Topic: Voice AI for Business Growth

Don’t Miss a Single Collection Opportunity with 24/7 Inbound Support

By definition, debt collection agencies tend to make outbound outreach the focus of their recovery strategy. Contact consumers, remind them of their due balances, and collect payments. Whether it’s manual or automated, outbound outreach is at the core of what a collection agency does. But inbound calls from consumers can easily represent a dangerous blind spot resulting in a significant loss of revenue.

Every time a consumer calls your collection agency and their call goes to your voicemail or to an inconvenient IVR menu, you lose an opportunity to collect a payment.

The statistics are sobering. Agencies can lose up to 14% of their collection opportunities whenever inbound calls route to voicemail or drop due to the absence of an available agent. At Skit.ai, we reviewed data on inbound consumer calls provided by one of our partnering agencies prior to the adoption of Skit.ai’s solution.

In this article, we’ll discuss our findings and how our Multichannel Conversational AI solution can help agencies solve this issue.

Why Consumers’ Voicemail Messages Equal Margin Losses

Inbound calls lead to several challenges for collection agencies, especially those without a large team of live agents on the floor.

Inability to answer inbound calls 24/7: Agencies tend to receive many inbound calls from consumers outside of business hours—in the evening or during the weekend. While these are times when agencies don’t have staff available to answer calls, they’re also the times consumers tend to be free. According to the data we reviewed, as many as 43% of your inbound calls may be coming outside of operational business hours.

Limited staffing and resources: For several years, agency executives have been grappling with the challenges related to hiring and retaining agents and collectors. Given the limited resources most agencies have, it’s likely that agents may not be able to answer an inbound call also during business hours.

Call volume is not uniformly distributed throughout the day: 20% of inbound voicemail messages were received during business hours when inbound calls were at their peak and there were not enough agents to handle all the traffic. For example, 4:00 p.m. to 8:00 p.m. tends to be the busiest time of the day for agencies, according to our research.

In the graphic below, you can see an example of inbound traffic on an average day, showing that call volume is not uniformly distributed:

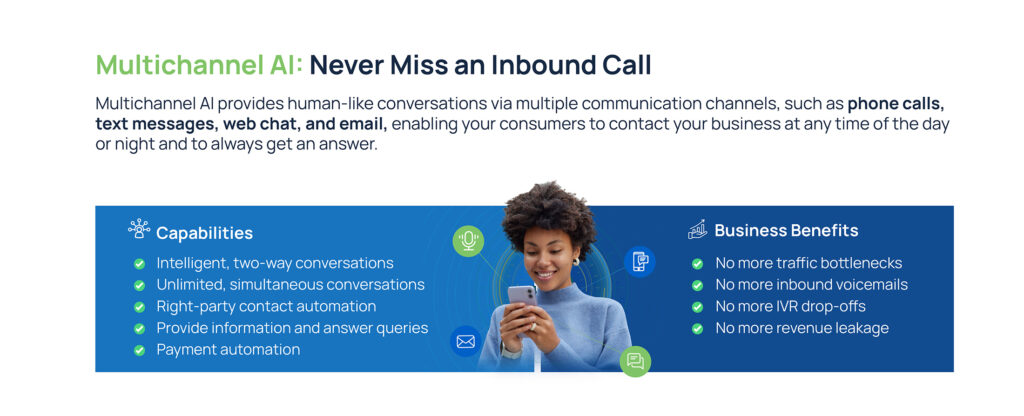

Multichannel AI: Never Miss an Inbound Call

The idea that your business is not able to operate 24/7 is wrong and outdated. To never miss a single inbound call, automation through artificial intelligence is the answer. AI–enabled platforms present a practical and innovative solution to provide round-the-clock inbound support.

Multichannel AI provides human-like conversations via multiple communication channels, such as phone calls, text messages, web chat, and email, enabling your consumers to contact your business at any time of the day or night and to always get an answer.

Here are the capabilities of a multichannel bot for inbound use cases:

Intelligent, two-way conversations: A virtual assistant or bot can handle human-like, intelligent conversations that are multi-turn.

Unlimited, simultaneous conversations: Conversational AI can handle as many conversations as needed simultaneously, solving the issue of traffic volume for agencies and lenders.

Right-party contact automation: Automate simple and repetitive tasks such as right-party contact verification.

Provide information and answer questions: The virtual assistant will be able to answer common queries, and provide information on the outstanding debt or balance.

Payment automation: The bot can easily collect payments during the interaction via an integrated payment gateway.

Benefits for Collection Agencies with Conversational AI

Automating inbound calls and communications can save collection agencies and creditors a lot of money, enablign them to seize more recovery opportunities.

No more traffic bottlenecks: Solve traffic bottlenecks with Conversational AI, eliminating wait times.

No more inbound voicemails: Setting up a voicemail for inbound calls is likely to kill many recovery opportunities. Instead, allow your consumers to chat with your bot to get the assistance they need right away.

No more IVR drop-offs: IVR menus force consumers to listen to many irrelevant options and make their way through complicated IVR trees, resulting in high drop-off rates.

When automating inbound communications with Conversational AI, at Skit.ai we’ve seen the following results:

- 2X boost in connectivity

- 25% reduction in live agent time investment

- 20% increase in agent productivity

- 25% boost in right-party contact (RPC) rate

- Up to 20% increase in promise-to-pay (PTP) rate

- 10X ROI

Benefits for Consumers with Multichannel Conversational AI

Multichannel Conversational AI also elevates the user experience for your consumers, making their debt resolution easier and faster. While customer experience (CX) might not always be top of mind for collectors, Conversational AI does provide many benefits for consumers:

Consumers utilize their preferred channel: Every individual prefers to communicate through a different channels. Some may prefer to speak over the phone, others may prefer to text via SMS. Offering multiple channels enables consumers to utilize whatever method of communication they feel most comfortable with.

