequently improving the customer experience? Here are some guidelines you can follow:

Simplify prompts and confirmations: Using as few and simple prompts and confirmations as possible helps reduce the need for users to remember and respond to multiple options, ultimately leading to an optimal cognitive load and user experience. This is easier to accomplish with a well-designed conversational Voice AI than with legacy technologies such as IVR systems, in which users are forced to listen to long menus of mostly irrelevant options.

For example, a legacy IVR system will offer a lengthy menu of options, such as: “For your account balance, press 1; for information on your upcoming payment, press 2; to update your personal information, press 3 … To hear this options again, please press #.”

Instead, a Voice AI solution will simply ask: “How can I help you?”

Another example is the prompt for a user’s date of birth. A poorly-designed voicebot will say: “Please enter your date of birth in the following format—two digits for the month, two digits for the day, four digits for the year,” or a similarly lengthy and confusing prompt.

Instead, a well-designed voicebot will ask: “Could you please say or enter your date of birth?”

Use natural language: Use natural language and avoid complex sentence structures to reduce the cognitive effort required to understand the conversation.

See below an example that highlights the difference between a more robotic language choice and an alternative with more natural-sounding language.

Robotic language: Unfortunately, the payment amount that you have given is less than the acceptable minimum amount of $50. Can you please state an amount that is equal to or higher than $50?”

Natural-sounding language: “Sorry, but the minimum we can accept is $50. Can you please tell me how much above that amount you can afford to pay today?”

Provide clear cues: Open-ended questions can prompt a multitude of responses from the users; the voicebot might not understand many of the possible answers. Therefore, using clear cues to indicate when the user should speak, and using audio cues to confirm that the system has understood the user’s response should be adopted as a standard practice.

For example, here’s what the Voice AI solution will say to negotiate a payment plan: “We offer a choice of 2-month, 4-month, and 8-month payment plans. Which payment plan would you like?”

Another way to provide clear cues is the use of an audio signal informing the user that something is happening; in jargon, this is knows as an “earcon” (a brief, characteristic, harmonized and structured sound and its job is to communicate a specific message, event, status to a user or convey a task being performed).

This type of audio signal gives the user a cue that something is happening (e.g. a payment is being processed), instead of just having plain silence, which can lead to confusion. An earcon, for example, could be the sound of someone typing on a keyboard, which signals that the information is being processed.

Use progressive disclosure: Progressive disclosure is a strategy in interaction design to reveal information gradually and start only with the most essential information. Providing information to the user in a step-by-step manner, rather than overwhelming them with too much information at once, leads to increased engagement and enhanced experience.

See the example below:

Voicebot: “To set up a payment plan, can you tell me how much you are comfortable paying each month?”

User: “$60.”

Voiebot: “Thanks! Based on a $60 monthly payment, we can set up a payment plan with a duration of 4 months. Your payment plan will start on the next billing cycle. How does that sound?”

The reiteration of the monthly payment amount also serves as an implicit confirmation.

Contextual design: Using context to guide the conversation reduces the need for the users to provide additional information. For example, just as we do when we talk with a waiter at a restaurant, if the user has already provided their name, the system should use that name in subsequent interactions. As the conversation progresses, the voicebot will have more and more context and will be able to utilize the information it has collected to improve the user experience.

The voicebot shouldn’t just rely on context of the specific conversation taking place, but also on the context of previous interactions with the same user. Acknowledging previous interactions is a good idea.

Test and iterate: Testing the bot’s conversations with users and iterating the flows based on their feedback helps improve the user experience (UX) and reduce the cognitive load. The conversation flow can be optimized based on the different users’ needs. Additionally, different types of debt, different users, different demographics often require slightly different approaches.

There is no doubt that leveraging cognitive science in the design and development of conversational Voice AI solutions can significantly enhance the customer experience (CX).

By understanding how human cognition impacts user interactions, conversation designers can create intuitive and engaging interactions that reduce cognitive load, leading to more positive user experiences.

By applying these insights and best practices, business can rely on voicebots to meet their customers’ needs and optimize the use of their own resources. As the technology continues to advance, the potential for Voice AI continues to grow.

Want to learn how Conversational AI can transform your business? Use the chat tool below to schedule a meeting with one of our experts!