Are you ready to automate your inbound operations with multichannel Conversational AI? Use the chat tool below to schedule a meeting with one of our experts to learn how your can optimize your collection strategy.

The Role of Conversational AI for Calls and Email in Commercial Debt Collections

In the high-stakes world of commercial (B2B) debt collections, where high call volumes and rising staffing costs are common challenges, the integration of AI-powered technology can be a game-changer for collection agencies. Here’s where Conversational AI—in the forms of multichannel automation, including voice, email, and text—can transform a business’ recovery prospects. This technology can enhance agent productivity, streamline operations, and significantly improve customer satisfaction.

In this article, we’ll explore the power and potential of Conversational AI automation for B2B collections and how you can leverage this technology to optimize every step of your recovery efforts.

Understanding Agent Challenges in Commercial Debt Collections

Collection agencies servicing commercial debts typically face several staffing-related challenges:

Staffing Costs: Recruiting, hiring, training, and retaining talented agents is not easy, and certainly not cheap. The costs associated with maintaining a robust workforce to handle calls and pursue collections represent a significant portion of an agency’s operational expenses. In a competitive market, these costs can easily eat into profit margins.

High Call Volumes: Commercial collection agencies endure a relentless stream of outbound calls, each call representing an opportunity to engage with the debtor and move toward a resolution. Agents tend to be overwhelmed by the high number of calls they are expected to place, leading to burnout and decreased productivity.

Persistent Follow-ups: Successful debt recovery often hinges on persistent follow-ups, a business imperative for the recovery strategy. The process typically requires multiple contact attempts before a resolution can be reached; persistent follow-ups require significant staffing resources and capabilities.

Compliance: The collections regulatory environment is fast-evolving and not always easy to navigate. Staff needs to be regularly trained and updated on laws and regulations, an effort that adds another layer of complexity to the agents’ jobs. Even in commercial collections, where fewer regulations are at play, collectors want to commit to the most ethical practices.

The Rising Role of Conversational AI in the Accounts Receivables Sector

AI has been the talk of the town in virtually every industry, and the accounts receivables space is no different. The challenges we outlined in the previous section make automation with artificial intelligence, Conversational AI in particular, an obvious solution for collection companies and lenders handling all types of debt—including commercial debt.

Industry-leading agencies have adopted Conversational AI, such as Voice AI, to automate interactions with consumers, accelerating recoveries and reducing costs. Whether these interactions take place over the phone or via email, Conversational AI can handle them end-to-end.

The benefits of Conversational AI go beyond those of the collection agency as a business, but significantly improve the agent experience as well. By automating repetitive and tedious calls and tasks, agents can focus on more rewarding or complex scenarios. Additionally, agents can focus on call transfers from the Voice AI solution.

Voice AI refers to the use of Interactive Voice Assistants or voicebots to initiate and handle outbound or inbound calls. In the context of collections, a Voice AI solution can handle collection calls from start to finish—from identifying the end-user to providing information on the due balance to collecting the payment on- or off-call. Powered by Generative AI, Skit.ai’s voicebots can handle multi-turn, two-way, intelligent conversations with consumers.

Conversational AI represents a significant leap in the efficacy of conversational interfaces. By leveraging the power of natural language processing and machine learning, these systems hold conversations that are just as good as your average agent’s conversations.

AI-driven systems do not just handle repetitive tasks; they also progress through call scripts and collections processes logically and methodically, ensuring that no detail is overlooked and that customers receive a consistent and polished interaction.

The Importance of Email Automation in a Multichannel Strategy

AI-powered email automation, when synergized with Voice AI, creates a comprehensive collection approach that extends beyond mere telephony. It casts a wider net for customer engagement and offers a structured, multimodal avenue for debt resolution. Skit.ai’s multichannel platform relies on the synergic utilization of multiple channels, without losing the context from one interaction to the other regardless of the channel.

Here are some benefits of incorporating email automation into your recovery strategy:

Timely and Cohesive Communications: Emails are scheduled and dispatched at opportune moments, complementing the call strategy to create a seamless and unrelenting push towards recovery. This synchronization significantly improves message retention and customer response rates.

Tailored Messaging: With email automation, each message is curated to resonate with the customer’s unique situation and history, engendering a sense of personal and purposeful outreach that traditional email blasts simply cannot replicate.

Customer Convenience: The inclusion of payment links in emails provides a user-friendly payment method, optimizing the customer’s experience and increasing the likelihood of prompt settlements.

Combining Voice and Email AI Automation for Optimal Results

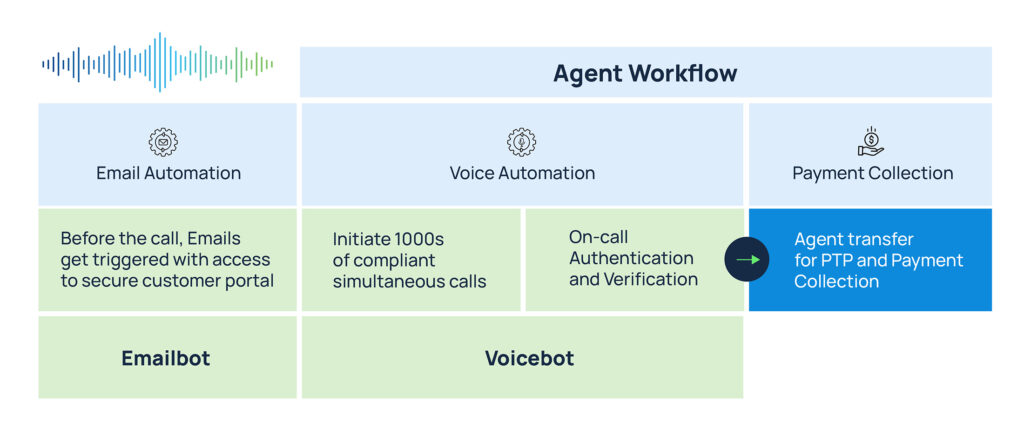

Let’s see a sample collection workflow that combines voice and email automation, as done by one of Skit.ai’s clients. When the agency receives an email from a debtor, an automated call can be triggered, which can be easily transferred to one of your live agents for a quick resolution.

Email bot / Email Automation: A personalized email is triggered including a link to a secure payment portal.

Voicebot / Voice Automation: The voiciebot can initiate and handle thousands of compliant, simultaneous calls to different debtors. On the call, the voicebot can verify the user’s identity and provide the necessary information on the debt. The voicebot can answer questions, capture promise-to-pay (PTP), process payments, or negotiate settlements as needed.

Live Transfers: When needed, the voicebot can easily transfer the call to a live agent, who can collect the payment or capture a promise-to-pay (PTP).

The Results Our Clients Have Achieved

Our clients have reported remarkable success using our multichannel platform.

For the email bot, they experienced an open rate of up to 40% and a payment rate of up to 7.5%. Both metrics varied based on age and type of debt.

With the Voice AI solution synched with the email bot, our clients experienced 100% account penetration and a connectivity rate of 13%. The solution enabled them to save their agents’ time by up to 50% and boost their agents’ productivity by 25%.

Are you interested in learning how Skit.ai’s multichannel solution for collections can benefit your business? Use the chat tool below to schedule a meeting with one of our experts.

How Can You Reduce High Delinquencies with Voice AI?

Delinquency rates are on the rise again. While this may have been the perception of many collections professionals over the past few months, the data published by the Federal Reserve Bank of New York’s Center for Microeconomic Data in February 2024 confirms it.

During the last quarter of 2023, the total household debt in the U.S. increased by $212 billion (+1.2%). This can be attributed to the rise in balances for multiple types of debt, including:

- Mortgage balances increased by $112 billion from the previous quarter.

- Credit card balances increased by $50 billion (+4.6%).

- Auto loan balances increased by $12 billion, standing at $1.61 trillion.

As a consequence, delinquency rates have been rising in Q4, with 3.1% of outstanding debt in delinquency at the end of the year.

Delinquencies have been consistently increasing among most types of debt; notably, credit card delinquencies have been rising among younger borrowers. Collection agencies now need to compete with multiple entities to recover payments from consumers, and their communication strategy is key.

What Does the Rise in Delinquencies Mean for Collection Agencies?

The rise in delinquencies signifies a challenging period for collection agencies, as they must navigate an environment where consumers are juggling multiple debts. This increase in late payments can lead to a heavier workload and the need for more resources as agencies attempt to manage an expanding portfolio of delinquent accounts.

With more accounts falling into delinquency, the probability of successful debt recovery diminishes without the adoption of efficient and strategic collection practices. Additionally, with the escalation of competition for repayments among different creditors, collection agencies are compelled to refine their approach to ensure they stand out and effectively reach consumers.

For collection agencies, this uptick in delinquencies also represents an urgent call to innovate and adopt newer technologies. Traditional methods of recovery, through letters and manual calling, no longer suffice in the face of evolving consumer behaviors. That’s where AI comes into play.

How Conversational Voice AI Can Reduce Delinquencies

Conversational Voice AI consists of the utilization of voicebots or Interactive Voice Assistants to automate collection phone calls. The benefits of using Voice AI are many:

Personalization: Interactive Voice Assistants offer a personalized and responsive interaction with consumers. The Voice AI solution addresses the consumer by name and knows the necessary contextual information on the due balance, the original creditor, and more.

End-to-End Automation: Voice AI can handle collection calls from start to finish: establishing right-party contact (RPC), providing information on the outstanding balance, answering questions, capturing promise-to-pay, taking payments on-call, and also transferring the call to a live agent whenever necessary.

Scalability and Account Penetration: A high delinquency rate means that agencies have more accounts to contact. This can be challenging in terms of staffing, since you can’t tap into unlimited staffing resources no matter how large your agency is. AI is infinitely scalable, and enables you to penetrate thousands of accounts within minutes.

Reach Younger Consumers: As we explained earlier, credit card delinquencies have been rising among younger borrowers. Younger consumers tend to prefer to interact with voicebots and chatbots rather than human collectors—and are unlikely to respond to a print letter. Meet young consumers where they are—with the latest technology.

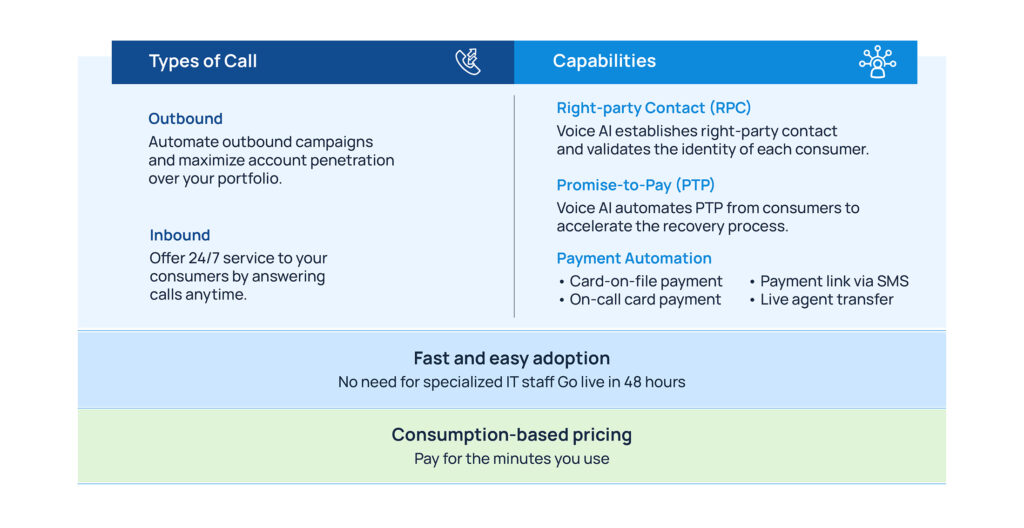

Is It Difficult to Adopt a Voice AI Solution?

The short answer is: no.

No IT staff needed: The adoption of Skit.ai’s Voice AI platform is fast, easy, and painless, not requiring any specialized IT staff on the agency’s end. Our team helps you set up the platform according to the type of campaigns you’re running and the type of debt you’re servicing.

Preset compliance filters: The platform is already preset with all the applicable compliance filters at the federal and state levels, ensuring that calling times and frequency are programmed to be fully compliant.

Go live in 48 hours: You can easily share your first campaign data via a simple flat-file transfer, and you’ll be able to go live in less than 48 hours.

Consumption-based pricing: The pricing model is consumption-based, so you pay for the minutes you use.

Are you ready to take the leap, or do you want to learn more about our solution? Schedule a call with one of our experts using the chat tool below.

Discovering Conversational Voice AI’s Impact on Creditors’ Rights Law Firms

Debt collection is a notoriously difficult task—and law firms specializing in this field are no exception to that rule.

Creditors’ rights law firms involved in collections frequently face obstacles such as compliance with ever-changing regulations, account penetration, staffing challenges, and the high costs associated with collections. As a consequence, these firms are increasingly looking towards innovative solutions to streamline their operations, making them not only more efficient but also more cost-effective.

The field of legal collections is complex and ever-evolving, and just like other segments of the accounts receivables industry, it’s quickly catching up with technology, particularly the use of artificial intelligence. In this article, we’ll explore the use of Conversational Voice AI for legal collections, a booming technology that will likely become an industry standard.

Investing in AI Technologies for Collections and Beyond

Investing in AI technologies is not just a trend—it’s a strategic move that can significantly transform the collections process.

AI-driven solutions like machine learning, natural language processing, and automation have been gaining significant traction among law firms and collections agencies. These technologies are capable of analyzing large datasets to identify trends, predict payment behaviors, and personalize communication strategies.

Most notably, the introduction of Conversational Voice AI has revolutionized the debt collection industry, with Skit.ai emerging as the industry’s leading provider of this type of technology. Voice AI enables organizations to automate phone interactions with consumers, streamlining and accelerating the entire collection process.

This development ushers a new era of efficiency, personalization, cost-effectiveness, and customer satisfaction.

Here are some of the most common challenges faced by creditors’ rights law firms:

Regulatory Compliance: Law firms and agencies are the most careful and well-informed when it comes to complying with laws and regulations, including the TCPA, FDCPA, and Reg F.

Staffing: Collecting in-house requires hiring and retaining full-time staff, including legal assistants and live transfer agents, which is costly and time-consuming.

Outsourcing: Outsourcing collections to a third-party agency is a common practice, yet it’s an expensive option for law firms.

Call Volume: Maximizing the number of consumers reached, known as account penetration, can be a pain point that some companies end up compromising on, especially when dealing with hundreds of thousands of accounts.

Time and Resources: The last calling attempts before pursuing legal action cost time and resources, including establishing right-party contact (RPC).

What Is Voice AI and How Does It Work?

Conversational Voice AI is a sophisticated technology that simulates human-like conversations with consumers. It combines natural language processing (NLP), machine learning (ML), and speech recognition technologies to effectively interact with consumers in a natural-sounding and fluent manner.

Voice AI enables companies to automate thousands of consumer interactions within minutes at a fraction of the cost of a traditional collection call. Collection agencies have been relying on this solution for both outbound and inbound collection calls, successfully cutting costs and accelerating the recovery process.

This technology must not be confused with an IVR system. An IVR forces users to listen to lengthy menus that are mostly irrelevant. Research has consistently shown that IVRs are not popular among consumers. Unlike IVR, an AI-powered solution like Skit.ai handles intelligent, personalized, and effective conversations with consumers, eliminating wait times and cutting costs.

Skit.ai’s solution is fully compliant with all laws and regulations at the federal and state levels related to debt collection, including the TCPA, FCDCPA, and Reg F. Additionally, we also adhere to a stringent data privacy policy.

The adoption of Voice AI is incredibly smooth and efficient. Many of our clients experience a seamless integration, going live with the solution in less than 48 hours. This rapid deployment enables you to start collecting immediately, requiring minimal effort and eliminating the need for specialized IT personnel.

Here’s what one of Skit.ai’s clients has said about us: “Skit.ai’s technology has proved very effective. The platform smoothly integrated with our payment gateways, effortlessly handled high call volumes, and strictly adhered to compliance standards. Consumers have begun to prefer interacting with the Voice AI solution, marking an improvement in the overall consumer experience.”

Are you curious about how Conversational AI can streamline your collection efforts? Use the chat tool below to schedule an appointment with one of our experts!

Why Buy Now, Pay Later Companies Are Turning To Voice AI for Collections

Companies offering Buy Now, Pay Later solutions have been in business for over a decade; in recent years, with the boom of e-commerce, BNPL has become an established vertical within financial services and consumer lending.

This past Cyber Monday, a record number of holiday shoppers used BNPL services to relieve stress on their wallets; the surge in popularity amounted to a 19% increase from the previous year, according to a report by Adobe Analytics. As more consumers struggle to make ends meet but don’t want to forgo their shopping, companies offering BNPL services are gaining popularity.

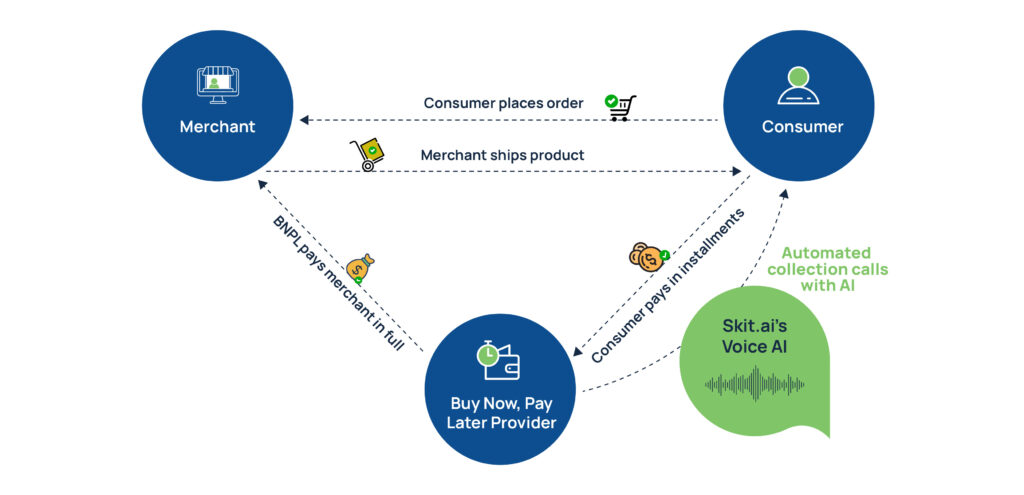

How do Buy Now, Pay Later services work, and what role is artificial intelligence playing in this promising industry? How can BNPL companies leverage the power of Conversational Voice AI to streamline and accelerate their collection processes? In this blog post, we’ll dive into the answers to these questions.

The Buy Now, Pay Later Boom in U.S. Financial Services

Buy Now, Pay Later solutions usually offer consumers (mostly online shoppers) highly customizable payment plans to purchase products so they can pay in installments rather than upfront. Here’s how it works: The BNPL provider pays the merchant the full product’s price, indirectly lending the money to the consumer. Transactions through BNPL are easy and fast to execute; they’re highly customizable, so the consumer can choose the plan that works best for them.

What’s appealing is that BNPL are often interest-free. The longer the time range for the installments is, the higher the interest rate becomes. However, consumers will be charged a late fee whenever they miss a payment.

Affirm, Afterpay, Klarna, and Sezzle are some of the most renowned BNPL companies; tech giants like Amazon and Apple have recently jumped on the bandwagon and unveiled their own solutions.

Why Collections Are the Most Important Piece of the BNPL Puzzle

For Buy Now, Pay Later businesses, payment recovery is vital. To improve business operations, figuring out how to optimize the recovery process is the key to long-term success.

Most BNPL companies handle collections in-house, with a team of agents or collectors who reach out to consumers to remind them to pay and collect their due payments. This process can present some serious challenges if done manually and without AI.

Why Voice AI Is the Collections Industry’s Preferred Recovery Channel

Being part of the fintech industry, BNPL companies are usually pretty agile and fast at adopting new technologies. There are many different uses of artificial intelligence (AI) in this industry, from fraud detection to data analysis, from credit scoring to AIOps.

Given the importance of collections for BNPL businesses, employing AI to streamline the recovery process and automate interactions with consumers is the answer to the challenges we explored earlier. In particular, Conversational Voice AI has emerged as the collections industry’s preferred recovery channel, as it enables companies to automate thousands of consumer interactions within minutes at a fraction of the cost of a traditional collection call.

Here’s how Voice AI can streamline the collection process:

Here’s what one of Skit.ai’s clients has said: “Skit.ai’s technology has proved very effective. The platform smoothly integrated with our payment gateways, effortlessly handled high call volumes, and strictly adhered to compliance standards. Consumers have begun to prefer interacting with the Voice AI solution, marking an improvement in the overall consumer experience.”

As another client of Skit.ai put it: “When it comes to collections, most consumers don’t want to have to interact with another person. We wanted to make the process easier. Skit.ai’s solution allows consumers to choose; they can interact with the voicebot, ask to speak to one of our agents, or visit our website to make a payment.”

Are you curious to learn more about how Conversational AI can accelerate your collection efforts? Use the chat tool below to schedule an appointment with one of our experts!

Skit.ai’s Augmented Voice Intelligence Platform Takes a Giant Leap with Generative AI

Skit.ai’s Augmented Voice AI Platform is now powered by Generative AI. With the incorporation of Generative AI, we are taking a giant step forward and boosting the capabilities of our Conversational Voice AI solution. The interactions with consumers are about to become more natural-sounding and complex, leading to an improvement in customer experience (CX) and better results for collection agencies using Voice AI.

At Skit.ai, we embrace the future and go beyond industry standards and expectations.

How Generative AI Impacts the Capabilities of Skit.ai’s Augmented Voice Intelligence Platform

With the ongoing application of large language models (LLMs), we are seeing a big jump in the conversational capabilities of our solution:

Higher Conversational Accuracy: LLMs are capable of understanding consumer interactions through an improved understanding of context, sentence parsing, and response accuracy, leading to significantly higher conversational accuracy.

Better Handling of Complex Conversations: Generative AI enables our voicebots to better handle more complex interactions that were earlier escalated to human agents. This improvement can reduce the percentage of call transfers from the Voice AI solution to the company’s human agents.

Out-of-scope Calls: The LLM’s ability to grasp a wide range of questions and topics enables our voicebots to better handle out-of-scope utterances and calls.

Natural Utterances: The Voice AI solution is able to express a wide variety of natural-sounding utterances that improve the quality of the interaction.

Faster Voicebot Creation: Incorporating Generative AI give a big boost to the speed at which new voicebots can be created as the inherent complexity and effort involved in the design, and creation is a fraction of earlier effort.

Massive Performance Gains with Generative AI Springboard

In addition to the massive gains we are seeing thanks to LLMs, we intend to take this exercise even further and enable our voicebots to outperform human agents and collectors.

Going Beyond Human Agent Performance

An agent’s performance rests on two things: the ability to communicate and technical skills. At Skit.ai, we’ve seen that, with current LLMs, we can achieve superlative communication skills, and by training extensively with end-user data, we can achieve a high degree of technical skills. Hence our solution can excel on both fronts.

To share a rough estimate: the best-performing agent finds success on 5% of the calls (out of all connected calls), while low performers convert about 2% of the calls.

With Generative AI, we take a big jump. From the current voicebot conversion capability of around 1-2%, we expect the performance to jump 3-4 folds. Beyond this, our Reinforcement Learning platform learns from outcomes to personalize the conversation to figure out the ideal strategies, learning from thousands of daily conversations.

Better and More Natural Spoken Conversations

Generative AI, with its unparalleled conversational capabilities, needs to be complemented with equally capable speech synthesis and understanding systems that produce the right speech given the output from LLMs. And that is one of the major areas from the many below:

- A more natural-sounding TTS (text-to-speech) voice

- Conversational context handling prosody of generated audio

- Full duplex and backchannels in speech conversations

Ultimately, we will be able to deliver the most engaging conversations that delight consumers by solving their problems faster and better than human agents.

The Business Outcomes of Incorporating Generative AI

Below are five major impact areas we will move the needle on:

Higher Collection Rate, ~5%: This is a difficult number to quantify, but as the incorporation of Generative AI matures, we expect its collection capability to move beyond 5%, surpassing even the best of human agents.

Lower Agent Dependency, reduction by 50-80%: As the voicebot will be able to handle more complex queries, we expect a 50-80% reduction in agent touch points.

Higher Resolution Rate, ~100%: Better accuracy and conversations with higher engagement will help us achieve a conversational resolution rate close to 100%.

Creating New Voicebots: The effort to create new voicebots will see a significant dip, as the complexity will be remarkably lower.

Entering New Markets with Ease, 15X faster: Entering new markets and training for new use cases and applications will require less effort and resources. We are estimating the process to be 15X faster.

What’s Next

Though the improvements in our Augmented Voice Intelligent Platform are visible and clear, we will further our efforts to achieve greater performance gains and stay ahead of the curve.

To learn more about how Voice AI can help support your collection efforts through call automation, schedule a call with one of our experts using the chat tool below.

An Unbiased Look into the Positive Side of Voice AI

Artificial intelligence is experiencing exponential innovation. Generative AI, ChatGPT, DALL-E, Stable Diffusion, and other AI models have captured popular attention, but they have also raised serious questions about the issue of ethics in machine learning (ML).

AI can make several micro-decisions that impact such real-world macro-decisions as authorization for a bank loan or be accepted as a potential rental applicant. Because the consequences of AI can be far-reaching, its implementers must ensure that it works responsibly. While algorithmic models do not think like humans, humans can easily and even unintentionally introduce preferences (biases) into AI during development and updates.

Ethics and Bias in Voice AI

Voice AI shares the same core ethical concerns as AI in general, but because voice closely mimics human speech and experience, there is a higher potential for manipulation and misrepresentation. Also, people tend to trust things with a voice, including friendly interfaces like Alexa and Siri.

Call automation for call centers and businesses is not a new concept. Unlike computerized auto dealers (pre-recorded voice messages) like Robocall, Skit.ai’s Voice AI solution is capable of intelligent conversations with a real consumer in real-time. In other words, Voice AIs are your company representatives. And just like your human representatives, you want to ensure your AI is trained in and acts in line with company values and displays a professional code of conduct.

Human agents and AI systems at any given point should not treat consumers differently for reasons unrelated to their service. But depending on the dataset, the system might not provide a consistent experience. For example, more males calling a call center might result in a gender classifier biased against female speakers. And what happens when biases, including those against regional speech and slang, sneak into voice AI interactions?

In contrast to human agents, who might sometimes unintentionally display biases, Voice AI follows a predetermined, inclusive script while strictly adhering to guidelines that prioritize consumer satisfaction and compliance. This level of professionalism eliminates the potential for misbehavior and creates a positive consumer experience.

Our team is always potentially looking out for any potential bias that accidentally seeps in, as ‘biases’ as constantly evolving. One thing can be acceptable today, but may bee seen as a bias tomorrow. At Skit.ai our skilled team of dedicated designers meticulously construct the dialogue patterns to guarantee balanced responses. Following these predefined scripts allows our Voice AI solution to offer consistent, unbiased interactions, thus establishing an inclusive user experience. This emphasis on conversation design aids us in overcoming potential biases that may surface in human interactions, thus securing a more balanced and impartial user experience.

Consumer Convenience and the Growing Preference for Voice AI

Consumers increasingly prefer interacting with Voice AI rather than human agents due to the convenience it offers. Voice AI allows users to communicate naturally through voice commands, eliminating the need to type or navigate complex menus. This convenience aligns with the preferences of many individuals who find it easier and more natural to speak rather than type. Furthermore, Voice AI is available 24/7, providing round-the-clock support without the need to wait for human agents.

This instant access to information and assistance enhances consumer satisfaction and can lead to faster issue resolution. Additionally, voice interactions can be personalized and tailored to individual preferences, creating a more personalized and engaging consumer experience. The convenience and preference for voice-based interactions make Voice AI a valuable tool for meeting consumer expectations.

Building Ethical Voice AI

Empathetic conversational design eliminates bias. At Skit.ai, we’re dedicated to developing leading-edge Voice AI technology. Our mission is to facilitate communication that is equitable and devoid of bias. Through conversational design, biases are eliminated, ensuring fair and inclusive interactions. A significant part of our strategy involves refining the conversational capabilities of our systems, striving for a natural, seamless exchange of speech that ensures equal treatment for all and eradicates discriminatory tendencies. As we navigate the future of work, Voice AI stands as a valuable tool, empowering enhanced communication, fostering seamless consumer conversations, and further elevating customer satisfaction.

To learn more about how Voice AI can help support your human resources and scale their collection efforts with call automation, schedule a call with one of our experts or use the chat tool below.

How Auto Finance Companies Can Improve Collections with Skit.ai’s Voicebot

The economic volatility is affecting auto financers directly, and so do the inflation and other consumer behavioral trends, making it a genuinely complex space to be in.

Inflationary pressure is mounting significantly in the US economy, and the core inflation jumping to 6.6%, a 40-year high; on the other hand, the US economy is slowing down significantly, putting significant pressure on consumers to avoid delinquencies, which are now at historic highs.

Adding on top of these macroeconomic stresses for auto financers is the acute skilled labor shortage. The cumulative effect has made auto financers scout for automation solutions that can solve their challenges on all fronts.

Before Voice AI, no tech had such a capability that could automate collections and customer support calls without the need for agent intervention. Today, we are crossing the call automation rubicon with Voice AI solutions such as that offered by Skit.ai.

How Voice AI Can Empower an Auto Financing Company with Call Automation

A voicebot is a conversational Voice AI solution that can engage in meaningful conversation with the customers and understand what they are saying, having been trained extensively for particular business support issues. The design of the entire conversation is done, keeping in mind all the possible difficulties a customer can encounter and how best the collection process can be optimized.

So for every customer query, the voicebot has a ready answer as it pulls out relevant and accurate information from the client system and informs the customer, reducing the duration of the conversation remarkably.

Before we deep dive, here are a few salient points that must be borne in mind:

- Our voicebots, also known as Digital Voice Agents, are trained extensively for specific business problems and hence are capable of engaging in intelligent conversations.

- Our voicebot can handle all tier-I disputes, around 70% of customer queries.

- The remainder of calls, nearly 30%, are escalated to the human collector after the voicebot has established and verified the person’s identity and captured disposition. Thus saving human agent time and helping them engage in high-value tasks.

- The cost of a voicebot is less than 1/5th of the human agent cost. Thus, overall pure cost savings are humongous.

- The voicebot can place thousands of calls concurrently, thus reducing the dependence on human agents considerably.

- Our voicebot can be deployed within 45 minutes, making the results tangible and fast.

The impact of our voicebot on the top and bottom lines is well-documented and clear.

Extrapolating results from Skit.ai’s clients with similar use cases, an auto finance company can realize impressive recovery rates at a fraction of the cost.

Before we explain the nuances of our tech, you can take a minute to watch our voicebot in action.

Voice AI for Inbound/Support Calls

Inbound calls are gold mines because of these; a fraction of customers have called to pay and perhaps need assistance in processing their payment.

Present Status Quo or Before Voicebot Deployment: Unfortunately, most auto financers cannot answer a significant portion of incoming customer calls because of a lack of skilled human agents and due to the prohibitive costs. This a considerable opportunity miss.

After Skit.ai’s Voicebot: Every call gets answered, the intent gets captured, and willing consumers are facilitated to make on-call payments. Any query or dispute gets immediately noted or resolved. Also, details of any further follow-ups are recorded, and calls are scheduled.

Voice AI’s Impact:

All the clients of Skit.ai experienced the following:

- Better collections as willing consumers were facilitated with payment options

- Better disposition and intent capture

- Improvements in their CSAT scores

- Better customer experience as financiers can listen and record every customer query.

Voice AI for Outbound Calls

The capability to dial prompt and perfectly timed calls to reach out to overdue and delinquent accounts is perhaps the most significant capability an auto financer can have. The reason is that almost all auto financers with diverse portfolios have faced the problem of limited scalability and portfolio penetration.

The search for automation has always been, in essence, to ease the problem of limiting the scalability of dialing outbound or consumer reach-out calls. Outbound IVRs and other telephony solutions have eased the problem in their limited way. But only with Voice AI do auto financers experience call automation or intelligent automation of consumer calls.

Present Status Quo or Before Voicebot Deployment:

At present, auto finance has a limited number of agents that can place a call for collections. The process begins with an SMS reminder for payment, followed up in due course of time with a call made by an agent, and then depending upon the significance of the account, the subsequent follow-ups. Agent attrition and compliance breach always have auto financers wary of pushing things.

The diversity of auto loans in the portfolio increases the number of calls that need to be made. This leaves a significant part of the debt portfolio unattended.

After Skit.ai Voicebot:

Before you read further, listen to our voicebot in action and how easily it can help consumers pay.

Our voicebot addresses one of the most significant pain points of auto financers—scalability. We have empowered collectors to dial millions of calls within a week if they so desire. This means that reminders for every overdue or delinquent account will be reached out by our voicebot at the right time, at the desired frequency, and even help them make a payment or reschedule their payments if the need arises.

This means that simplistic calls such as reminders and notification calls can be done by the voicebot, which can even capture intent and help agents prioritize accounts.

This seamless scalability in outbound calls empowers collectors tremendously and can take their recovery rates and portfolio coverage intensity to new heights.

Voice AI’s Impact:

- Repayment Rate at par with an average human agent

- Better overall collections at a fraction of the cost

- Human-Agent Bandwidth Optimization

- Cost of Collections slashed to less than 1/5th

- Portfolio Coverage of 100%

- Seamless Scalability that leaves scope to increase portfolio with the same collections team

- Better compliance as the voicebot sticks to the script

Summarizing the Overall Transformation

The distinct advantages of a Voice AI solution such as that of Skit.ai are conspicuous and indubitable, as many collectors have realized tangible benefits quickly. The impact of this technology is truly transformative and has begun to disrupt many businesses function, such as collection and customer support.

Though our solution can be incorporated in less than 45 minutes, the competitive leg up for early adopters is as significant and can impact long-term success.

If you found our technology relevant and exciting, feel free to schedule a meeting with one of our experts using the chat tool below.

Voice AI: The Answer to Every Major Auto Finance Collection Challenge

Auto finance companies dealing with collections face a pivotal moment of seemingly unprecedented activity.

Here’s what’s happening right now: car prices have hit a record high, interest rates are skyrocketing, and — as a consequence — the auto finance industry is facing a high number of delinquencies. As they find themselves with very high numbers of loans, lenders and collectors have to drastically scale up the number of outbound calls to borrowers.

While challenging times are not always fun, they also allow us to think outside the box and come up with innovative solutions. In this article, we’ll go over some of the major challenges related to auto finance collections and explain how Voice AI and call automation can solve each of these problems.

A growing number of auto finance companies are starting to look to Voice AI (the use of automated voicebots) as the go-to solution to handle both outbound and inbound calls with customers and borrowers. In particular, voicebots are used for collection calls and payment reminders.

Voice AI-powered Digital Voice Agents can handle human-like conversations with users, eliminating wait times and enabling a much larger number of calls to be handled at the same time. A Voice AI technology like Skit.ai’s Augmented Voice Intelligence platform allows auto finance companies to handle collection campaigns at a fraction of the cost.

Challenge 1: Scalability

Auto loan volume varies significantly depending on the year and the season. Anyone who has been in the industry for a while can tell you that they’ve seen very busy seasons as well as quieter ones. Because of the unpredictability of these changes, it can be difficult for an auto finance company to easily adapt and scale either up or down. When facing a particularly busy period, auto finance companies need the ability to quickly scale up to handle larger volumes of loans and customers.

How Voice AI can help you solve this challenge: Voice AI enables auto finance companies to scale up and down with just a few clicks, deploying as many Digital Voice Agents as they need depending on the year and season. As soon as loan volume goes down, the company can simply scale down its use of the Voice AI solution.

Challenge 2: Cost

Collections can be an expensive process. Agents or collectors typically have very large portfolios, with many accounts to reach out to; because the process still tends to be manual for the most part, it takes time. Additionally, if your collectors take a commission, that can also reduce profits.

How Voice AI can help you solve this challenge: By automating the collection process, Voice AI can significantly augment the work of your live agents on the floor, contact many customers simultaneously, and massively reduce costs. Additionally, an AI-powered Digital Voice Agent does not take commissions!

Challenge 3: Hiring and Training

A poorly-trained team of agents and collectors can be a recipe for disaster. As new loans pile up and many become delinquent, it can be tempting to throw new employees into the midst of the action; but if the agents are not qualified and they are not familiar with the existing laws and regulations, you might find yourself in trouble in no time.

How Voice AI can help you solve this challenge: A Digital Voice Agent requires minimal training at the very beginning of the deployment process. After that, you can easily tweak its conversational flows and capabilities with just a few simple changes to the Voice AI platform, either on your own or with the help of your provider.

Challenge 4: Talent Shortage

Since the pandemic and the Great Resignation, many industries, including the auto finance and debt collection industries, have been faced with a shortage of talent. The lack of human capital poses serious challenges to auto finance companies, whose teams and management need to deal with overwhelming workloads. Attracting talent can be a costly endeavor.

How Voice AI can help you solve this challenge: Automation is the answer to the human capital shortage. Voice AI can fill the gaps created by the lack of talent and help the existing team members handle the most repetitive and mundane calls. The adoption of a debt collection software like Skit.ai’s platform can solve this problem in a very short time.

Challenge 5: Agent Attrition

While it’s hard to define the exact attrition rate in the collections space, from talking to many companies operating in both the collections and the auto finance industries, we know that attrition is a real challenge for them. In a 2016 Consumer Financial Protection Bureau survey, large debt collection agencies reported an average turnover rate of 75% to 100%.

Agents and collectors are often dissatisfied, frustrated, and understimulated, so they hop on to the next job opportunity as soon as they find one, whether it’s because the pay is better or because they think the work will be more rewarding.

Every time your company loses one team member, you’ll have to undergo the process of recruiting, hiring, and training a substitute, which can be costly and time-consuming.

How Voice AI can help you solve this challenge: A Voice AI-powered agent never gets tired of handling repetitive and mundane tasks. With the help of Voice AI, you can also focus on retaining your existing talent, as you can ensure every team member has the opportunity to focus on more rewarding and complex tasks.

Challenge 6: Compliance

The collections industry is affected by so many laws and regulations that, if you haven’t been in this space for a while, it can be overwhelming to understand what you can and cannot do. How often can you call borrowers? Are there any times of the day you can’t call them? What do you do if a borrower asks not to be contacted again? How do you handle the privacy of your customers? How should you safely process payments?

These questions are just the tip of the iceberg when it comes to compliance! Think about the TCPA, the FDCPA, the SCRA, PCI standards, and so many others. Additionally, some of these regulations vary depending on the state where the borrower resides.

An auto finance company pursuing collections must be well-versed in these rules and should stay up to date, as lawsuits abound and regulations change relatively often. Better safe than sorry!

How Voice AI can help you solve this challenge: Digital Voice Agents, unlike live agents, don’t go off-script, misspeak, or get confused. When they are trained to follow a set of regulations, they just stick to it. With the help of Voice AI, you can let the solution do the work while you handle other tasks.

Challenge 7: Recordkeeping

For an auto finance company, few things can be more disastrous than poor recordkeeping! Especially when it comes to collection efforts, notes, documentation, and records are crucial. That’s why total reliance on manual recordkeeping is at best risky and at worst harmful. Collectors should keep track of each interaction with their borrowers so that they can follow up and make progress with each new conversation.

Additionally, other team members — such as fellow collectors and managers — should be able to easily access the notes and track the progress made with each account. Automated notetaking is one possible solution to tackle this challenge.

How Voice AI can help you solve this challenge: A Voice AI platform automatically keeps track of all customer interactions, taking notes of every conversation and capturing payment disposition and propensity to pay. With Voice AI, you get to automate conversations with borrowers, and you can be fully aware of the background and context of each account. Whenever a live agent wants to take over, they can easily do so by looking at the record of the relationship between the auto finance company and the borrower.

Are you curious to learn more about how Skit.ai can transform your auto finance operations, customer interactions, and collection efforts? Schedule a free demo with one of our experts using the chat tool below.